From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Upsurge in European Steel Activity Amid Political Changes

In Europe, steel markets are witnessing a positive trend in activity levels, particularly driven by recent political developments in Germany. The articles “CDU stimmt Koalitionsvertrag zu“ and “Katherina Reiche: Die Pläne der neuen Wirtschaftsministerin“ emphasize renewed governmental commitment to economic stability and climate initiatives, potentially influencing industrial productivity and investment in the steel sector.

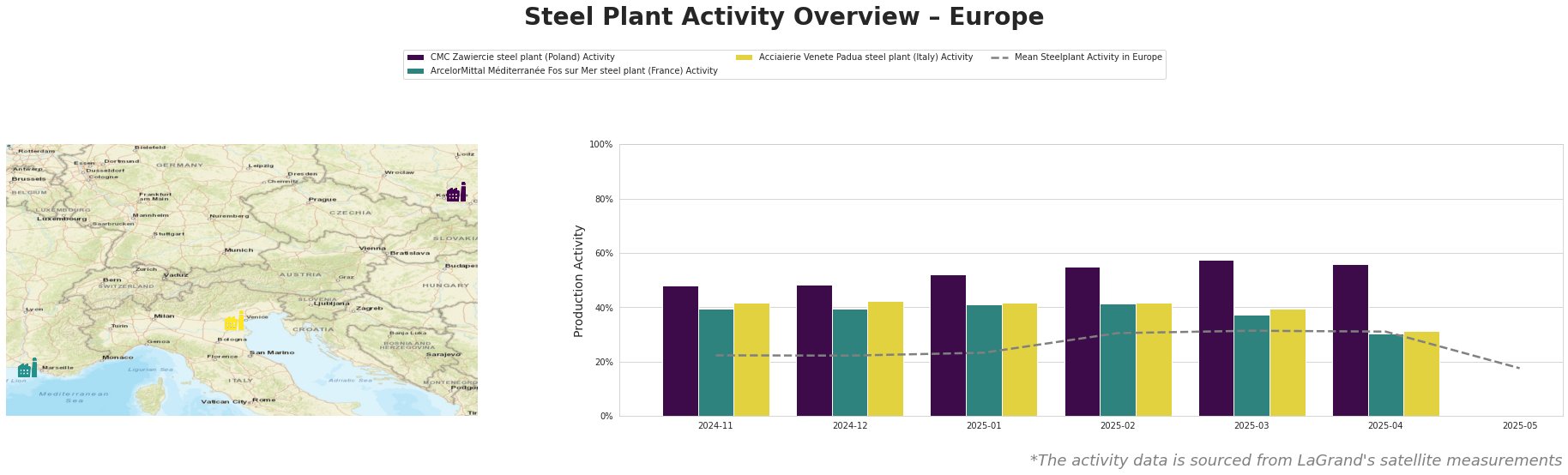

The activity at CMC Zawiercie surged to 57% in March, surpassing the European average, reflecting robust operational output despite a slight reduction to 56% in April. This increase is linked to the strengthening government position highlighted in the “CDU stimmt Koalitionsvertrag zu” article, suggesting a supportive environment for industrial growth.

ArcelorMittal Méditerranée showed notable volatility with a peak of 41% in January followed by a steep decline to 30% in April. This downturn could correlate with broader uncertainties stemming from government policies, as demarcated in the “Katherina Reiche: Die Pläne der neuen Wirtschaftsministerin” article, which suggests potential shifts in economic priorities affecting operational strategies.

Acciaierie Venete maintained activity at a low but stable level between 31% and 42%, indicating resilience in operations amidst fluctuating market conditions. This stability does not establish a direct link with the mentioned news articles; therefore, no explicit correlation is drawn.

Potential supply disruptions may arise from the observed fluctuations in ArcelorMittal’s activity, particularly if economic and operational directives evolve unfavorably under new ministerial leadership. Buyers should assess their supply chain resilience concerning potential shortfalls from influential players like ArcelorMittal amidst shifting political landscapes.

For steel buyers, it is crucial to capitalize on the current strong performance of CMC Zawiercie by securing orders that could leverage this operational surge before any political or economic turbulence impacts output. Additionally, procuring from stable suppliers like Acciaierie Venete may safeguard against supply risks identified in the market sentiment.

In conclusion, proactive procurement strategies should be adjusted to align with the reported activity trends and the political climate’s implications for the steel sector in Europe.