From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine’s Steel Export Surge Impacts European Supply: Plant Activity Stable Amidst Shifting Trade Flows

Ukraine’s increasing role in the European steel market is evident through rising exports and imports, while steel plant activity in Italy shows relative stability. The trends are indicated in news articles such as “Ukraine increase exports of long products by 26% y/y in January-April,” “Ukraine increased exports of ferrous scrap by 95% year-on-year“, and “Ukraine increased imports of long products by 81.1% y/y in January-April“. While the articles highlight trade dynamics, no direct relationship to the observed activity levels of the Italian steel plants can be established.

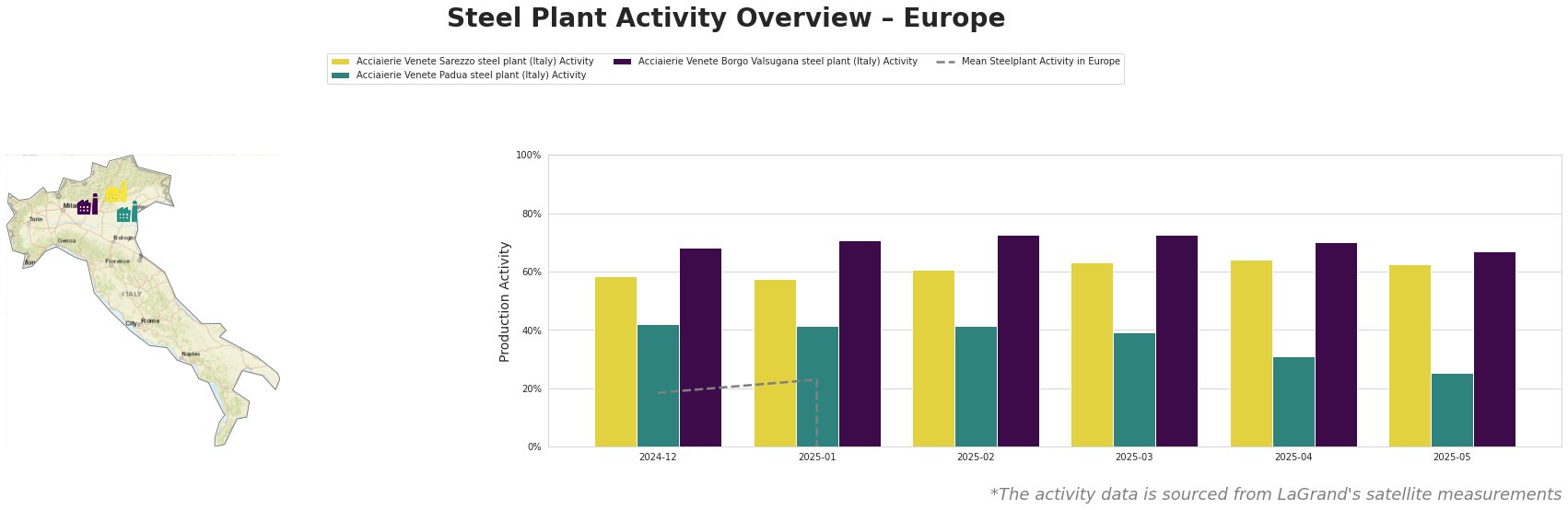

The mean activity level across all observed plants in Europe shows extreme values due to data recording errors, which should be disregarded for practical analysis. Acciaierie Venete Sarezzo’s activity remained relatively stable, fluctuating between 58% and 64% from December 2024 to May 2025. Acciaierie Venete Padua showed a steady decline from 42% in December 2024 to 25% in May 2025. Acciaierie Venete Borgo Valsugana displayed high but slightly decreasing activity, moving from 68% to 67% over the same period.

Acciaierie Venete Sarezzo steel plant, located in the Province of Brescia, Italy, operates an EAF with a crude steel capacity of 540 thousand tons. The plant primarily produces semi-finished and finished rolled products like bars and wire rod for automotive, building, and energy sectors. Its satellite-observed activity has been quite stable in the observed period, staying near the 60% activity mark without major fluctuations. No direct link between this stability and the provided news articles concerning Ukrainian import/export can be established.

Acciaierie Venete Padua steel plant, situated in the Province of Padova, Italy, also relies on EAF technology with a slightly larger crude steel capacity of 600 thousand tons. Similar to Sarezzo, it focuses on bars and wire rod for various sectors. The Padua plant shows a decreasing trend in activity from 42% to 25% over the observed timeframe. This decline does not have a directly evident link to the news articles regarding Ukrainian steel trade flows, and may be due to local or company-specific conditions.

Acciaierie Venete Borgo Valsugana steel plant, located in the Province of Trentino-Alto Adige, possesses a 600 thousand tons crude steel capacity through EAF process. It produces similar long products. Borgo Valsugana displayed the highest activity levels of the three plants, remaining consistently above 67% throughout the observed period. As with the other plants, no direct connection between its activity level and the provided news articles can be established.

Based on the news article “Ukraine increased exports of ferrous scrap by 95% year-on-year,” and Ukraine’s increased export of long steel products and ferrous scrap, a shift in material availability for EAF-based steel producers in Europe might occur. The Ukrainian government is considering export restrictions, which could impact scrap availability. Steel buyers should monitor Ukrainian scrap export policies closely, as potential restrictions could lead to increased scrap prices in Europe, impacting the cost of EAF steel production. Given the stable activity at the Acciaierie Venete plants and the potential for future scrap export restrictions out of Ukraine, steel buyers should build relationships with diverse suppliers and negotiate contracts that account for raw material price fluctuations. Consider hedging strategies to mitigate the risk of rising scrap costs.