From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Energy Boost Fuels Optimism for European Steel; Cremona Plant Faces Headwinds

Europe’s steel market exhibits a very positive sentiment, primarily fueled by supportive governmental actions in the UK. “The UK will reduce electricity costs for industry,” which, according to “UK industry welcomes Industrial Strategy but concerns remain,” has been met with applause from UK Steel. This anticipated reduction in energy costs potentially impacts the competitive landscape for steel producers across Europe. Observed activity shifts in specific plants, however, don’t directly correlate with these UK developments; no explicit link can be established.

Recent UK initiatives, including “The UK will increase investment in clean energy to over £30 billion per year” and “UK set to boost clean energy investments by £30bn/yr“, signal a long-term commitment to sustainable industrial growth. “Cheaper power key to reach UK’s climate targets” reinforces the importance of affordable electricity for achieving environmental goals, indirectly supporting the steel industry’s transition towards cleaner production methods. Despite these broad positive developments, a direct correlation between these investments and immediate activity level increases at observed steel plants cannot be explicitly established based on the provided data.

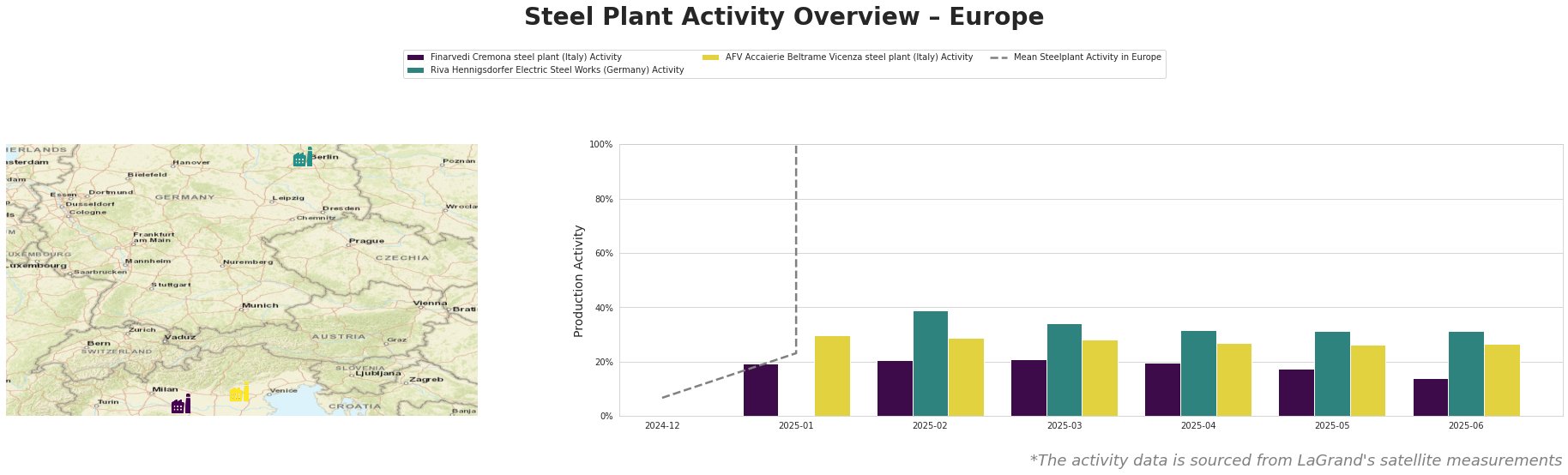

The mean steel plant activity in Europe, while showing enormous values due to data quality issues, does suggest a general, strongly increasing trend over the observed period.

Finarvedi Cremona, an Italian steel plant focused on hot-rolled coil and galvanized products for the automotive sector, utilizing two EAFs, experienced a decrease in activity from 21% in March 2025 to 14% in June 2025. This decline does not have an explicitly apparent relationship with the UK news articles provided.

Riva Hennigsdorfer Electric Steel Works, a German EAF steel plant producing steel billets and rebar, showed a relatively stable activity level, fluctuating between 31% and 39%. There is no immediate impact observable in its activity levels with the news articles.

AFV Accaierie Beltrame Vicenza, another Italian EAF steel plant, producing for building and infrastructure, recorded an activity level of 27% in June 2025. There is no immediate impact observable in its activity levels with the news articles.

Evaluated Market Implications:

The UK’s energy cost reduction measures, as highlighted in “The UK will reduce electricity costs for industry,” could shift the competitive landscape, potentially favoring UK-based steel producers. However, the satellite data doesn’t yet reflect these changes, and no specific plant shows correlation.

Given the observed decrease in activity at Finarvedi Cremona (Italy), steel buyers reliant on this plant for hot-rolled coil and galvanized products should proactively engage with Finarvedi to understand the causes behind the production slowdown and consider diversifying their supply base to mitigate potential disruptions. There is no news explicitly linked to the plant activity shifts.