From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Kametstal Boosts Output Amid UK CBAM Concerns

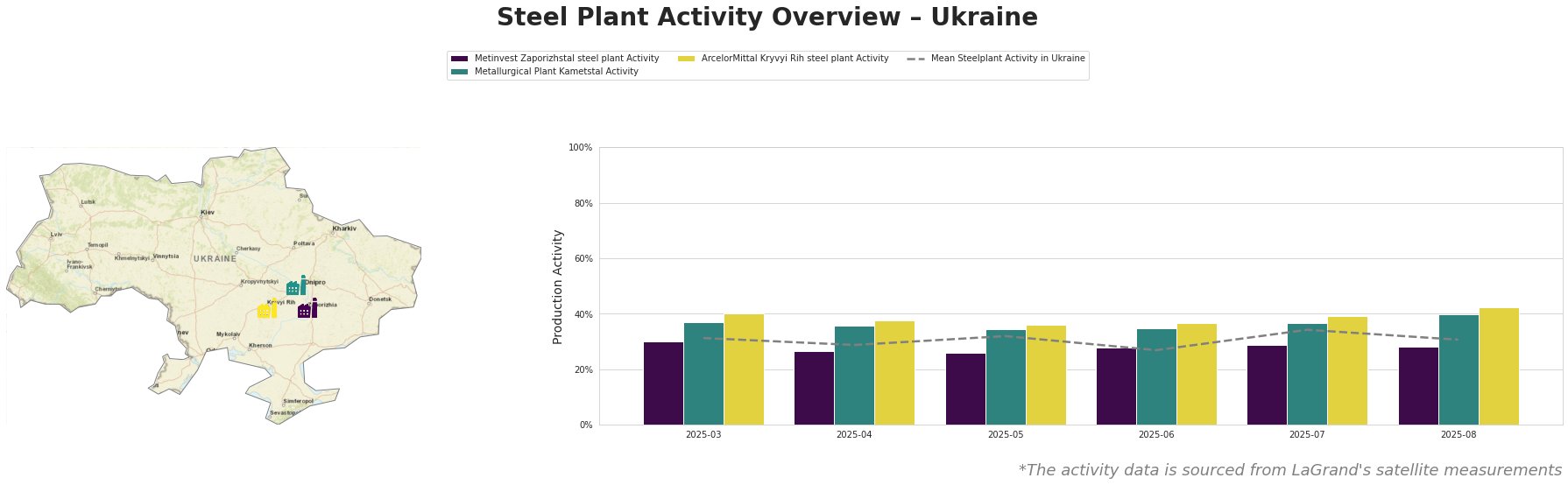

Ukraine’s steel sector shows mixed activity, with some plants increasing output while facing potential future impacts from the UK’s Carbon Border Adjustment Mechanism (CBAM). The UK to implement a CBAM in 2027 to prevent carbon leakage articles highlight the impending carbon costs for exports to the UK. However, a direct relationship between these announcements and current activity levels cannot be explicitly established based on the provided information.

Here’s a summary of recent activity:

The mean steel plant activity in Ukraine fluctuated, ranging from 27.0% to 34.0%. Metallurgical Plant Kametstal consistently operated above the average, peaking at 40.0% in August. ArcelorMittal Kryvyi Rih showed a steady increase, reaching 42.0% in August, the highest among the observed plants. Metinvest Zaporizhstal lagged behind the other two plants.

Metinvest Zaporizhstal steel plant

Metinvest Zaporizhstal, an integrated BF-OHF plant with a crude steel capacity of 4.1 million tonnes per annum (ttpa), has shown the lowest activity among the three observed plants. It mainly produces finished rolled products like hot- and cold-rolled sheets and coils. Its activity decreased from 30% in March to 28% in August. No direct relationship between this specific activity decrease and the UK to implement a CBAM in 2027 to prevent carbon leakage announcements can be established.

Metallurgical Plant Kametstal

Metallurgical Plant Kametstal, an integrated BF-BOF plant with a crude steel capacity of 4.2 million ttpa, produces semi-finished and finished rolled products. It showed a rise in activity to 40% in August, surpassing the mean. This increase suggests stable production capacity, but whether this is influenced by anticipatory stockpiling before the UK CBAM cannot be explicitly confirmed.

ArcelorMittal Kryvyi Rih steel plant

ArcelorMittal Kryvyi Rih, the largest plant with a crude steel capacity of 8 million ttpa using BF-BOF-OHF processes, has gradually increased its activity to 42.0% in August, indicating a stable increase in steel output. It produces both semi-finished and finished products. A direct link between this increased activity and the UK to implement a CBAM in 2027 to prevent carbon leakage announcements cannot be explicitly established based on the provided information.

Evaluated Market Implications

The upcoming UK CBAM, highlighted in the articles titled UK to implement a CBAM in 2027 to prevent carbon leakage, could disproportionately impact Metinvest Zaporizhstal due to its reliance on older OHF technology and consistently lower activity level relative to the mean activity of all Ukrainian steelplants. Given the impending CBAM and its potential impact on Zaporizhstal, steel buyers should:

- Diversify procurement: Explore alternative suppliers for hot- and cold-rolled sheets, potentially shifting from Zaporizhstal to Kametstal, which has increased its output to benefit from higher demand, mitigating risks associated with potential production cuts from Zaporizhstal when CBAM becomes effective.

- Negotiate contracts: Secure long-term contracts with Kametstal and ArcelorMittal Kryvyi Rih to ensure supply stability, leveraging their current higher production levels.

- Assess carbon footprint: Request detailed carbon emission data from Zaporizhstal’s coils, and where applicable, prepare for potential price adjustments as the CBAM implementation date approaches, as it seems more affected than Kametstal and ArcelorMittal.