From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Demand Surges Amidst Export Shifts: European Steel Market Analysis (October 2025)

European steel markets show a very positive sentiment driven by significant shifts in Ukrainian steel production, consumption, and trade flows. These changes are directly impacting regional supply dynamics. The observed trends coincide with reports such as “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September” and “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025“, signaling a robust increase in domestic demand coupled with a realignment of export strategies. The observed activity levels in SIJ Acroni Jesenice steel plant, Salzgitter Flachstahl steel plant, and Liberty Czestochowa steel plant will be reviewed but no direct relationship can be established.

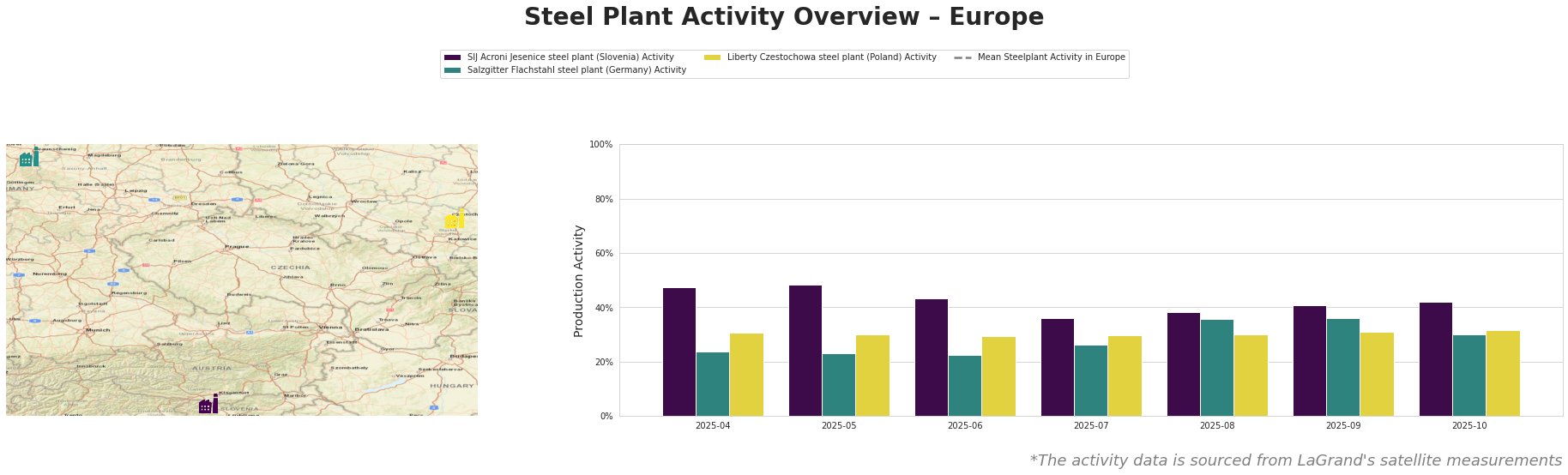

The Mean Steelplant Activity in Europe varied significantly from April to October 2025. SIJ Acroni Jesenice steel plant showed fluctuations, with a notable dip to 36% in July before recovering to 42% in October. Salzgitter Flachstahl steel plant saw a steady increase, peaking at 36% in August and September before decreasing to 30% in October. Liberty Czestochowa steel plant remained relatively stable throughout the period, hovering between 30% and 32%. The activity levels observed in SIJ Acroni Jesenice steel plant, Salzgitter Flachstahl steel plant, and Liberty Czestochowa steel plant will be reviewed but no direct relationship can be established.

SIJ Acroni Jesenice, a Slovenian steel plant with a 726kt EAF capacity specializing in flat rolled products, experienced fluctuating activity levels. After starting at 47% in April 2025, activity dipped to a low of 36% in July before recovering to 42% by October. While no direct correlation can be established between these fluctuations and the Ukrainian market news, the plant’s reliance on EAF technology and semi-finished/finished rolled products suggests it could be indirectly influenced by shifts in scrap availability or demand for finished products within Europe, as “Scrap exports from Ukraine reached 311,000 tons in January-September” indicates scrap export volumes are increasing.

Salzgitter Flachstahl, a major German integrated steel plant with a 5200kt BOF capacity focused on flat rolled products, showed a different trend. Activity started at 24% in April 2025 and gradually increased to 36% by August and September, before decreasing to 30% in October. As an integrated plant, Salzgitter’s activity is less directly tied to scrap market fluctuations but may be sensitive to overall European demand for flat rolled products. The plant’s ongoing transition to hydrogen-based steel production under the Salcos Green Steel project does not appear to have significantly impacted its observed activity levels during this period, as no sharp production changes are apparent.

Liberty Czestochowa, a Polish steel plant utilizing EAF technology with a capacity of 840kt and specializing in plate production, demonstrated stable activity. The plant’s activity remained between 30% and 32% from April to October 2025. While Poland is a key destination for Ukrainian scrap and flat steel exports, as highlighted in “Scrap exports from Ukraine reached 311,000 tons in January-September” and “Ukraine exported 1.29 million tons of flat products in January-September“, no direct connection can be made to the stable activity observed at Liberty Czestochowa.

The surge in Ukrainian domestic steel consumption, as indicated by “Consumption of steel products in Ukraine grew by 39.5% y/y in January-September“, coupled with decreased overall steel exports, described in “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025,” suggests a tightening of regional supply, particularly for flat steel products. The rise of exports in scrap can potentially tighten supply with domestic steelmakers and can have an adverse affect.

Procurement Actions:

* Diversify Sourcing: Given the potential for increased competition for European steel supply due to increased Ukrainian domestic consumption, steel buyers should actively diversify their sourcing strategies, looking beyond traditional suppliers.

* Monitor Scrap Prices: The surge in Ukrainian scrap exports, as highlighted in “Scrap exports from Ukraine reached 311,000 tons in January-September“, may put upward pressure on European scrap prices, particularly affecting EAF-based steel producers. Procurement teams should closely monitor scrap price trends and consider hedging strategies.

* Prioritize Long-Term Contracts: Secure long-term contracts with reliable suppliers to mitigate against potential short-term supply disruptions and price volatility stemming from the shifts in Ukrainian steel trade flows.