From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStellantis Cuts Trigger European Steel Downturn: Plant Activity Dips Signal Supply Risks

Europe’s steel market faces increased headwinds due to automotive production cuts. Stellantis’s planned suspensions, as reported in “Stellantis to suspend production at several European plants,” “Stellantis to reduce output in Europe: sources,” and “Stellantis to reduce production in Europe: sources,” signal reduced steel demand. While a direct link between these announcements and observed steel plant activity is not explicitly evident in all cases based on satellite data, observed downturns indicate a weakening sector.

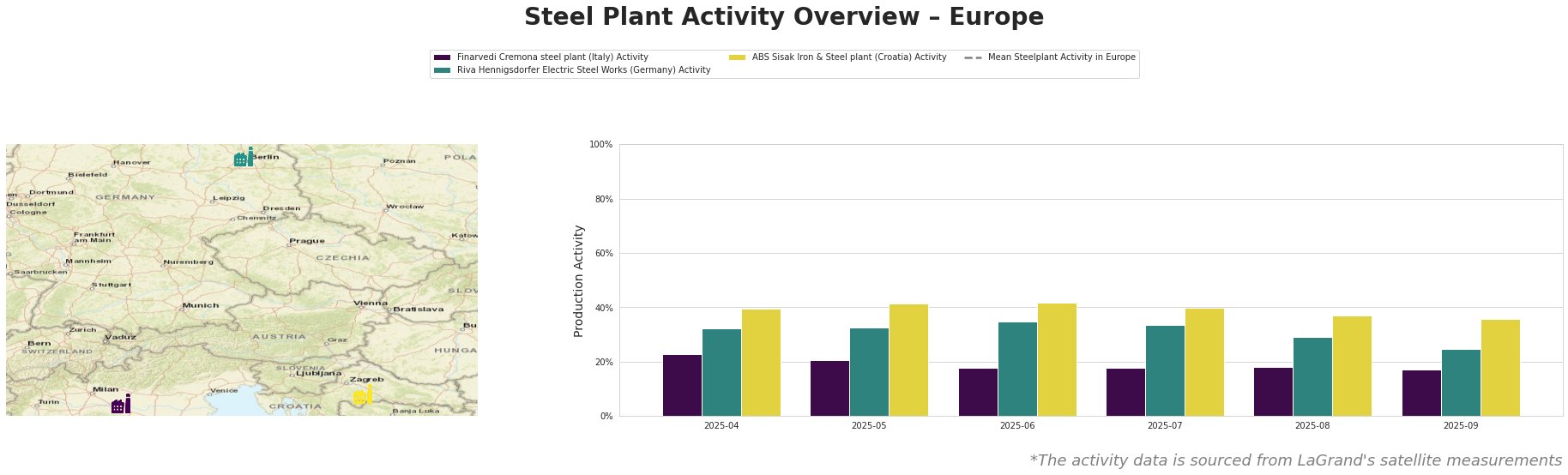

The mean steel plant activity in Europe has fluctuated, showing no consistent trend. While the highest mean activity was registered in May, by September activity had declined substantially, reflecting an overall negative trend.

Finarvedi Cremona, a 3.85 million tonne per year EAF steel plant producing hot rolled coil and galvanized products for the automotive sector, has shown a consistent decrease in activity. Starting from 23% in April, activity decreased to 17% by September. Given Stellantis’s announced production cuts impacting plants in Italy, as noted in “Stellantis to suspend production at several European plants“, this activity reduction may reflect reduced demand from the automotive sector.

Riva Hennigsdorfer Electric Steel Works, with a 1 million tonne per year EAF capacity producing steel billets and rebar, experienced a similar downward trend. Activity levels declined from 32% in April to 25% in September. While the Hennigsdorf plant is in Germany, where Stellantis is also cutting production (“Stellantis to suspend production at several European plants“), a direct causal link between Stellantis’s announcements and this specific plant’s activity cannot be definitively established based solely on the provided information.

The ABS Sisak Iron & Steel plant, a smaller EAF producer with a 0.35 million tonne capacity supplying billets to the automotive, energy, and transport sectors, also showed a decline, from 39% in April to 36% in September. As Stellantis production cuts have been announced for sites close to this steel plant, this decline may represent lower demand from the automotive sector.

Given the reduced activity at steel plants supplying the automotive sector and the Stellantis production cuts across Europe, steel buyers should expect potential localized supply disruptions, particularly for hot rolled coil and galvanized products from Italian and German suppliers and steel billets from Croatia. Procurement professionals are advised to:

1. Diversify sourcing: Mitigate risk by exploring alternative steel suppliers outside the directly affected regions, especially for automotive-grade steel.

2. Monitor inventory levels: Closely track inventory to anticipate and buffer against potential delivery delays.

3. Negotiate flexible contracts: Seek contracts with built-in flexibility to adjust order volumes and delivery schedules in response to fluctuating automotive demand.

4. Maintain close communication: Stay in close contact with existing suppliers to gain real-time insights into their production capacity and potential disruptions.