From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market Report: Positive Outlook for Germany Amid Strategic Acquisitions and Growing Plant Activity

Germany’s steel market is experiencing a very positive sentiment, driven by significant developments highlighted in the news and supported by satellite-observed activity data. The articles “US-based Worthington Steel to acquire Klöckner & Co for $2.4 billion“ and “Worthington Steel signs deal to buy Germany’s Klöckner & Co“ have not only marked the strategic consolidation of the steel sector but may also correlate with the recent observed uptick in plant activities.

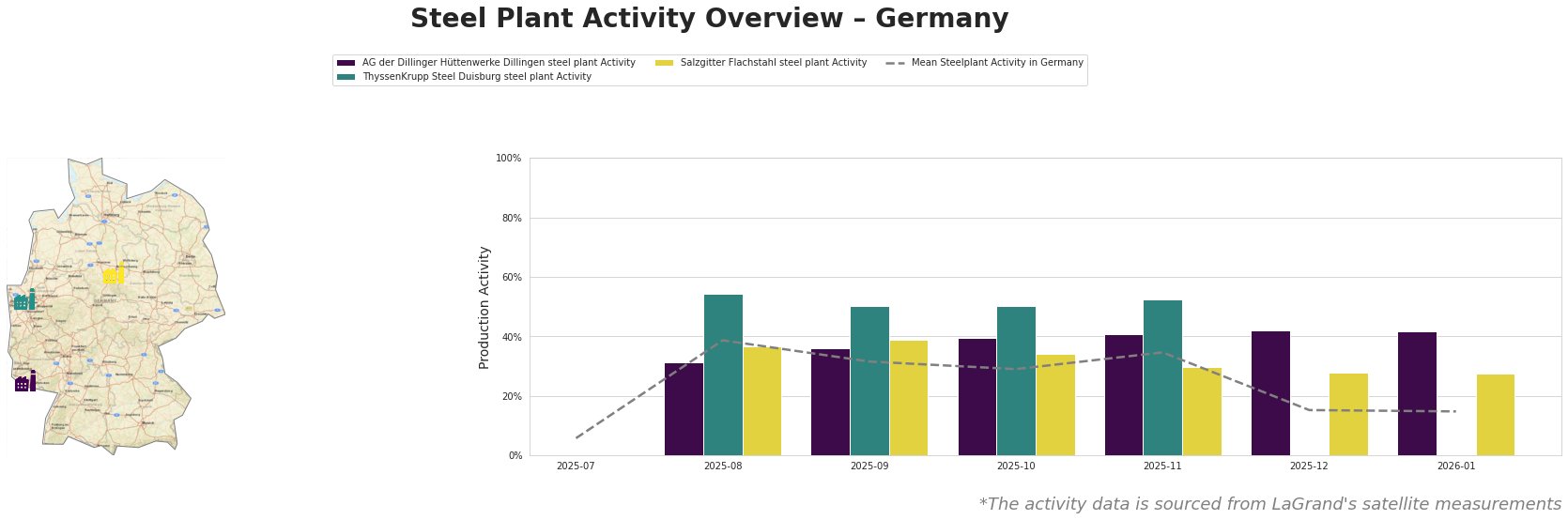

Measured Activity Overview

In August 2025, activity levels across the observed plants showed a notable rise, with ThyssenKrupp at 54.0% and AG der Dillinger Hüttenwerke reaching 31.0%, which significantly exceeds the mean activity of 39.0%. This peak could be directly linked to increased market confidence stemming from strategic mergers like Worthington Steel’s acquisition of Klöckner & Co. The activity began to stabilize in the following months, albeit with AG der Dillinger maintaining relatively high levels at 42.0% in December 2025, reflecting continued resilience amidst industry changes.

AG der Dillinger Hüttenwerke Dillingen

The AG der Dillinger Hüttenwerke steel plant, situated in Saarland, demonstrates significant historical production capabilities including a 2,760 kt crude steel capacity, largely focused on high-value finished products such as non-alloy structural steels. Satellite data indicates a robust operational performance, with activity peaking at 42.0% in December 2025, a figure that hints at a strong market response to procurement needs. This sustained activity is noteworthy particularly as the company emphasizes sustainable practices. However, the potential impacts of commodity supply changes following the Klöckner acquisition may influence future operational efficacy.

ThyssenKrupp Steel Duisburg

Located in North Rhine-Westphalia, the ThyssenKrupp plant boasts a crude steel capacity of 13 million tons. The satellite-observed peak of 54.0% in August highlighted the plant’s ability to respond rapidly to market demands, possibly motivated by the strategic acquisition activity seen in the sector. ThyssenKrupp’s focus on a diverse product line, including hot strip and coated products, positions it well for resilience despite upcoming supply chain shifts post-acquisition.

Salzgitter Flachstahl

Salzgitter Flachstahl, with a production capacity of 5,200 kt, has seen fluctuating activity levels, most notably a drop to 27.0% by January 2026. This downturn may reflect acute market adjustments related to the broader procurement landscape influenced by significant mergers like that of Klöckner & Co. Its emphasis on low CO2 processes signals strong sustainability commitments, which will be vital in refining competitive positioning in the evolving market.

Evaluated Market Implications

While the market outlook is positive, potential supply disruptions for specific products tied to Klöckner’s integration into Worthington Steel may affect supply chains across the sector. Steel buyers should closely monitor AG der Dillinger and ThyssenKrupp, which may have enhanced production capabilities in the wake of expanded operational networks following strategic mergers. It is advisable to prepare for potential variability in product availability from Salzgitter as they align their operations with broader sustainability goals. Each procurement decision should thus consider current activity levels and the strategic developments in the market, ensuring a proactive approach to sourcing in this dynamic environment.