From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market: Activity Fluctuations Amidst Global Trade Uncertainties

Ukraine’s steel sector exhibits fluctuating plant activity amid ongoing international trade negotiations impacting steel producers outside Ukraine, as highlighted in “The UK is fighting for Tata Steel’s duty-free access to the US market,” “Tata Steel may be left out of the UK-US trade deal,” and “UK continues negotiations with the US on steel as part of a trade deal.” While the news articles do not directly relate to the operational realities of steel plants in Ukraine, the overall market sentiment could be affected through global steel supply chains. Observed activity shifts at key Ukrainian plants are detailed below, with specific developments correlated to news articles where possible.

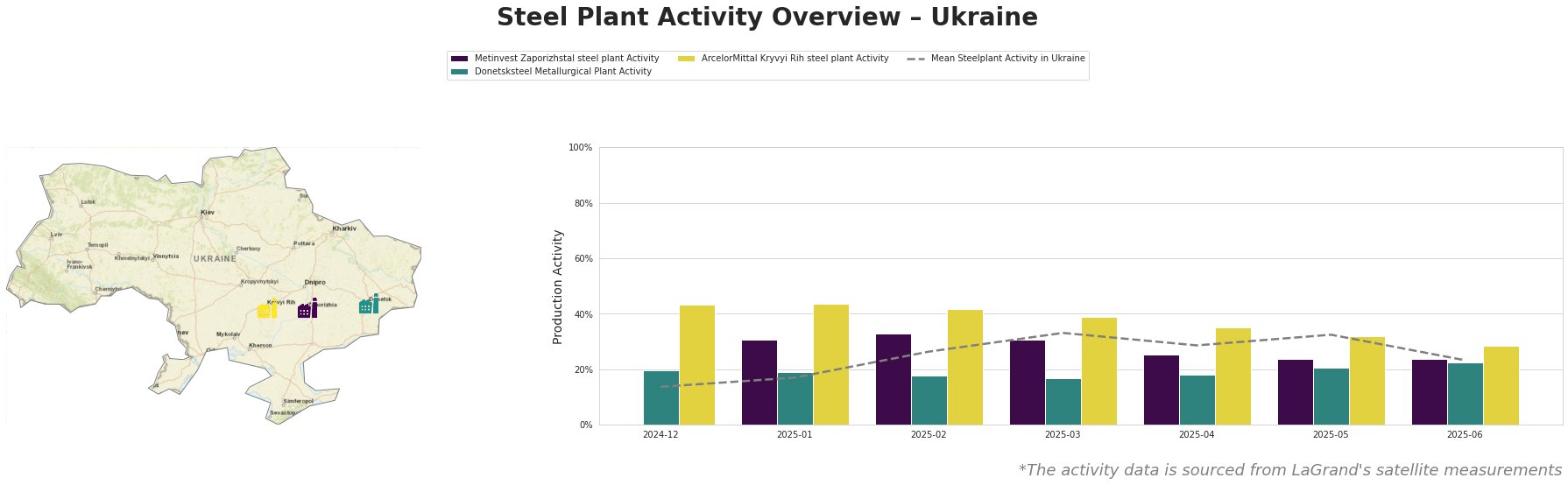

Overall, the mean steel plant activity in Ukraine demonstrates a fluctuating trend, peaking at 33% in March 2025, followed by a decline to 23% by June 2025.

Metinvest Zaporizhstal steel plant, an integrated BF-OHF plant with a crude steel capacity of 4100 TTPA, showed a peak activity of 33% in February 2025, declining to 24% by June 2025. This plant primarily produces finished rolled products, including hot-rolled and cold-rolled sheets. No direct connection can be established between the observed activity fluctuations and the developments described in “The UK is fighting for Tata Steel’s duty-free access to the US market,” “Tata Steel may be left out of the UK-US trade deal,” and “UK continues negotiations with the US on steel as part of a trade deal“.

Donetsksteel Metallurgical Plant, an integrated BF-EAF plant focused on pig iron production, saw its activity hover around 20% with slight fluctuations. It reached 23% in June 2025. No direct connection can be established between the observed stable activity and the developments described in “The UK is fighting for Tata Steel’s duty-free access to the US market,” “Tata Steel may be left out of the UK-US trade deal,” and “UK continues negotiations with the US on steel as part of a trade deal“.

ArcelorMittal Kryvyi Rih steel plant, a major integrated BF-BOF-OHF plant with a crude steel capacity of 8000 TTPA, recorded the highest activity among the observed plants. Its activity declined steadily from 44% in January 2025 to 28% in June 2025. The plant produces a range of semi-finished and finished rolled products, including billet, rebar, and wire rod. No direct connection can be established between the observed activity decrease and the developments described in “The UK is fighting for Tata Steel’s duty-free access to the US market,” “Tata Steel may be left out of the UK-US trade deal,” and “UK continues negotiations with the US on steel as part of a trade deal“.

Given the fluctuating mean plant activity in Ukraine, and that international trade negotiations like those mentioned in “The UK is fighting for Tata Steel’s duty-free access to the US market,” “Tata Steel may be left out of the UK-US trade deal,” and “UK continues negotiations with the US on steel as part of a trade deal“, can have cascading effects on global supply, steel buyers should:

- Maintain diversified sourcing: Broaden the supplier base beyond a few key players to mitigate potential disruptions from any single plant.

- Closely monitor regional activity: Regularly assess activity trends at key Ukrainian steel plants to anticipate potential supply shortages or price increases.

- Negotiate flexible contracts: Secure contracts with built-in flexibility to adjust order volumes and delivery schedules based on evolving market conditions.