From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Sector Shows Resilience Amidst UK Market Turmoil: Plant Activity Analysis

Ukraine’s steel sector exhibits varied activity levels, partially insulated from the UK’s current market disruptions. Specifically, recent satellite observations highlight activity fluctuations that are not directly linked to the UK’s steel market challenges described in news articles such as “Sudden tariff crisis on UK steel imports: Producers prepare lawsuit“, “UK government seizes Liberty Speciality Steel UK to protect jobs“, “The UK government is preparing to acquire its third largest steel mill.“, “U.K. Government to Take Partial Control of Liberty Steel“, “UK government considers taking over Liberty Speciality Steel UK“, and “The UK government is preparing to take over its third-largest steel plant“. While these events significantly impact the UK steel industry, their immediate impact on Ukrainian steel production appears limited based on observed plant activities, though potential indirect effects on global steel prices should be monitored.

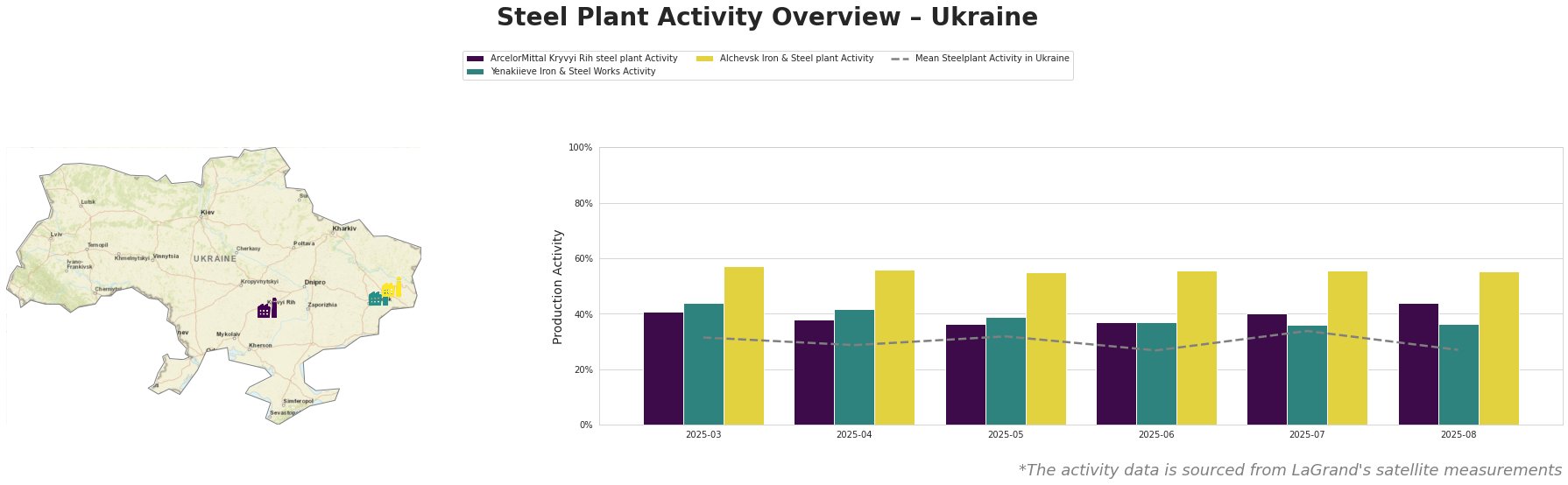

Overall, the mean steel plant activity in Ukraine has fluctuated, ranging from a low of 27% in June and August to a peak of 34% in July. The individual plant activity levels reveal more nuanced trends.

ArcelorMittal Kryvyi Rih, an integrated BF-BOF plant with a crude steel capacity of 8000 ttpa, showed a fluctuating activity pattern. After a dip to 36% in May, it increased to 44% in August, the highest among the observed plants, surpassing its March activity of 41%. This rise does not appear to be directly linked to the challenges faced by UK steel producers detailed in the provided news articles.

Yenakiieve Iron & Steel Works, another integrated BF-BOF plant with a crude steel capacity of 3300 ttpa, experienced a gradual decline in activity, from 44% in March to 36% in July and August. Again, no direct relationship can be established between this decline and the UK market events reported in the news articles.

Alchevsk Iron & Steel plant, an integrated BF-BOF plant with a crude steel capacity of 5472 ttpa, maintained a relatively stable activity level, fluctuating between 55% and 57% throughout the observed period. This consistency, despite the external pressures in the UK market, suggests operational resilience, however, no explicit connection to UK market dynamics could be established based on the news provided.

Given the varied activity levels and the UK market uncertainty highlighted in articles like “Sudden tariff crisis on UK steel imports: Producers prepare lawsuit” and the government intervention described in “UK government seizes Liberty Speciality Steel UK to protect jobs,” steel buyers should:

- Monitor Global Price Fluctuations: The UK’s steel market turmoil, while not directly impacting Ukrainian plant activity, could indirectly affect global steel prices. Track price indices closely for any upward trends, particularly in the long-term finished product segments of ArcelorMittal Kryvyi Rih.

- Assess Supply Chain Resilience: Evaluate the potential impact of UK supply chain disruptions on the availability of specific steel products or raw materials sourced from the UK or reliant on UK logistics.