From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineThyssenkrupp Investment Drives Optimistic Outlook for European Steel; Differing Plant Activities Signal Supply Dynamics

Europe’s steel market exhibits a very positive sentiment, buoyed by modernization efforts despite varied plant activity levels. Thyssenkrupp’s investment is driving the optimism, as evidenced by the articles “Thyssenkrupp launches a new continuous casting machine“, “Thyssenkrupp starts trial production at new continuous slab caster” and “The first slabs were poured in Duisburg: a new era of Thyssenkrupp steel production has begun“. These articles correlate with an anticipation of increased efficiency and premium product output; however, these articles do not contain information directly relating to changes to satellite-observed plant activity.

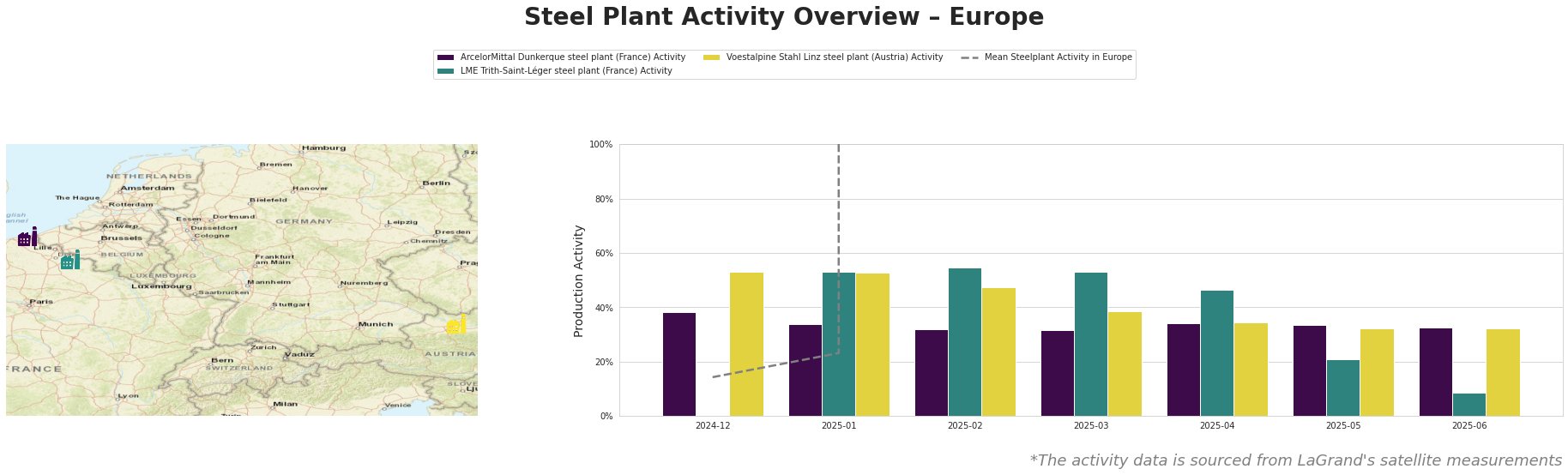

Across Europe, the mean steel plant activity shows extreme volatility, with activity levels increasing steadily between December and March. Following this period, the activity level remains high, but fluctuates. Individual plant activity varies significantly.

ArcelorMittal Dunkerque, an integrated BF-BOF plant with a crude steel capacity of 6.75 million tonnes annually, shows relatively stable activity. Its activity ranges from 32% to 38% of its all-time-high activity over the observed period, showing no significant fluctuation. There is no directly observable connection between the recent Thyssenkrupp news and the stable activity at ArcelorMittal Dunkerque.

The LME Trith-Saint-Léger steel plant, an EAF-based producer of 850,000 tonnes of crude steel per year, experienced a significant drop in activity, falling from 53% in January 2025 to 9% in June 2025. This sharp decline contrasts with the overall market sentiment and requires close monitoring. No direct connection can be established between the LME Trith-Saint-Léger plant activity and the Thyssenkrupp news.

Voestalpine Stahl Linz, a major integrated steel producer with 6 million tonnes of BOF-based crude steel capacity, exhibits a declining activity trend, decreasing from 53% in both December 2024 and January 2025 to 32% in May and June 2025. The decrease could reflect strategic adjustments, such as maintenance or production realignments. There is no directly observable connection between the recent Thyssenkrupp news and activity at Voestalpine Stahl Linz.

The commencement of trial production at Thyssenkrupp, combined with consistently stable or slightly reduced activity at other major European plants and a major reduction at LME Trith-Saint-Léger, suggests a potential shift in supply dynamics. Steel buyers should actively monitor the output from Thyssenkrupp’s modernized Duisburg plant. Given the significant decrease in activity at LME Trith-Saint-Léger, procurement professionals should proactively diversify their slab and hot rolled coil supply sources in Hauts-de-France. Furthermore, monitor Voestalpine Stahl Linz activity shifts, and consider alternative suppliers for hot-rolled, cold-rolled, and coated steel strip.