From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Sector Shows Resilience: Pig Iron Surges, Rolled Steel Gains Despite Export Concerns

Ukraine’s steel industry exhibits mixed signals with pig iron production surging while rolled steel output shows moderate growth amidst export challenges, as indicated by “Ukraine reports eight percent rise in pig iron output for January-August 2025” and “Ukraine produced 4.25 million tons of rolled steel in January-August“. These production increases do not show a clear correlation with satellite-observed activity changes. “Ukraine reduced iron ore exports by 7% y/y in January-August” highlights potential headwinds for the sector, although no direct relationship to observed steel plant activity levels can be established based on the provided data.

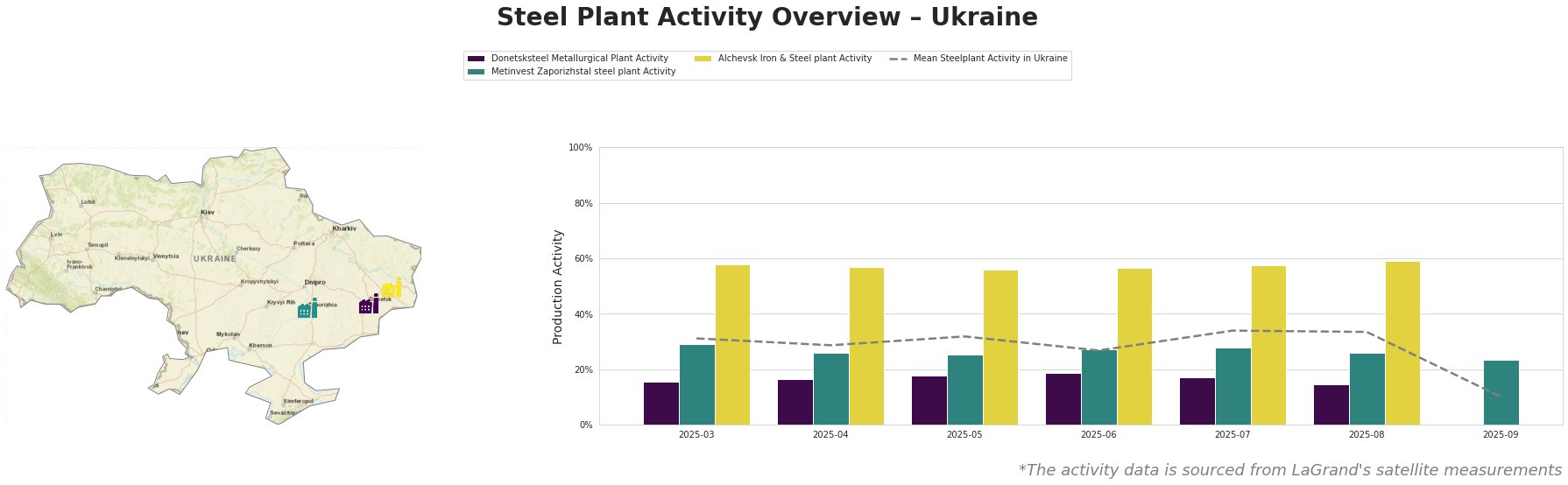

Monthly activity trends of selected Ukrainian steel plants are shown in the following table:

Between March and August 2025, the mean steel plant activity in Ukraine fluctuated, peaking at 34% in July before declining to 33% in August. Donetsksteel Metallurgical Plant’s activity remained relatively stable at low levels, ranging between 15% and 19%. Metinvest Zaporizhstal’s activity also showed relative stability ranging between 25% and 29% during the same period. Alchevsk Iron & Steel plant exhibited the highest activity levels, consistently above 56%. Notably, the mean steel plant activity experienced a sharp drop to 10% in September, while Metinvest Zaporizhstal’s activity decreased slightly to 24%. The activities of Donetsksteel Metallurgical Plant and Alchevsk Iron & Steel plant are not available for September.

Donetsksteel Metallurgical Plant, located in Donetsk, is an integrated (BF) steel plant primarily producing pig iron with a BF capacity of 1500 TTPA. Its activity levels, consistently below the national average, decreased from 19% in June to 15% in August. These activity fluctuations do not show any directly apparent connection to the news articles.

Metinvest Zaporizhstal, situated in Zaporizhzhia, operates as an integrated (BF) plant, focusing on finished rolled products such as hot-rolled coil and cold-rolled sheets with a crude steel capacity of 4100 TTPA using OHF technology. It is a key consumer of Zaporizhcoke’s production, as reported in “Zaporizhcoke increased production to 593,000 tons in January-August.” Its activity levels remained relatively consistent, ranging between 25% and 29% from March to August, before dropping to 24% in September. This slight activity decrease does not show a direct relation to the news articles.

Alchevsk Iron & Steel plant, located in Luhansk, is an integrated (BF) plant with a crude steel capacity of 5472 TTPA and BOF technology. Its satellite-observed activity consistently exceeds the national average. From March to August, its activity gradually increased from 58% to 59%. No activity data is available for September. These observed activity levels do not show a direct connection to the provided news articles.

The reported 7% year-on-year decrease in iron ore exports, as stated in “Ukraine reduced iron ore exports by 7% y/y in January-August,” combined with the overall increase in pig iron production reported in “Ukraine reports eight percent rise in pig iron output for January-August 2025,” suggests a potential shift towards greater domestic consumption of iron ore. Given the growth in pig iron output and rolled steel production, procurement professionals should:

- Closely monitor pig iron availability and pricing: The increased pig iron production could lead to a more competitive pricing environment. Steel buyers should leverage this increased domestic supply, while acknowledging that rolled steel production has been only moderately increasing.

- Factor in potential export disruptions: The decrease in iron ore exports may indicate potential challenges in the steel export market. Steel buyers should diversify their supply chains and closely monitor export policies to mitigate potential disruptions.