From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel: Production Mixed Amidst Metinvest Decline, Ferroalloy Surge

Ukraine’s steel sector shows a mixed performance in the first half of 2025, with overall crude steel production experiencing a decline, while some individual plants demonstrate growth. This dynamic landscape requires careful navigation. According to “Ferroalloy enterprises in Ukraine produced 155.2 thousand tons of products in 1H2025,” the ferroalloy sector has rebounded significantly. However, “Metinvest” reduced steel output by 13%“, indicating challenges for the country’s largest mining and metallurgical holding, and “steel production in Ukraine dropped by 7 in 7 months%“. These reports highlight diverging trends within the Ukrainian steel industry.

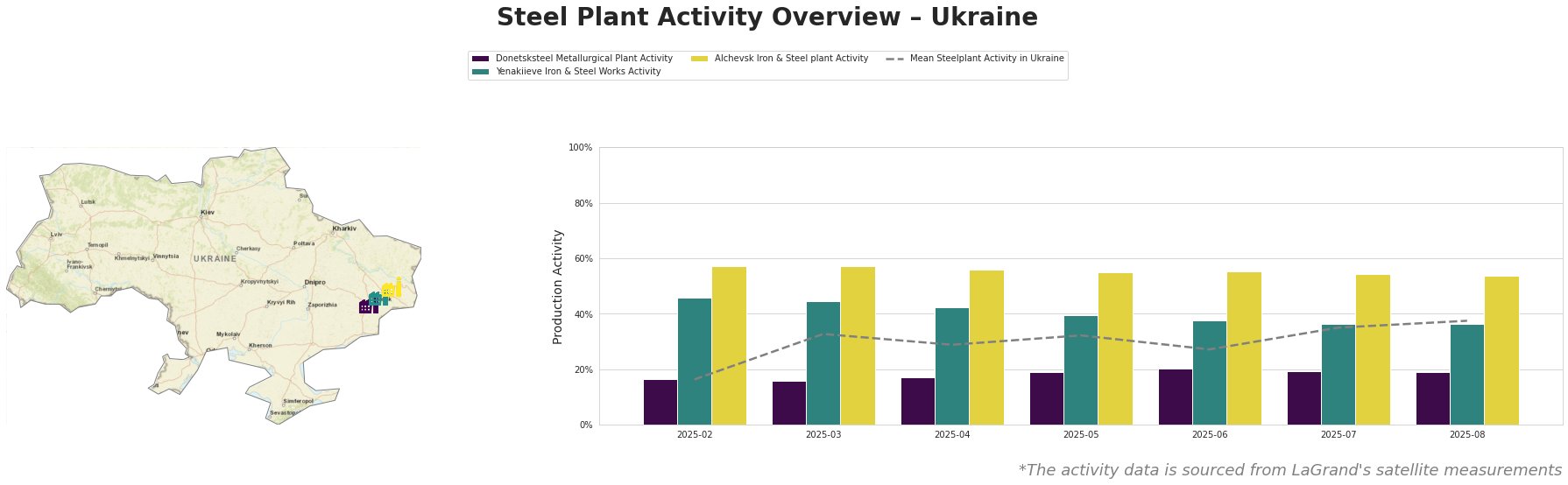

The satellite data indicates that the mean steel plant activity in Ukraine has shown a fluctuating but overall upward trend from February (16%) to August (38%) of 2025. Donetsksteel Metallurgical Plant activity remained relatively stable at low levels (16-20%) throughout the observed period. Yenakiieve Iron & Steel Works activity experienced a gradual decline from 46% in February to 36% in August. Alchevsk Iron & Steel plant demonstrated consistently high activity, ranging between 54% and 57% throughout the period.

Donetsksteel Metallurgical Plant, located in Donetsk and primarily producing pig iron using integrated (BF) process with a capacity of 1500 thousand tons per annum (ttpa), shows minimal activity change, remaining consistently below the national average. No direct connection can be established between the observed activity levels and the provided news articles.

Yenakiieve Iron & Steel Works, also in Donetsk, uses an integrated (BF) process to produce 3300 ttpa of crude steel (BOF) and 2600 ttpa of iron. Its activity gradually declined from 46% in February to 36% in August. Given its production of semi-finished and finished rolled products such as rebar and wire rods, a potential impact from the overall decline in rolled steel production reported in “Ukraine produced 3.62 million tons of rolled steel in January-July“ cannot be ruled out, although a direct link is not explicitly evident.

Alchevsk Iron & Steel plant, situated in Luhansk, has a capacity of 5472 ttpa of crude steel (BOF) and 5320 ttpa of iron, and is equipped with a coking plant. Its activity remained consistently high, between 54% and 57%, despite overall challenges. No direct connection can be established between the observed activity levels and the provided news articles.

“Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025” indicates output increase in one facility not monitored by satellite. Likewise, “Ukraine’s Interpipe posts increased pipe output for Q1 2025” shows a positive trend in pipe production, without satellite confirmation.

Based on the decrease in overall steel output reported in “Metinvest” reduced steel output by 13%” and “steel production in Ukraine dropped by 7 in 7 months%”, coupled with the satellite data showing declining activity at Yenakiieve Iron & Steel Works, steel buyers should:

- Diversify Sourcing: Explore alternative suppliers to mitigate potential disruptions linked to Metinvest’s reduced output and the activity decline at Yenakiieve.

- Monitor Ferroalloy Prices: The surge in ferroalloy production, as noted in “Ferroalloy enterprises in Ukraine produced 155.2 thousand tons of products in 1H2025,” may impact the cost of alloyed steel grades. Closely track ferroalloy market dynamics.

- Focus on Zaporizhstal: Given the increased production at Zaporizhstal reported in “Ukraine’s Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025”, consider prioritizing procurement from this source, but consider the potential disruptions in the supply chains in the region and diversify beyond it.