From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Exports Surge Despite Domestic Production Fluctuations: A Positive Outlook for Buyers

Ukraine’s steel sector demonstrates resilience with increased exports across various product categories, as detailed in “Ukraine increased exports of flat products to 554 thousand tons in January-April,” “Pig iron exports from Ukraine increased by 37% in 4 months,” “Ukraine increase exports of long products by 26% y/y in January-April,” and “Ukraine increased exports of ferrous scrap by 95% year-on-year.” However, this export surge occurs alongside fluctuating steel plant activity levels observed via satellite, which may signal evolving production dynamics within the country. While increased exports of long products coincided with increased imports of long products, per the title “Ukraine increased imports of long products by 81.1% y/y in January-April,” it is difficult to pinpoint precisely which factors are driving these dynamics.

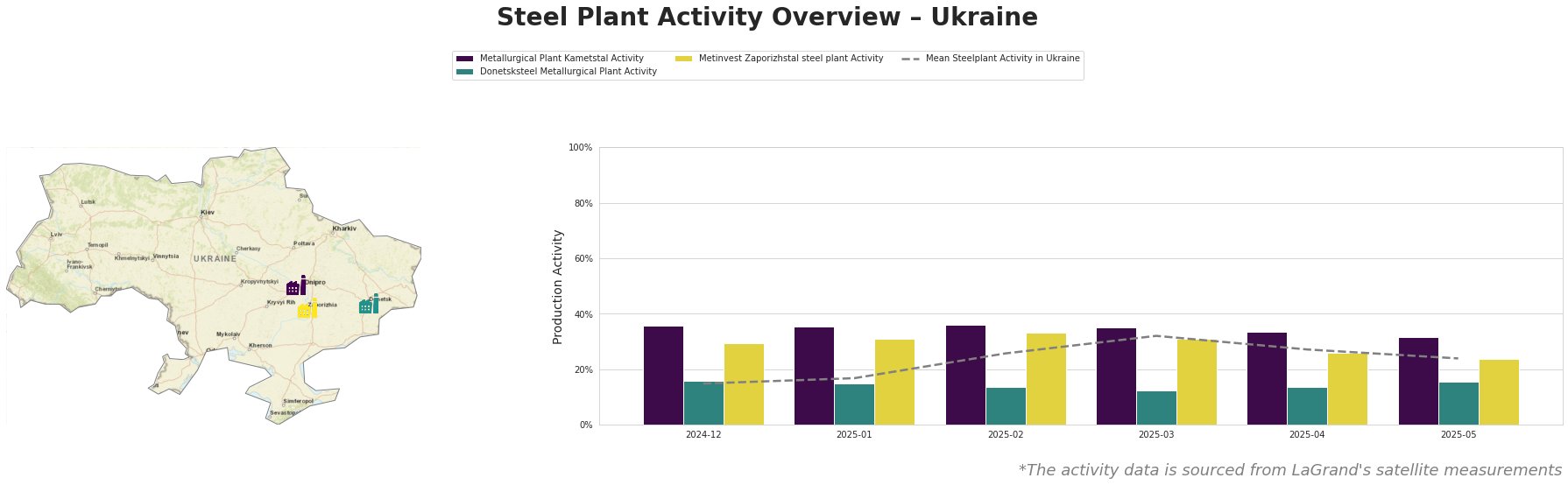

The table shows that the Mean Steelplant Activity in Ukraine reached a peak in March 2025 at 32.0%, before declining to 24.0% in May 2025. Metallurgical Plant Kametstal shows relatively stable activity, hovering around 35% and gradually decreasing to 32% in May 2025. Donetsksteel Metallurgical Plant demonstrates relatively low activity levels, remaining consistently below the Ukrainian mean. Metinvest Zaporizhstal steel plant activity mirrors the mean trend, peaking in February 2025 before trending downwards.

Metallurgical Plant Kametstal, with a crude steel capacity of 4.2 million tonnes utilizing BOF technology, maintained relatively stable activity, ranging between 36% and 32% from December 2024 to May 2025. This plant focuses on semi-finished and finished rolled products such as billets, wire rods, and rails, supplying sectors like energy and transport. While overall Ukrainian steel exports are up, there is no direct connection that can be drawn between the stability of production at Kametstal and the trends in exports detailed in the news articles.

Donetsksteel Metallurgical Plant, primarily a pig iron producer with a blast furnace capacity of 1.5 million tonnes, has shown the lowest activity levels among the observed plants, fluctuating between 12% and 16%. The satellite data indicating low activity levels at Donetsksteel could possibly correlate with the report “Pig iron exports from Ukraine increased by 37% in 4 months” because this suggests existing pig iron inventories are being exported instead of new product being created.

Metinvest Zaporizhstal, an integrated BF-OHF plant, boasts a crude steel capacity of 4.1 million tonnes, specializing in finished rolled products, including hot-rolled and cold-rolled sheets. Its activity levels closely follow the national average, peaking at 33% in February before declining to 24% in May 2025. Given the plant’s focus on flat products, the observed activity trend could possibly correlate with the drop in flat product exports in April as mentioned in “Ukraine increased exports of flat products to 554 thousand tons in January-April“, though this is speculative.

The observed increase in scrap exports, as reported in “Ukraine increased exports of ferrous scrap by 95% year-on-year,” alongside an increase of exports of pig iron, coupled with the overall export growth, suggests that Ukrainian steelmakers are leveraging export opportunities while navigating domestic production constraints and shifting market dynamics.

Evaluated Market Implications:

The surge in Ukrainian steel exports, particularly of flat products, long products, pig iron and scrap, presents both opportunities and potential risks. The significant increase in ferrous scrap exports, potentially driven by attractive pricing in Poland, may impact domestic steel production costs if local scrap availability tightens.

Given the increased imports of long products, potentially from Turkey and China, in accordance to the news article “Ukraine increased imports of long products by 81.1% y/y in January-April,” Ukrainian steel buyers should consider diversifying their supply base and closely monitoring import prices and logistics. Steel buyers should evaluate securing contracts with Kametstal to hedge against potential supply variability linked to observed production fluctuations in other steel plants, or with other local producers, considering the recent decrease in exports from Metinvest Zaporizhstal steel plant. The recommendation is substantiated by the relatively stable satellite activity data from the plant combined with the rising overall demand for steel products, and provides a level of supply security to Ukrainian buyers. Furthermore, the Ukrainian steel buyers should carefully consider procuring long products from Turkey and China due to the increased imports of these steel products, but at the same time carefully monitor the import prices and logistics.