From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Steel Demand Surge: Defense Strategy Boosts Domestic Production Amidst Global Uncertainty

The Ukrainian steel market shows fluctuating activity across major plants, with overall activity below historical averages. The UK’s defense industrial strategy, outlined in “UK’s new defense industrial strategy puts UK steel at core of national security” and “British defense strategy emphasizes priority for domestic steel,” is expected to drive demand for UK-produced steel. However, no direct link between the UK’s defense strategy and observed activity in Ukrainian steel plants can be established based on the provided data. The article titled “The UK government is considering a plan for the development of domestic steel production” highlights the challenges faced by the UK steel industry, suggesting a focus on domestic market dynamics.

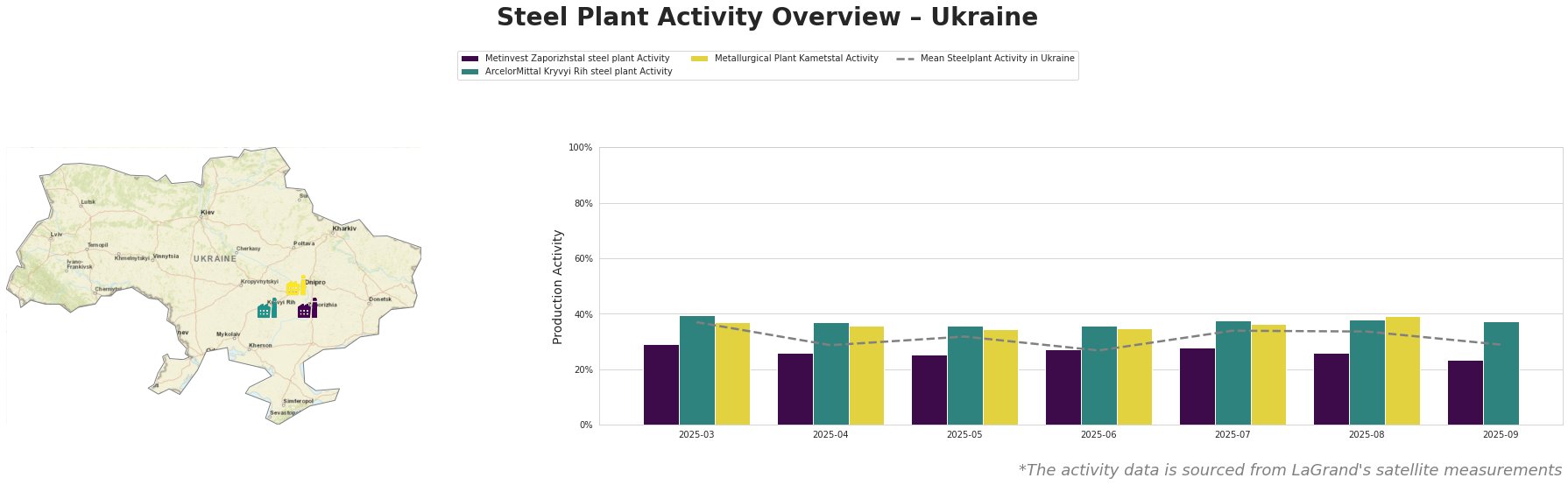

The mean steel plant activity in Ukraine has fluctuated, peaking at 37% in March and bottoming out at 27% in June. The most recent observation for September indicates a slight recovery to 29%, but the overall trend remains volatile.

Metinvest Zaporizhstal, an integrated steel plant with a 4.1 million tonne crude steel capacity relying on older OHF technology, has consistently operated below the Ukrainian average. Activity decreased from 29% in March to 24% in September. Given its reliance on open-hearth furnaces, the plant might face challenges adapting to stricter environmental regulations or energy efficiency standards. No explicit connection to the named news articles can be established.

ArcelorMittal Kryvyi Rih, a major integrated steel plant with a significant 8 million tonne crude steel capacity split between BOF and OHF processes, shows more stable activity compared to the other plants. Activity levels held relatively steady around 36-40% throughout the observed period. Similar to Metinvest, it has some older processes. No explicit connection to the named news articles can be established.

Metallurgical Plant Kametstal, another integrated plant but with a smaller 4.2 million tonne BOF-based crude steel capacity, exhibited activity close to the national average. Its activity rose to 39% in August before dropping slightly to 38% in September. No explicit connection to the named news articles can be established.

Evaluated Market Implications:

Based on the news articles, the increased prioritization of UK steel in defense procurement may lead to increased demand for UK steel and decreased demand for imported steel. The activity levels of the Ukrainian plants are volatile.

Recommended procurement actions:

- Steel buyers focusing on the UK market should anticipate potential price increases in UK-produced steel due to increased demand driven by the UK’s Defence Industrial Strategy. Carefully consider the specific grades and standards favored in defense applications as outlined in the DIS when negotiating contracts.

- Given the volatility of activity levels in Ukraine, procurement professionals should closely monitor production trends at individual plants and diversify their supply sources to mitigate potential disruptions. Review contract clauses related to force majeure and delivery timelines, especially if sourcing from plants showing declining activity.