From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Activity Fluctuations Amidst UK Import Quota Concerns

Ukraine’s steel sector shows variable plant activity amidst concerns surrounding potential UK import quota changes. Uncertainty in the UK market, as highlighted in “TRA unveils proposed restrictions on steel imports from the UK,” may indirectly influence Ukrainian export strategies. However, a direct relationship between this news and observed activity changes in Ukrainian plants cannot be explicitly established based on the provided information.

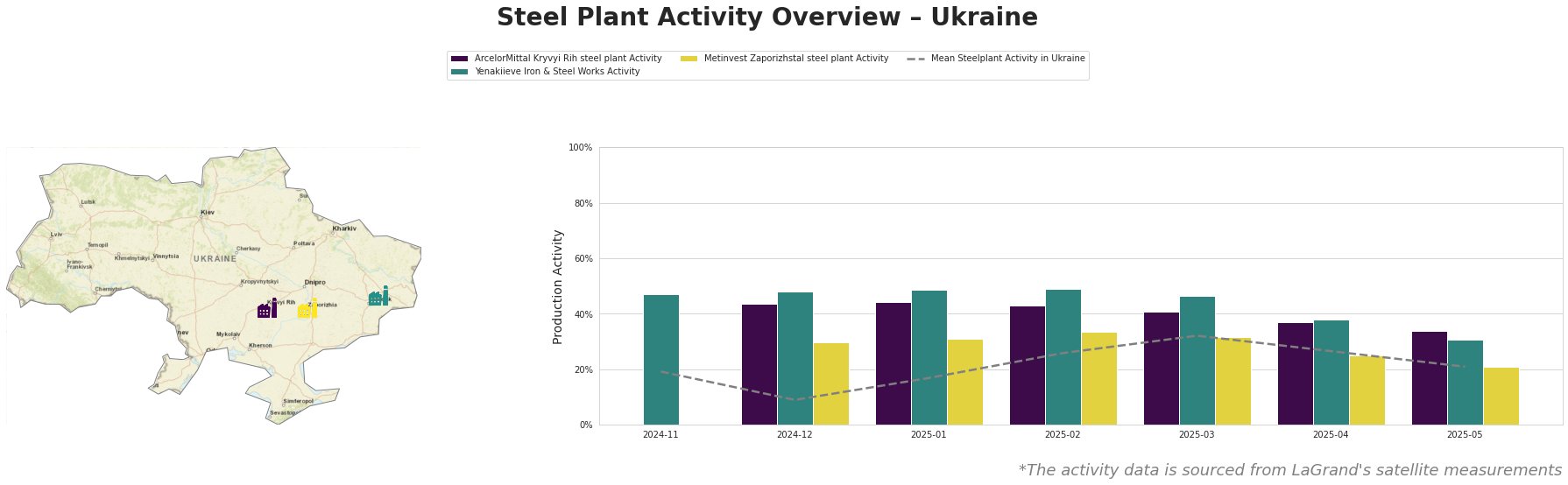

The mean steel plant activity in Ukraine peaked in March 2025 at 32.0%, subsequently declining to 21.0% by May 2025. ArcelorMittal Kryvyi Rih saw a consistent decline from 44.0% in December 2024 to 34.0% in May 2025. Yenakiieve Iron & Steel Works displayed the highest activity among the three, remaining relatively stable around 47.0% to 49.0% until March 2025, before dropping to 31.0% by May 2025. Metinvest Zaporizhstal showed similar trends to the overall mean, with a peak of 34.0% in February 2025, then fell to 21.0% in May 2025, matching the lowest level since December 2024. No direct connection between these observed activity changes and the provided news articles can be established.

ArcelorMittal Kryvyi Rih, an integrated (BF) steel plant with a crude steel capacity of 8000 TTPA, utilizes BF, BOF, and OHF technologies to produce semi-finished and finished rolled products. The plant’s activity decreased from 44.0% in December 2024 to 34.0% in May 2025. Considering UK Steel’s concerns about global overcapacity, mentioned in “Proposed TRQ changes ‘fall short’, says UK Steel“, this reduction might be a strategic adjustment to balance production with anticipated export demand in the face of potential trade barriers in the UK. However, this remains speculative, as no direct link can be explicitly established.

Yenakiieve Iron & Steel Works, another integrated (BF) steel plant located in the Donetsk region, has a crude steel capacity of 3300 TTPA and primarily produces semi-finished and finished rolled products like rebar and wire rods. Although activity was highest overall, it dropped significantly from 46% in March to 31% in May. The cause for this drop is unknown and cannot be linked directly to any provided news articles.

Metinvest Zaporizhstal, located in Zaporizhzhia, is an integrated (BF) steel plant with a crude steel capacity of 4100 TTPA, focusing on finished rolled products for the automotive, packaging, and machinery sectors. Its activity decreased to 21.0% in May 2025, mirroring the overall mean. As with ArcelorMittal, the recent announcement of proposed restrictions on steel imports by the UK TRA, highlighted in “TRA unveils proposed restrictions on steel imports from the UK“, may have prompted adjustments in production schedules, though a direct correlation remains unconfirmed.

Given the observed activity declines across Ukrainian steel plants and the uncertainty surrounding future UK trade policies as referenced in “UK Steel: TRA’s quota cap recommendation falls short“, procurement professionals should:

- Diversify Export Markets: Actively explore alternative export destinations to mitigate potential disruptions stemming from the UK’s evolving trade landscape.

- Monitor UK Policy: Closely monitor the final recommendations from the UK’s Trade Remedies Authority and subsequent government decisions regarding steel import quotas.

- Negotiate Flexible Contracts: Secure flexible supply contracts with Ukrainian steel producers to accommodate potential shifts in production and export strategies.