From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Pig Iron Export Decline Offset by Flat Steel Gains Amidst Iron Ore Export Challenges

Ukraine’s steel sector presents a mixed picture. Increased flat steel exports contrast with a sharp decline in pig iron exports and reduced iron ore exports, as evidenced by recent reports and observed plant activity. The news article “Ukraine reduced pig iron exports by 60% m/m in April” highlights a significant drop, which cannot be directly linked to observed plant activity based on the provided data, though broader trends may be reflected in overall averages. Meanwhile, according to the news article “Ukraine’s flat steel exports up 4.1 percent in Jan-Apr” there have been increases in steel exports, but these cannot be directly linked to activity at specific plants based on the provided satellite data.

The steel sector is influenced by the news articles “Ukraine has reduced iron ore exports by 10 in 4 months%” and “Ukraine reduced iron ore exports by 10% y/y in January-April“, revealing export challenges and reduced demand from key partners. Furthermore, the news article “Consumption of steel products in Ukraine increased to 1.2 million tons in January-April” highlights an increased domestic consumption of steel products which may be correlated to flat steel export growth. The news article “Titanium ore exports from Ukraine fell by 90%” highlights the impact on the country’s mining industry which may have implications on the broader steel production sector but is not directly linked to current observed activity. Finally the news article “Ukraine reports 8.1 percent rise in pig iron output for Jan-Apr” indicates an increase in pig iron output even though exports fell in April.

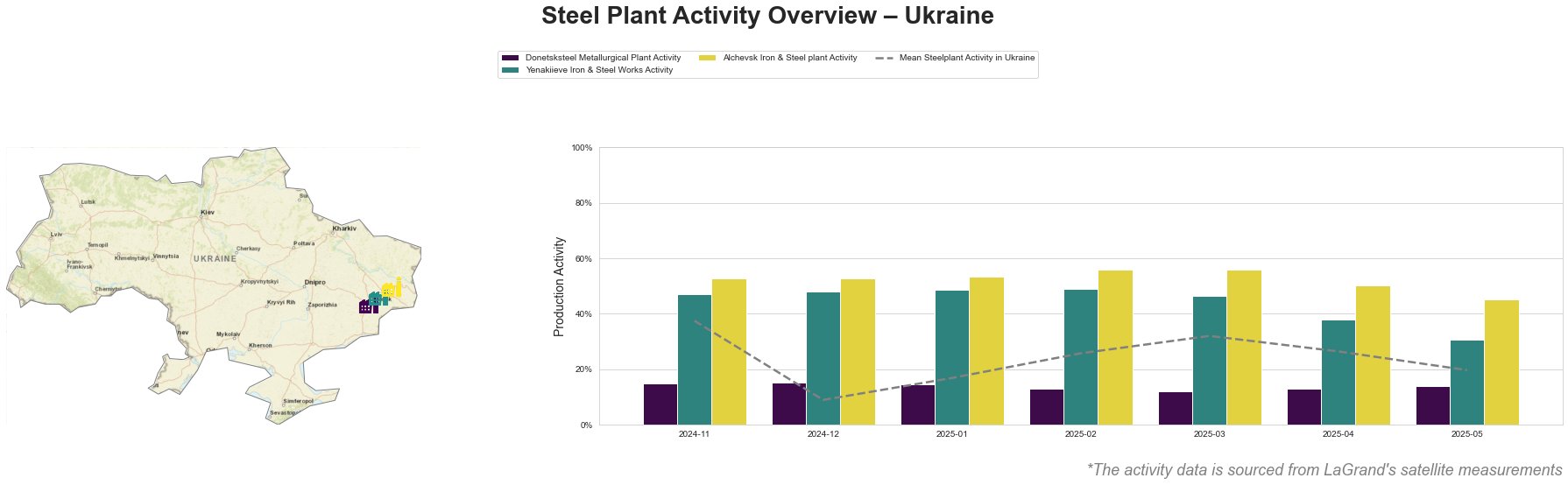

The mean steel plant activity in Ukraine shows a fluctuating trend, peaking at 38% in November 2024 and then sharply dropping to 9% in December, followed by a gradual increase until March 2025 (32%), before declining again to 20% by May 2025.

Donetsksteel Metallurgical Plant has demonstrated relatively stable, low activity, consistently ranging between 12% and 15% throughout the observed period. This is significantly below the mean activity for Ukraine. There is no immediate link between this consistently low activity and the above-mentioned news articles.

Yenakiieve Iron & Steel Works shows a decline from 47% in November 2024 to 31% in May 2025, with a high of 49% between January and February 2025. This decline may reflect the reduced pig iron exports highlighted in “Ukraine reduced pig iron exports by 60% m/m in April“, but no direct evidence links these events.

Alchevsk Iron & Steel plant consistently shows the highest activity levels compared to the other plants and the mean, starting at 53% and rising to 56% in February and March 2025, before declining to 45% by May 2025. No direct correlation can be established between this activity and the provided news articles.

Donetsksteel Metallurgical Plant, located in Donetsk, is an integrated steel plant with a crude steel capacity of 0 tons (BOF dismantled). It focuses on pig iron production using BF technology, with a capacity of 1,500 tons. The consistently low activity at Donetsksteel, ranging from 12% to 15%, does not directly correlate with the news articles, suggesting other factors may be influencing its operations.

Yenakiieve Iron & Steel Works, also in Donetsk, is an integrated steel plant with a crude steel capacity of 3,300 tons using BOF technology. It produces semi-finished and finished rolled products like rebar and wire rods, utilizing BF technology. The decline in activity at Yenakiieve, from 47% in November 2024 to 31% in May 2025, might reflect the overall decrease in pig iron exports, although a direct causal link cannot be confirmed.

Alchevsk Iron & Steel plant, located in Luhansk, is an integrated steel plant with a crude steel capacity of 5,472 tons, using BOF technology. It produces semi-finished and finished rolled products like slabs and structural shapes. Despite showing the highest activity levels, the decline from 56% in March 2025 to 45% in May 2025 cannot be directly linked to any specific news events.

Market Implications and Procurement Actions:

Given the significant decline in pig iron exports highlighted in “Ukraine reduced pig iron exports by 60% m/m in April” and the reduced activity at Yenakiieve Iron & Steel Works, steel buyers should anticipate potential supply disruptions in pig iron, particularly for US-based consumers, as highlighted in the news article “Ukraine reduced pig iron exports by 60% m/m in April“. Buyers reliant on Ukrainian pig iron should diversify their supply base and explore alternative sources, especially given the fluctuating production landscape. Procurement professionals should also closely monitor flat steel export trends (“Ukraine’s flat steel exports up 4.1 percent in Jan-Apr“) as domestic consumption increases (“Consumption of steel products in Ukraine increased to 1.2 million tons in January-April“), ensuring availability and competitive pricing.

The observed challenges in iron ore exports (“Ukraine reduced iron ore exports by 10% y/y in January-April“) suggest that steel producers relying on Ukrainian iron ore may face increased input costs or supply constraints, potentially impacting steel prices. Steel buyers should factor this into their cost projections and consider hedging strategies to mitigate price volatility.