From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Resilience Despite Export Declines: Ferroalloy Surge Signals Opportunity

Ukraine’s steel market presents a mixed picture, with decreased iron ore and pig iron exports potentially offset by a surge in ferroalloy exports, offering both challenges and opportunities for steel buyers. The reduced iron ore exports, as reported in “Ukraine reduced iron ore exports by 10% y/y in January-April” and confirmed in “Ukraine has reduced iron ore exports by 10 in 4 months%,” do not have an explicitly confirmed direct relationship to individual steel plant activities based on provided data. Similarly, the drastic 60% month-over-month decline in pig iron exports in April, detailed in “Ukraine reduced pig iron exports by 60% m/m in April,” while significant, shows no clear link to changes in specific plant activity during that period based on available data. However, the significant surge in ferroalloy exports, highlighted in “Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April,” presents a distinct upward trend that warrants attention.

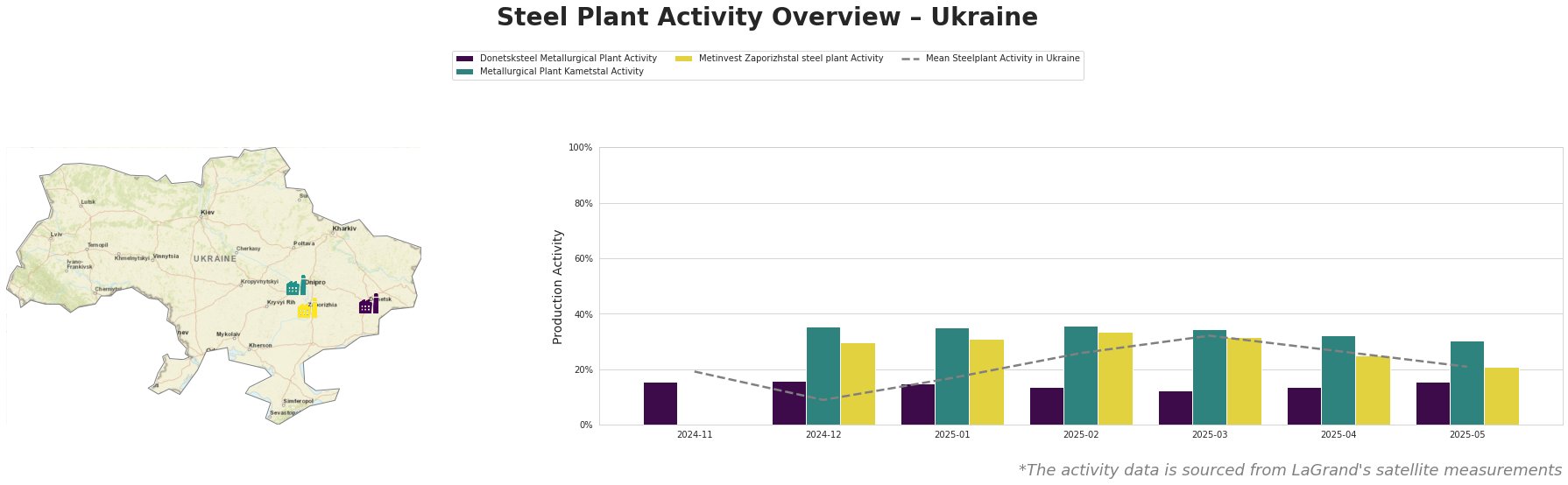

The mean steel plant activity in Ukraine shows a general upward trend from November 2024 (19.0%) to March 2025 (32.0%), followed by a decrease to 21.0% by May 2025. Donetsksteel Metallurgical Plant has maintained a relatively stable activity level around 15%, consistently below the national average. Metallurgical Plant Kametstal shows peak activity in February 2025 (36.0%) with a subsequent decline to 30.0% in May, still significantly above the national mean, while Metinvest Zaporizhstal steel plant follows a similar trend, peaking in February (34.0%) and ending at 21.0% in May, equalling the national mean. The activity fluctuations in Kametstal and Metinvest, in conjunction with overall export shifts, suggest specific production realignments, although a direct causal link cannot be definitively established based on the provided information.

Donetsksteel Metallurgical Plant, located in the Donetsk region, primarily produces pig iron using integrated BF technology with a capacity of 1500 TTPA. Satellite data indicates a stable but consistently below-average activity level, fluctuating between 12.0% and 16.0% throughout the observed period. Although the plant holds Responsible Steel certification, this stable activity does not directly correlate with the export declines reported in “Ukraine reduced iron ore exports by 10% y/y in January-April” or “Ukraine has reduced iron ore exports by 10 in 4 months%,” indicating other factors may be at play.

Metallurgical Plant Kametstal, situated in Dnipropetrovsk, operates with integrated BF and BOF technologies, boasting a crude steel capacity of 4200 TTPA and an iron capacity of 4350 TTPA. Activity levels peaked at 36% in February 2025 before decreasing to 30% in May. Kametstal’s product portfolio includes semi-finished and finished rolled products targeted at the energy and transport sectors. While the plant maintains ISO14001 and Responsible Steel certifications, the observed decline in activity from February to May does not directly align with any specific news events, suggesting possible adjustments in production schedules or market demand shifts independent of the cited export news.

Metinvest Zaporizhstal steel plant, located in Zaporizhzhia, utilizes integrated BF and OHF technologies for a crude steel capacity of 4100 TTPA and an iron capacity of 4359 TTPA. Its primary products are finished rolled steel, including hot-rolled and cold-rolled sheets, catering to the automotive, steel packaging, and transport sectors. The plant’s activity mirrors the national trend, peaking at 34.0% in February 2025 before declining to 21.0% in May. Despite ongoing discussions for a new 3200 TTPA BOF, the recent activity decrease does not have an explicit link to the news articles provided, thus any connection cannot be reliably established.

Based on the observed data and news articles, potential supply disruptions are more likely to arise from fluctuations in pig iron demand and iron ore availability than from widespread plant shutdowns. Despite decreased pig iron exports, the Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April, suggesting steel buyers could potentially diversify their sourcing strategies, focusing on Ukrainian ferroalloy exports as an alternative. Given the 60% month-over-month decline in pig iron exports in April as reported in “Ukraine reduced pig iron exports by 60% m/m in April,” steel buyers heavily reliant on Ukrainian pig iron should proactively secure alternative supply chains or negotiate contract terms to mitigate potential price volatility and supply shortages. Analysts should closely monitor ferroalloy pricing trends, production costs (especially electricity), and logistical bottlenecks to gauge the sustainability of increased ferroalloy exports.