From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK-US Tariff Deal Boosts European Steel Optimism: Spanish Activity Surges Amidst Import Concerns

Europe’s steel market displays positive sentiment fueled by potential trade liberalization and adjustments to import restrictions. The “UK, US near final deal to eliminate steel tariffs following quota breakthrough“ suggests increased trade flow, potentially impacting regional supply dynamics. While the news does not directly explain plant activity, the anticipation of reduced tariffs could be influencing production levels. Conversely, the article “British importers have become outraged by the tightening of trade protection measures“ highlights concerns about reduced import quotas and their impact on prices, creating uncertainty. These measures are not immediately reflected in plant activity data. The “EU begins consultations on future steel import guarantees“ signals a proactive approach to maintaining competitiveness amidst global overcapacity, reflecting a broader trend of protectionism across Europe.

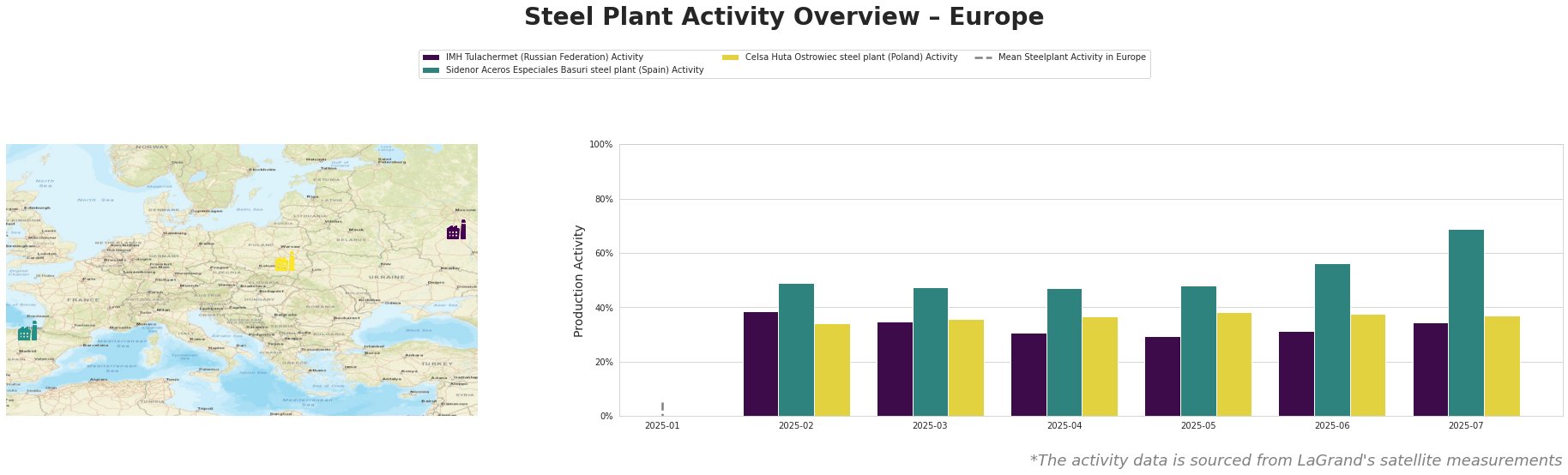

The table highlights significant fluctuations in the “Mean Steelplant Activity in Europe”, making it difficult to interpret as a reliable benchmark. Activity at IMH Tulachermet (Russian Federation) shows a gradual decline from February (38.0) to May (29.0), followed by a slight recovery. Sidenor Aceros Especiales Basuri steel plant (Spain) shows a notable increase in activity, peaking at 69.0 in July. Activity at Celsa Huta Ostrowiec steel plant (Poland) remains relatively stable. No direct connections can be established between the observed activity changes at IMH Tulachermet and Celsa Huta Ostrowiec and the provided news articles.

IMH Tulachermet, an integrated steel plant in the Tula region of Russia with a capacity of 1.8 million tonnes of crude steel (BOF) and 3.763 million tonnes of iron (BF), produces semi-finished and finished rolled products. The observed activity decrease from February to May, followed by a slight rebound, does not directly correlate with the provided news articles focusing on UK and EU trade policies. Therefore, the factors influencing IMH Tulachermet’s production remain unclear from this data.

Sidenor Aceros Especiales Basuri, located in Spain, operates an EAF with a capacity of 740,000 tonnes of crude steel, producing finished rolled products for various sectors. The plant’s activity increased steadily, reaching 69.0 in July. While the news article “British importers have become outraged by the tightening of trade protection measures” might suggest a potential boost for domestic producers like Sidenor due to import restrictions, no direct link can be firmly established without additional data on regional demand and import volumes.

Celsa Huta Ostrowiec, a Polish EAF steel plant with a 900,000-tonne capacity focused on bar and rebar production, shows a stable activity level. The lack of significant fluctuations suggests consistent demand and production. As with IMH Tulachermet, no direct connection to the UK and EU trade news can be established.

Given the impending UK-US tariff reductions and potential trade shifts, steel buyers should closely monitor price fluctuations, especially for products previously subject to tariffs. For buyers in the UK, consider diversifying suppliers to mitigate potential price increases resulting from the “British importers have become outraged by the tightening of trade protection measures“. The surge in activity at Sidenor Aceros Especiales Basuri suggests a potential increase in supply from this plant. Procurement professionals should explore opportunities to secure contracts with them, particularly if seeking specialized steel products for the automotive, construction, or energy sectors. Consider future supply chain vulnerabilities if the EU follows through with stricter import guarantees, which could cause increased prices in the future.