From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSurge in Asian Steel Activity Amid Trade Deals: A Bright Outlook for Buyers

Activity levels across steel plants in Asia are witnessing a significant uptick, particularly driven by recent trade agreements and discussions such as “India, Mexico Begin Trade-Deal Talks As Tariff Hikes Put $2 Billion Of Exports At Risk“ and “India, Oman To Sign Free Trade Agreement Tomorrow In Muscat.” These developments align with satellite observations indicating a rise in operational activity, particularly at Indian and Turkish steel plants, signaling a favorable environment for buyers.

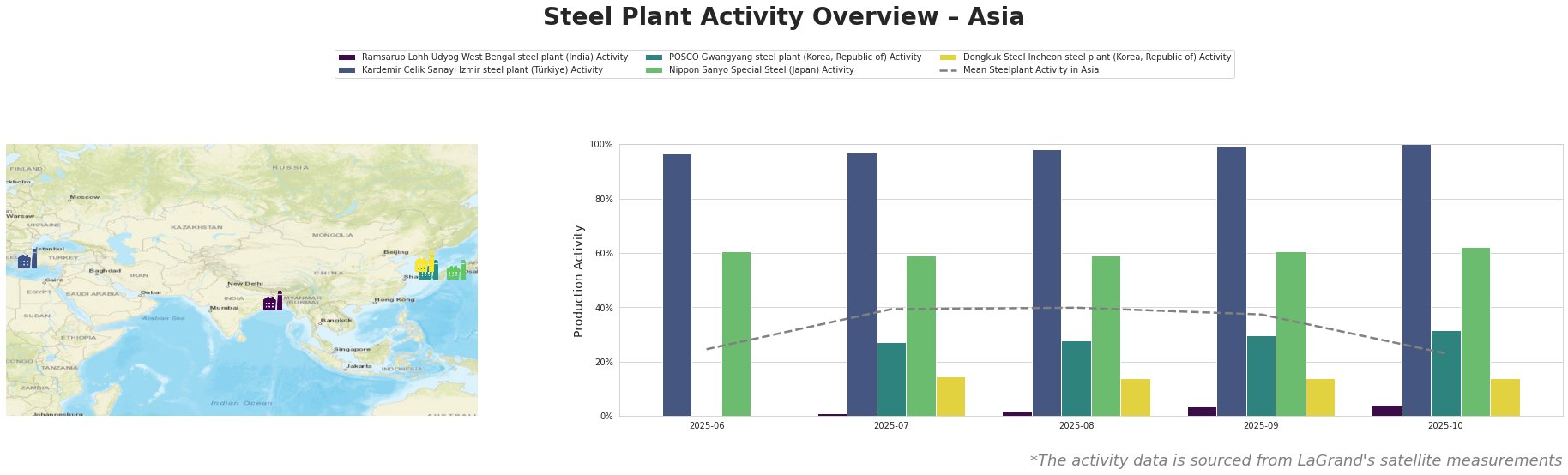

The Ramsarup Lohh Udyog steel plant in West Bengal exhibits a steady low activity level, starting at only 1.0% in July 2025, with slight increases peaking at 4.0% by October. Despite the India-Oman CEPA providing potential opportunities for enhanced supply and reduced tariffs that could benefit local producers, no direct activity correlation could be established with recent trade developments.

Conversely, the Kardemir Celik Sanayi plant in Turkey has shown robust activity, reaching its peak utilization of 100% in October 2025, correlating well with the positive sentiment attributed to European recovery and demand sustainability. These trends could serve as actionable insights for regional buyers looking to secure a reliable supply chain and pricing stability moving forward.

The POSCO Gwangyang plant has also demonstrated moderate recovery, noting a rise to 32.0% activity by October 2025, suggesting stabilization in South Korean outputs which aligns with increasing demand triggered by favorable regional geopolitical developments. In contrast, the Dongkuk Steel Incheon plant has maintained lower activity at around 14.0%, indicating potential operational constraints.

Given the “India–Oman FTA Likely To Kick In By March 2026; Export Target At $6 Billion,” there may be potential supply disruptions from India if output capabilities do not align with the anticipated surge in export orders driven by lower tariffs and improved trade terms. Steel buyers are advised to closely monitor the developments, particularly procurement strategies regarding Indian steel products, as the market is set to become more competitive.

Steel buyers should consider increasing stockpiles from plants demonstrating higher activity, particularly Kardemir and POSCO, while keeping a close eye on their purchasing timelines to mitigate risks associated with potential supply disruptions stemming from plant activity alterations in light of ongoing trade negotiations.