From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Sector Faces Deepening Crisis: Plant Activity Stalls Amidst Geopolitical Tensions

The Ukrainian steel market faces significant headwinds due to escalating geopolitical tensions, hindering recovery. Observed plant activity is stagnant, failing to rebound. This trend appears linked to broader geopolitical instability, as evidenced by news reports such as “At least 82 killed in Israeli strikes on Gaza as critical aid fails to reach Palestinians” and “Netanyahu accuses the UK, France and Canada of ‘enabling Hamas’,” which suggest increasing global tensions and potential disruptions to trade and investment. However, no direct causal relationship between specific international events and activity rates of individual plants could be established from the provided information.

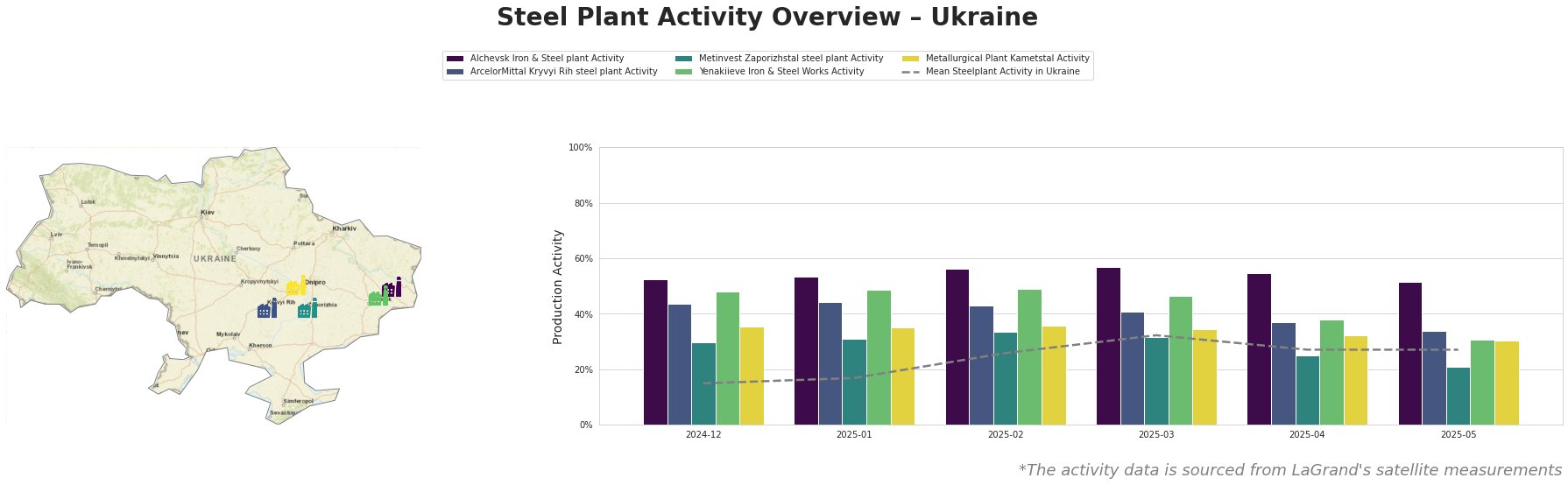

Overall, the mean steel plant activity in Ukraine has stagnated at 27% in May 2025, after a peak of 32% in March 2025, reflecting a stalled recovery.

The Alchevsk Iron & Steel plant in Luhansk, an integrated BF-BOF plant with a crude steel capacity of 5472 ttpa, has consistently shown the highest activity level among the observed plants, starting at 53% in December 2024 and reaching 57% in March 2025, followed by a decrease to 52% in May 2025. The ArcelorMittal Kryvyi Rih steel plant in Dnipropetrovsk, another integrated BF-BOF plant with a larger crude steel capacity of 8000 ttpa, showed an activity decrease from 44% in December 2024 to 34% in May 2025. Metinvest Zaporizhstal steel plant in Zaporizhzhia, with a crude steel capacity of 4100 ttpa, experienced a marked drop in activity, from 34% in February 2025 to 21% in May 2025, the lowest level among all plants. The Yenakiieve Iron & Steel Works in Donetsk, with a capacity of 3300 ttpa, saw activity decline from 49% in January and February 2025 to 31% in May 2025. Metallurgical Plant Kametstal in Dnipropetrovsk, boasting a 4200 ttpa capacity, saw relatively stable activity, decreasing from 35% in December 2024 to 30% in May 2025.

While some plants show higher activity than the mean, the overall trend points towards stagnation or decline. No direct connection could be established between the steel plant activities and the geopolitical news, but the timing of the stagnation coincides with increased geopolitical instability and related news flow.

Given the observed stagnation and decline in steel plant activity, potentially exacerbated by broader geopolitical instability reflected in the cited news articles, steel buyers and market analysts should prioritize securing supply from the Alchevsk Iron & Steel plant given its relatively higher and more stable production activity compared to other observed plants. It is recommended that buyers explore diversifying their supply base to mitigate risks associated with potential disruptions at other plants, particularly given the sharp decline observed at Metinvest Zaporizhstal. Further monitoring of plant activity and close attention to geopolitical developments impacting the region are crucial for informed decision-making.