From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Outlook for Europe’s Steel Market Amid Plant Expansion and M&A Activity

Europe’s steel market sentiment has shifted significantly to Very Positive following recent strategic developments noted in the region. This shift aligns with the Knauf Interfer reorganises steel activities and Worthington Steel is in talks to acquire Germany’s Klöckner & Co articles, which highlight increased operational activity and key mergers impacting supply dynamics.

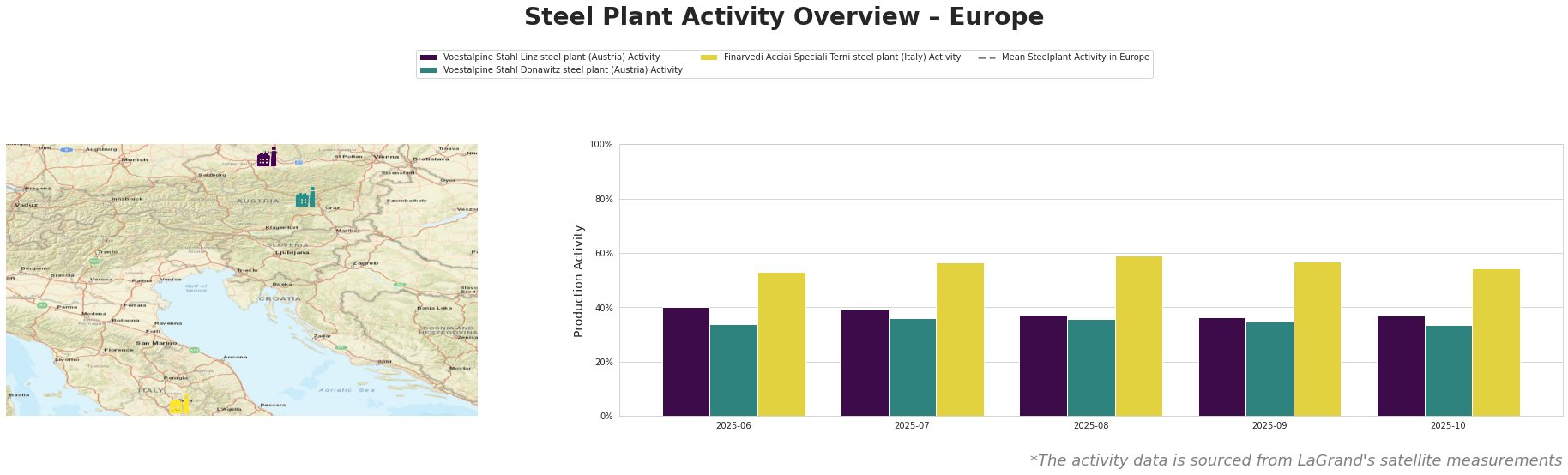

Measured Activity Overview

Recent satellite data indicates that Finarvedi Acciai Speciali Terni is maintaining a relatively strong output, indicated by its peak of 59% activity in August, contrasting with Voestalpine Stahl plants which have shown declining trends. Specifically, the Linz plant peaked at 40% in June, whereas activity fell to 37% by October, aligning with the broader mean trend in Europe. This dip may correlate to the ongoing industry restructuring as highlighted in Knauf Interfer reorganises metallurgical activities.

Plant Information

The Voestalpine Stahl Linz steel plant, a major integrated facility in Upper Austria with a capacity of 6000 tons of crude steel, shows fluctuations, notably falling from 40% in June to 37% by October. This decline may reflect internal adjustments amid rising demand with merger discussions affecting market sentiment, as upholds in Worthington’s potential acquisition of Klöckner could signal shifting supply chains nationally.

On the other hand, the Voestalpine Stahl Donawitz plant, producing similar semi-finished products, followed a consistent trend, with activity levels decreasing steadily from 34% to 34% over the same period. This suggests operational stability even amidst market shifts, although no direct connections with current news articles could be established.

Finarvedi Acciai Speciali Terni, utilizing Electric Arc Furnace (EAF) technology and serving sectors such as automotive and construction, remains resilient, maintaining activity levels above the 50% mark. The healthy performance correlates with ongoing discussions in the market about increased demand due to pertinent expansions mentioned in other articles.

Evaluated Market Implications

Given the strategic shifts outlined in Knauf Interfer reorganises steel activities, the reorganization of operations and the subsequent expansion at the Delta Stahl plant is likely to enhance production capacity in the Benelux region. This suggests potential supply disruptions could arise from the Knauf reorganization impacting overall supply flow, especially as it integrates enhanced logistics.

Steel buyers are advised to consider securing contracts with Finarvedi for immediate needs to mitigate any fluctuations from potential disruptions stemming from Klöckner’s restructuring. With Klöckner anticipated to enhance its operational efficiencies post-acquisition, procurement professionals should closely monitor developments regarding Worthington’s engagement with Klöckner to leverage favorable purchasing conditions. Immediate engagement with suppliers during this period of market realignment is crucial to optimize sourcing strategies ahead of potential volatility.