From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Strong Consumption Growth Despite Export Declines: Activity Stable, Scrap Exports Surge

Ukraine’s steel market presents a mixed picture of robust domestic consumption growth alongside export challenges. Recent data, as highlighted in “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September,” shows a significant increase in domestic demand. However, this is juxtaposed with a decrease in overall steel exports, as noted in “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025,” raising concerns about the sector’s external competitiveness.

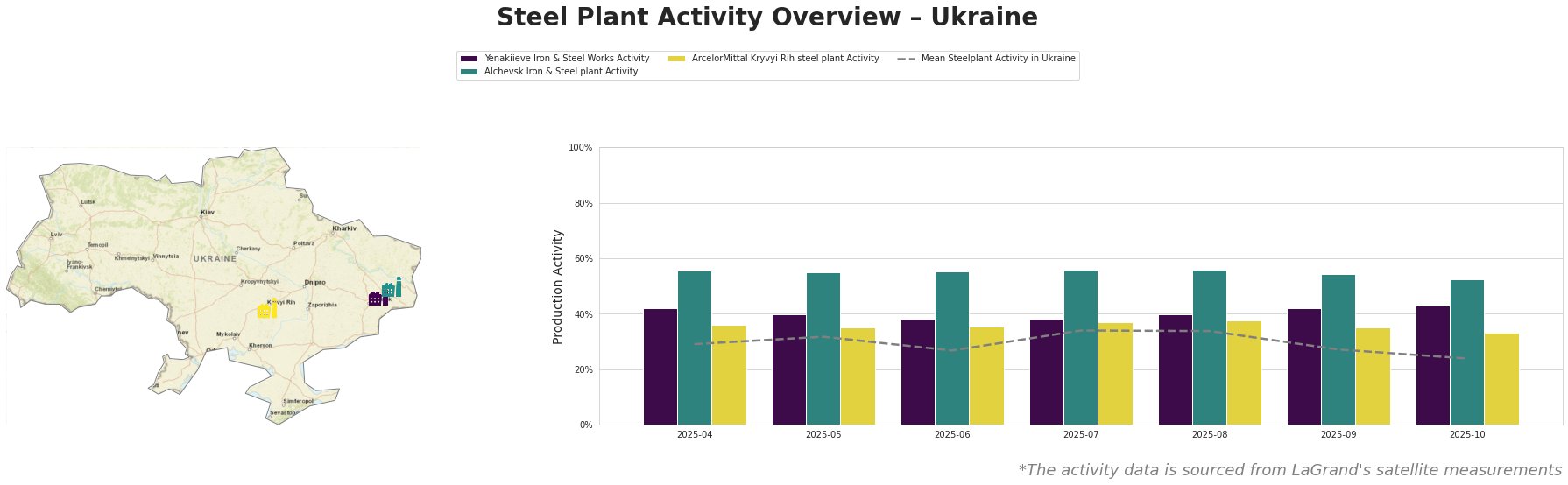

The satellite-observed activity data shows a relatively stable trend across the three observed steel plants, with the mean activity fluctuating between 24% and 34% over the seven-month period. Alchevsk Iron & Steel plant consistently exhibits the highest activity levels, peaking at 56% in July and August, while ArcelorMittal Kryvyi Rih generally shows the lowest activity compared to the other two.

Yenakiieve Iron & Steel Works, a BOF-based integrated plant with a crude steel capacity of 3.3 million tons, has shown relatively stable activity, ranging from 38% to 43%. The slight increase to 43% in October, coinciding with news of growing domestic consumption, doesn’t establish a direct connection, as the plant’s output is semi-finished and finished rolled products, while semi-finished products saw export declines, as outlined in “Exports of Ukrainian semi-finished steel products fell by 38.5%“.

Alchevsk Iron & Steel plant, another integrated BOF-based producer with a larger capacity of 5.472 million tons of crude steel, has the highest observed activity levels, fluctuating between 52% and 56%. No explicit link can be established between these activity levels and recent news events, however, the plant focuses on slabs and billets, which are relevant to export decline in semi-finished products.

ArcelorMittal Kryvyi Rih, the largest plant with 8 million tons of crude steel capacity, displays relatively lower activity levels compared to the other two plants. The activity remains within a narrow band, and no immediate connection can be established to any specific news event.

The surge in scrap exports, as reported in “Scrap exports from Ukraine reached 311,000 tons in January-September,” could present a challenge for domestic steel producers relying on EAF technology, although none of the observed plants use EAF. Also, the decline in exports of semi-finished products, as detailed in “Exports of Ukrainian semi-finished steel products fell by 38.5%,” suggests potential production adjustments at plants specializing in these products, although this is not clearly reflected in the satellite data for the mentioned facilities.

Given the rising domestic consumption reported in “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September,” steel buyers should prioritize securing supply agreements with domestic producers. The observed stability in plant activity suggests that domestic production is currently able to meet the increased demand. However, analysts should closely monitor scrap export policies, as any restrictions could further influence domestic steel production costs.