From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Anti-Dumping Measures Extended Amid Fluctuating Plant Activity

Ukraine’s steel market is navigating extended anti-dumping measures while plant activity shows recent fluctuations. According to “Ukraine extends duties on coated steel from Russia and China for another 5 years,” import duties have been prolonged, potentially impacting supply dynamics. At the same time, activity levels have shifted at key steel plants, although no direct link can be established between the trade policy and these specific changes. The review of anti-dumping measures on Chinese seamless pipes, as reported in “Ukraine reconsiders duties on Chinese seamless pipes” and “Ukraine can keep protection from dumping from China – the review continues“, further contributes to market uncertainty.

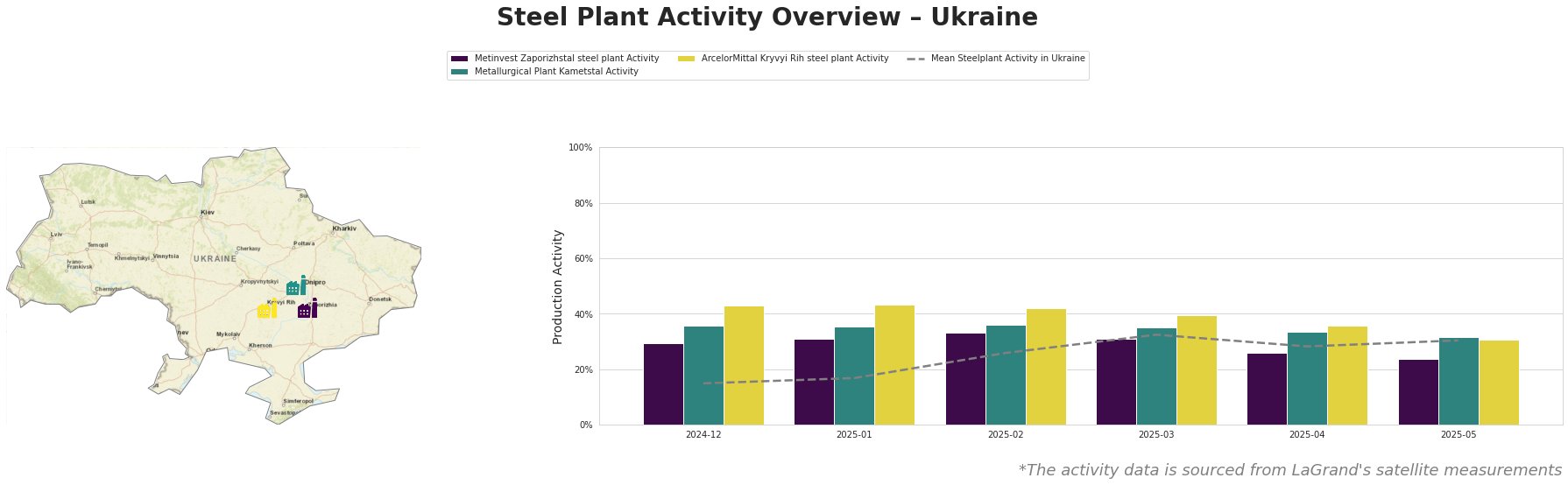

The average steel plant activity across Ukraine saw a general increase from December 2024 to March 2025, peaking at 32%, followed by a slight decline and then stabilization, ending May 2025 at 30%.

Metinvest Zaporizhstal steel plant, an integrated BF-OHF plant with a crude steel capacity of 4.1 million tonnes per annum and key products including hot-rolled coil and cold-rolled sheets, showed activity above the national average until April 2025. The activity dropped from 30% in December 2024 to 24% in May 2025. No direct link can be established between this decline and the news articles regarding anti-dumping measures.

Metallurgical Plant Kametstal, another integrated BF-BOF plant producing semi-finished and finished rolled products like square billets and rails with a crude steel capacity of 4.2 million tonnes per annum, displayed activity levels consistently above the national average. However, activity decreased in May 2025 to 32% from 36% in February 2025. There’s no clear connection between this change and the cited news articles.

ArcelorMittal Kryvyi Rih steel plant, the largest plant in Ukraine with an 8 million tonne crude steel capacity using BF-BOF-OHF technology and producing billet, rebar, and wire rod, consistently showed activity significantly above the national average until March 2025. Activity steadily decreased from 43% in January 2025 to 31% in May 2025. As with the other plants, no direct correlation between this trend and the cited news articles can be established.

Given the extension of duties on coated steel from Russia and China as mentioned in “Ukraine extends duties on coated steel from Russia and China for another 5 years” and the ongoing review of anti-dumping measures on Chinese seamless pipes as highlighted in “Ukraine reconsiders duties on Chinese seamless pipes” and “Ukraine can keep protection from dumping from China – the review continues“, steel buyers should anticipate potential price volatility in coated and seamless steel products due to altered import dynamics. Procurement professionals focusing on coated steel should diversify their supplier base and explore domestic alternatives, recognizing that extended duties aim to bolster local production. Given the anti-dumping reviews, buyers of seamless pipes should closely monitor the Ministry of Economy’s announcements and prepare for potential tariff adjustments that could impact import costs. The recent downtrend in plant activities requires further monitoring.