From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Sector Shows Resilience Despite Export Challenges, Cautious Optimism Prevails

Ukraine’s steel industry demonstrates unexpected operational strength amid ongoing conflict, coupled with export adjustments in key materials, demanding careful navigation by steel buyers. Recent operational changes correlate with reports such as “Ukrainian steel industry is operating at 92% capacity utilization – deputy minister,” while iron ore and pig iron export data from “Ukraine reduced iron ore exports by 4.4% y/y in January-October” and “Ukraine exported 1.59 million tons of pig iron in January-October” suggest shifts in trade dynamics that buyers must consider. The observed activity levels at specific plants don’t provide an immediate link to the “Metinvest reduced steel production by 10% due to the effects of the war” article but could indicate localized responses to operational pressures detailed therein.

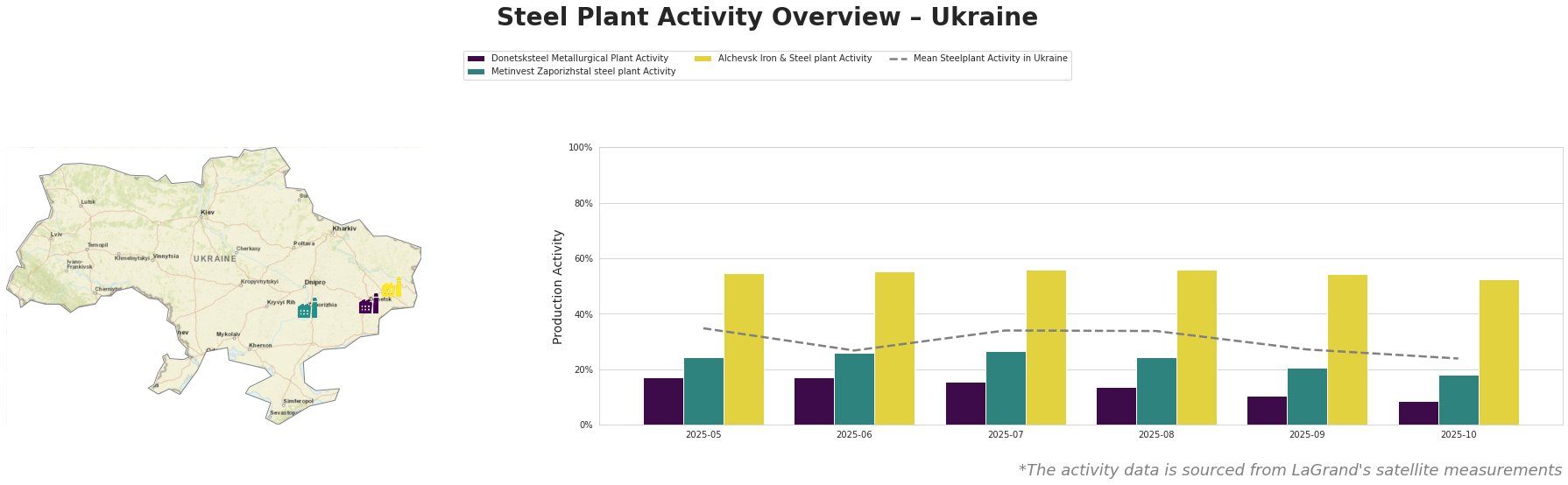

Overall Ukrainian steel plant activity displays a fluctuating, downward trend from May to October 2025, dropping from 35% to 24%. Donetsksteel Metallurgical Plant consistently operated below the mean, exhibiting a pronounced decline from 17% in May to only 9% in October. Metinvest Zaporizhstal’s activity closely tracked the overall mean, experiencing a similar decline from 24% to 18%. Alchevsk Iron & Steel plant demonstrated significantly higher activity levels than the other plants and the national average, remaining relatively stable around 55%, but also showing a small decline to 52% in October.

Donetsksteel Metallurgical Plant, located in Donetsk, is an integrated steel plant primarily producing pig iron using BF/EAF technology. Its activity levels have consistently been the lowest among the observed plants, dropping from 17% in May to 9% in October. This persistent low activity, and the lack of explicit correlation with the news articles, may reflect ongoing operational challenges specific to this location.

Metinvest Zaporizhstal, situated in Zaporizhzhia, is an integrated plant producing finished rolled products, including hot- and cold-rolled sheets, utilizing BF/OHF technology. The plant’s activity levels mirrored the overall mean, decreasing from 24% in May to 18% in October. This decline may be connected to the disruptions outlined in “Metinvest reduced steel production by 10% due to the effects of the war“, though the available data does not definitively establish this link.

Alchevsk Iron & Steel plant in Luhansk, an integrated plant producing semi-finished and finished rolled products like slabs and structural shapes via BF/BOF technology, maintained the highest activity levels among the observed plants, remaining around 55%. The plant’s consistent high activity relative to the others, despite a small dip to 52% in October, could indicate differing regional dynamics or operational conditions. No direct link can be established between this relative stability and the named news articles.

Based on reported export data and observed production, steel buyers should note the following:

- Pig Iron Sourcing: The significant 63.6% year-on-year increase in pig iron exports, as reported in “Ukraine exported 1.59 million tons of pig iron in January-October,” with the U.S. emerging as the primary consumer, suggests potential stability in pig iron supply despite domestic challenges. Buyers reliant on Ukrainian pig iron, particularly in the U.S., can expect continued availability, but should closely monitor logistical routes and potential disruptions.

- Iron Ore Procurement Adjustments: Given the 4.4% decrease in iron ore exports reported in “Ukraine reduced iron ore exports by 4.4% y/y in January-October,” buyers, particularly those in Slovakia and Poland (experiencing declines of 8.5% and 12.8% respectively), need to diversify their iron ore sources to mitigate potential supply shortages. Chinese imports from Ukraine are up and may indicate a shift in export strategy for Ukraine.

- Regional Production Monitoring: Steel buyers should closely monitor the operational status of the Donetsksteel Metallurgical Plant. Its consistently low activity levels may signal long-term production constraints requiring the qualification of alternative suppliers for pig iron. The “Ukrainian steel industry is operating at 92% capacity utilization – deputy minister” makes it clear that fair market rules for recovery are important.