From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Faces Uncertainty Amidst Trump-Putin Talks and Fluctuating Plant Activity

The Ukrainian steel market is facing uncertainty as diplomatic efforts to resolve the war are underway, with steel plant activity showing mixed signals. The outcome of these talks, detailed in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war,” could significantly impact the sector. The article “Could Trump’s meeting with Putin be the next Reagan-Gorbachev moment?” highlights the high stakes of these diplomatic efforts. There is no direct observed change in plant activity that immediately follows the publication dates of these two articles.

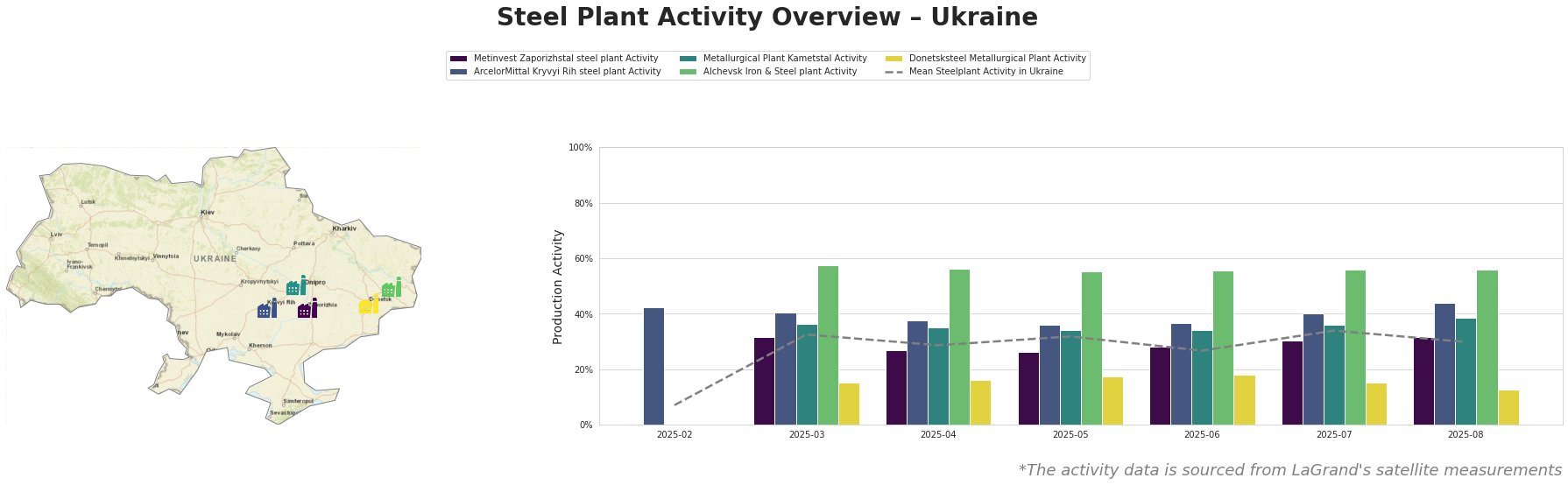

The mean steel plant activity in Ukraine fluctuated throughout the observed period, reaching a peak of 34% in July 2025 and falling to 30% in August 2025. The highest activity level across all plants was consistently at the Alchevsk Iron & Steel plant.

Metinvest Zaporizhstal steel plant: This integrated BF-OHF plant with a crude steel capacity of 4.1 TTPA, primarily producing finished rolled products like hot-rolled coils, showed an increase in activity from 30% in July to 32% in August 2025. It remained consistently below the mean Ukraine activity, except for March of 2025. No immediate connection could be established between the fluctuations in activity at this plant and the provided news articles.

ArcelorMittal Kryvyi Rih steel plant: As the largest steel plant in Ukraine, with a capacity of 8 TTPA crude steel via BOF and OHF processes and a strong focus on semi-finished and finished rolled products, this plant demonstrated an increase in activity from 40% in July to 44% in August 2025. This places it well above the mean steel plant activity in Ukraine. No immediate connection could be established between the fluctuations in activity at this plant and the provided news articles.

Metallurgical Plant Kametstal: This integrated BF-BOF plant, boasting a 4.2 TTPA crude steel capacity, primarily produces semi-finished and finished rolled products. Its activity increased from 36% in July to 38% in August 2025, aligning with the overall increasing trend. It remained marginally above the mean activity. No immediate connection could be established between the fluctuations in activity at this plant and the provided news articles.

Alchevsk Iron & Steel plant: With a crude steel capacity of 5.47 TTPA through integrated BF-BOF processes, this plant maintained the highest observed activity level, stable at 56% from April to July and showing a marginal decrease to 56% in August 2025. Given its location in the Luhansk region, any potential shift in control of Donbas as discussed in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war,” could severely impact the plant’s operations.

Donetsksteel Metallurgical Plant: Lacking crude steel production, this plant relies on BF-EAF to produce pig iron and shows the lowest observed activity. Activity decreased from 15% in July to 13% in August 2025. This plant’s activity has been consistently far below the mean. No immediate connection could be established between the fluctuations in activity at this plant and the provided news articles.

With uncertainty surrounding the Alchevsk Iron & Steel Plant due to its location, and the potential for shifts in regional control as discussed in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war,” steel buyers should:

- Assess exposure to Alchevsk Iron & Steel plant: Identify if your supply chain relies on Alchevsk Iron & Steel plant for slabs, square billets, or structural shapes. Prepare alternative sourcing options, specifically from ArcelorMittal Kryvyi Rih.

- Monitor diplomatic developments: Closely track the progress of the Trump-Zelenskyy meetings discussed in “Back from Alaska, Trump starts week with crucial foreign policy talks over Ukraine war.” Any indications of territorial concessions could significantly impact steel production in the Donbas region.

- Consult with geopolitical risk analysts: Given the complexities of the situation, engage with experts to assess the potential impact of various geopolitical scenarios on Ukrainian steel supply and pricing.

- Hedge against supply disruptions: “Gold Wavers as Traders Look to Jackson Hole and Ukraine Talks” references increased gold prices driven by geopolitical tensions. Consider hedging steel purchases or exploring alternative materials to mitigate risks associated with potential supply disruptions.