From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market in Asia: Positive Outlook Driven by Rising Activity and Technological Advancements

In Asia, the steel market is buoyed by a marked increase in production activities across key plants. Notable developments include insights from Viewpoint: Asia energy storage to accelerate in 2026, which correlates with rising energy storage system demands and connections to regional steel production, particularly in China. Furthermore, Viewpoint: ESS to jolt lithium higher in 2026 indicates increased investment in technology that could influence steel demand indirectly.

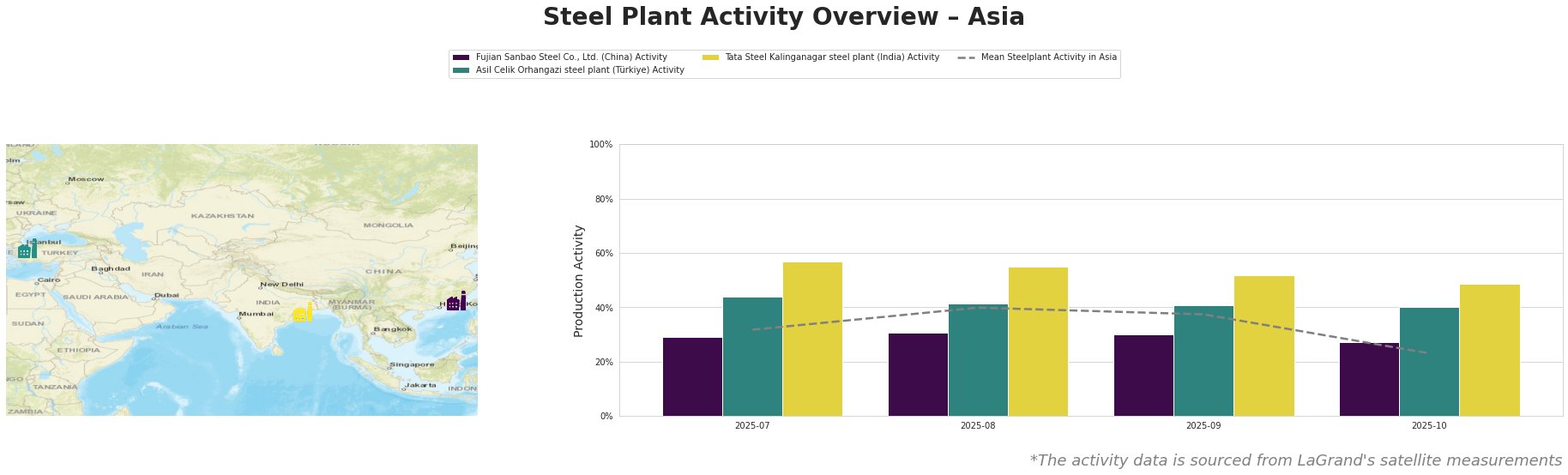

Fujian Sanbao Steel Co., Ltd. showed modest changes, peaking activity at 31% in August before falling to 27% by October, indicating a fluctuations phase possibly tied to emerging technologies discussed in Viewpoint: Will solid-state batteries upend the sector? However, no direct correlation can be drawn from satellite observed data to this article.

Conversely, the Tata Steel Kalinganagar plant remains robust, maintaining a relatively high and stable production range (49% to 57%), significantly above the mean for the period. As highlighted in Why 2026 will be a test of flexibility for automakers, the automotive industry’s need for reliable steel supplies amid shifting technologies strongly suggests ongoing demand stability for Tata’s production capabilities.

Asil Celik Orhangazi’s activity was notably higher than Fujian’s, peaking at 44% in July, but also dipped to 40% by October. This aligns with the shifting transportation and energy sectors, suggesting that while there are fluctuations, demand remains supported by industry adaptation trends such as those noted in Electric Vehicle Sales show slowest Growth since pandemic, which, despite a slowdown, still underpins the necessity for resilient supply chains.

In terms of procurement strategies, steel buyers should consider:

– Fujian Sanbao: Monitor fluctuations closely. If production dips continue due to lack of demand or competitive pressures, consider exploring alternative suppliers or increasing stock ahead of forecast potential shortages.

– Tata Steel Kalinganagar: Given its high activity and relevance in automotive supplies, it is imperative to secure contracts early to mitigate any potential supply chain disruptions.

– Asil Celik Orhangazi: Given its responsiveness to regional market shifts but lower production stability, diversifying procurement sources could prove beneficial in managing future demand volatility.

Overall, the steel market in Asia is well-poised for growth, with strategic procurement recommendations tailored to accommodate activity insights and evolving market dynamics.