From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Growth in European Steel Market Driven by Increased Scrap Exports and Production Activity

Recent developments in the European steel market signal a very positive outlook as we observe increased scrap export volumes and stable production activity across key facilities. Notably, Scrap exports from Germany rose by 4% y/y in January-November alongside Scrap exports from Ukraine reached a four-year high in 2025, correlating with elevated plant activity observed through satellite data.

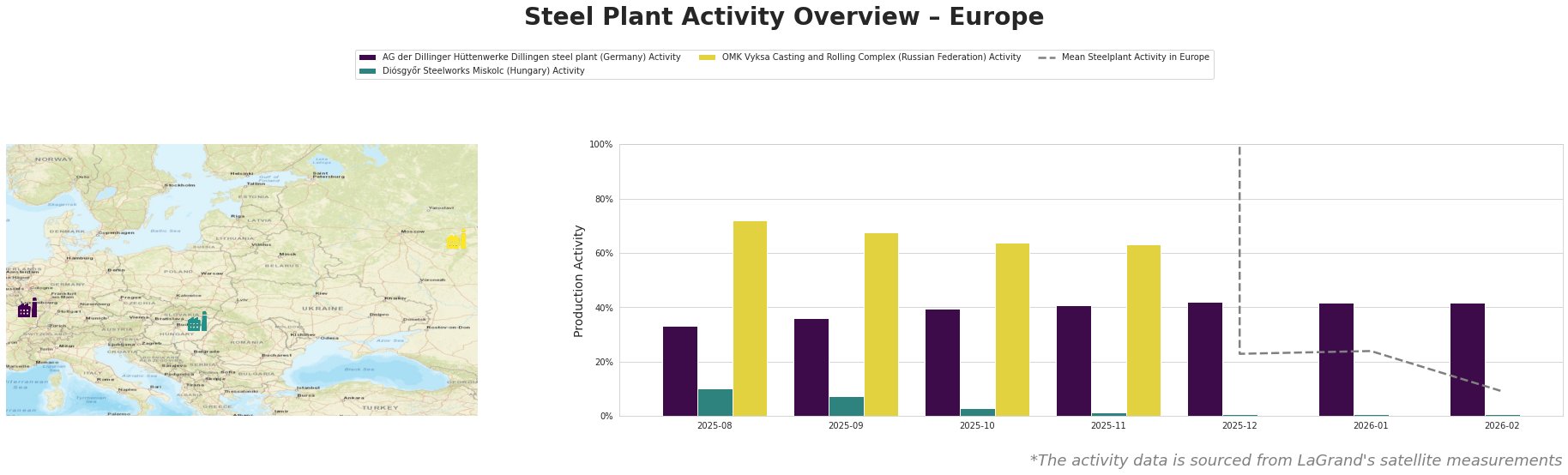

With activity levels indicating improvement, the AG der Dillinger Hüttenwerke Dillingen steel plant in Germany reported a gradual increase to 42% in December and January. The scrap export uptick aligns with the surge in domestic prices catalyzing this activity. Conversely, Diósgyőr Steelworks Miskolc has struggled considerably with activity plummeting to just 1%, potentially impacted by regional economic constraints, although Ukraine’s GDP grew by 3% y/y in Q4 may provide some recovery momentum for the sector ahead. The OMK Vyksa Complex, displaying robust periods of activity above 60%, has maintained significant production despite external pressures, confirming resilience.

Market implications indicate potential supply disruptions, especially for the Diósgyőr facility, which lacks current operational efficiency and may struggle to meet demand amidst the broader recovery. Steel buyers should consider the procurement of semi-finished products from Germany’s active facilities where heightened scrap export activity holds promise for increased output reliability. Supplies from the OMK Vyksa Complex also represent strong procurement interests despite potential geopolitical struggle, offering a steady output stream.

In sum, steel procurement strategies should closely follow the encouraging news from Germany’s rising scrap market alongside these observed activity trends, particularly favoring established, higher-performing plants to mitigate risks associated with lower activity facilities like Diósgyőr.