From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineTurkish Steel Exports Surge Amidst Fluctuating Chinese Plant Activity: Opportunities & Risks

Turkey’s steel sector shows strong export growth, potentially impacting Asian markets despite activity fluctuations in key Chinese steel plants. The “Turkish rebar exports up 21 percent in January-August 2025” highlights a significant increase in Turkish rebar exports, while “Turkey’s wire rod exports up 1.2 percent in Jan-Aug 2025” indicates more moderate growth in wire rod exports. At the same time “Turkey reduced scrap imports by 9.4% y/y in January-August 2025″, potentially impacting production costs. The satellite data for Chinese steel plants does not show a direct correlation with these Turkish export figures, indicating potentially independent market dynamics.

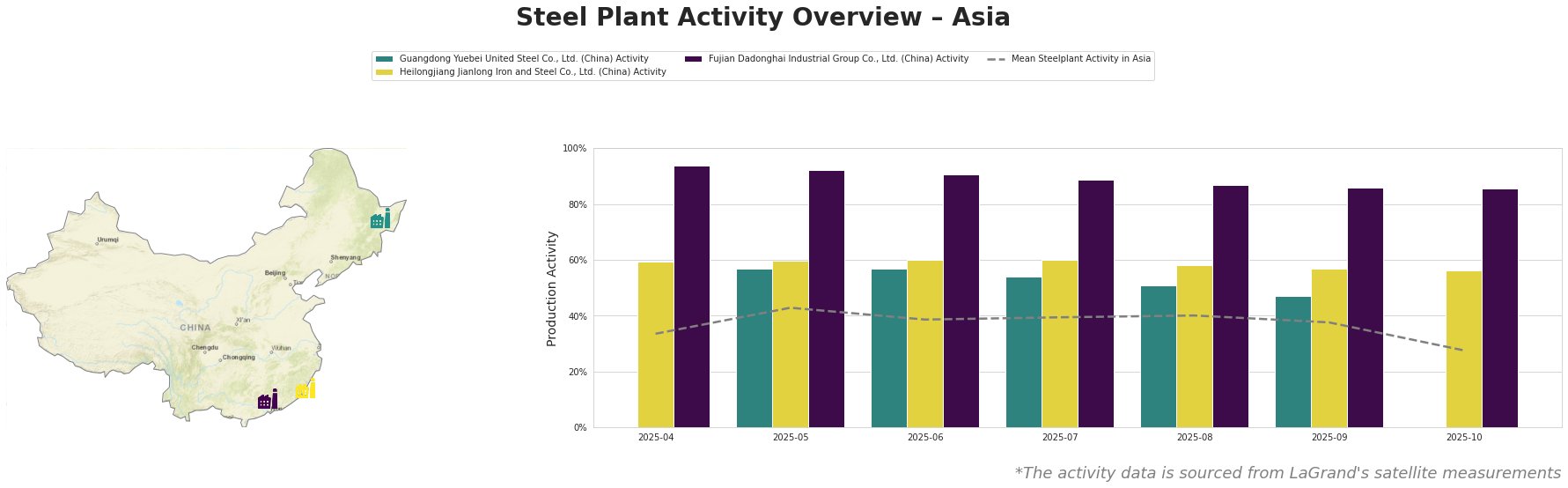

The mean steel plant activity in Asia shows a declining trend, especially noticeable in October 2025, dropping to 28.0% after hovering around 39-43% in the previous months. Guangdong Yuebei United Steel Co., Ltd., a rebar producer with integrated BF and EAF processes, shows a decline in activity from 57.0% in May-June to 47.0% in September. No data is available for April and October. Heilongjiang Jianlong Iron and Steel Co., Ltd., also an integrated BF/BOF producer focusing on rebar, hot rolled ribbed steel bars and seamless steel tubes, maintained relatively stable activity, fluctuating between 56% and 60% over the observed period. Fujian Dadonghai Industrial Group Co., Ltd., another rebar-focused integrated BF/BOF producer, demonstrates the highest activity levels among the observed plants, but steadily decreasing from 94.0% in April to 86.0% in September and October. There is no immediately apparent link between the activity levels of these Chinese plants and the Turkish export trends reported in the news articles.

Guangdong Yuebei United Steel Co., Ltd., primarily producing rebar via integrated BF and EAF processes, saw its activity dip from 57.0% in May-June to 47.0% in September. The absence of activity data for April and October makes it hard to assess long-term impacts. Given its focus on rebar, any extended downturn could potentially influence domestic Chinese supply, although no direct correlation can be established with the “Turkish rebar exports up 21 percent in January-August 2025”.

Heilongjiang Jianlong Iron and Steel Co., Ltd., operating integrated BF/BOF processes, maintained relatively stable activity levels between 56% and 60%. Specializing in rebar, hot rolled ribbed steel bars, and seamless steel tubes, its steady performance suggests reliable supply within its specific product categories. There is no evident connection between the plant’s activity and the reported changes in Turkish steel exports.

Fujian Dadonghai Industrial Group Co., Ltd., another integrated BF/BOF rebar producer, exhibited the highest activity, albeit with a consistent decline from 94.0% in April to 86.0% by October. This continuous downtrend, without an associated news event, could indicate evolving local demand or production adjustments independent of Turkish export dynamics.

Given the “Turkish rebar exports up 21 percent in January-August 2025” and steady decline of Fujian Dadonghai Industrial Group Co., Ltd., rebar buyers should:

1. Diversify Sourcing: Given the increased Turkish export activity and the slight decline of domestic Chinese production, buyers should explore Turkish rebar suppliers to secure competitive pricing and mitigate potential supply risks arising from Chinese production adjustments.

2. Carefully Evaluate Supply: Buyers should consider the 9.4% drop in Turkish scrap imports (“Turkey reduced scrap imports by 9.4% y/y in January-August 2025”) when negotiating prices, as this could lead to slightly increased production costs in the longer term.