From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSweden’s Steel Market: Positive Outlook Driven by SSAB’s Green Financing and Activity Trends

Recent developments in Sweden’s steel sector showcase a promising trajectory, particularly through SSAB’s strategic advancements. Notably, SSAB has secured €2.3 billion in green financing for its Luleå mill as reported in the articles “SSAB secures €2.3bn financing for Luleå mill,” and “SSAB raises €2.3 billion in green financing for Luleå plant.” This financing underpins a major transition towards fossil fuel-free production that aligns with observed increases in plant activity, specifically in the Luleå facility.

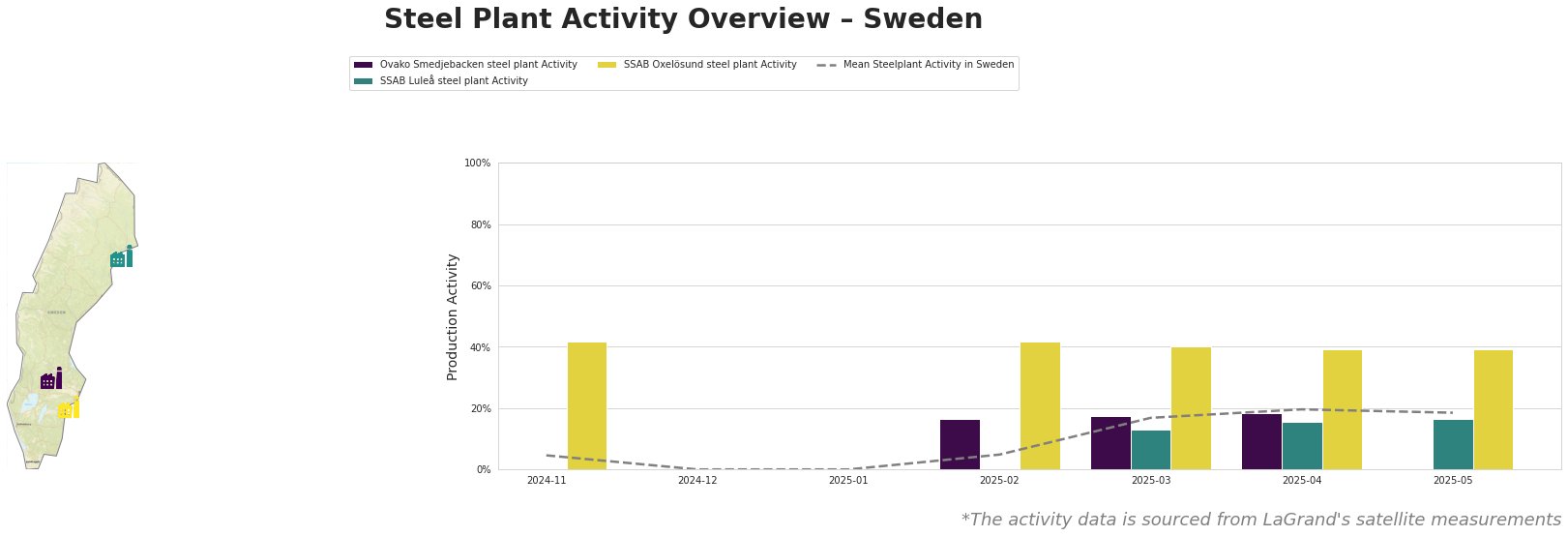

Measured Activity Overview

SSAB Luleå’s activity has remained relatively robust, with readings climbing from 13% to 16% in May 2025, aligning with the recent financing news and the upcoming plant transformation. Meanwhile, Ovako Smedjebacken’s activity remains low, hovering at 16% in February 2025. Notably, SSAB Oxelösund sustained its activity at around 39-40%, indicating stability but not direct correlation to the latest financial developments.

Plant Information

Ovako Smedjebacken: Focused on high wear resistance steel and micro-alloyed steel for sectors such as automotive, its activity peaked at 16% in February 2025. Currently, no direct correlation to SSAB’s activities has been established, leaving its future uncertain amidst industry shifts.

SSAB Luleå: SSAB Luleå is undergoing a significant transformation supported by the aforementioned financing. It holds a capacity of 2.3 million tons of steel annually. The upcoming plant features two electric arc furnaces, poised to reshape production in line with sustainability efforts, directly linking to the rise in activity from 13% to 16% observed in early 2025.

SSAB Oxelösund: This plant, producing notable products like Hardox wear plate, sustained strong activity levels at 39% despite the plant’s noted focus on older blast furnace methods. No direct relationship to recent financial dynamics was identified, indicating potential areas for operational efficiency enhancements.

Evaluated Market Implications

Given SSAB’s secured financing and active transformation towards a green plant in Luleå, buyers should prepare for an enhanced supply of sustainably produced steel by 2024. The anticipated output capacity of 2.5 million tons annually could significantly influence market prices and availability. Conversely, the absence of explicit links between ongoing activity levels at Ovako Smedjebacken and industry shifts requires strategic monitoring for potential supply disruptions.

Recommendations for Procurement Actions

- Focus on SSAB Products: Steel buyers should prioritize procurement from SSAB Luleå, particularly as it transitions to more sustainable practices and expands production capabilities.

- Mitigate Risk: Establish flexible contracts with SSAB Oxelösund to secure output during stability phases while monitoring Ovako Smedjebacken for potential shifts in activity.