From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market in Asia Faces Challenges: Key Insights from Recent Trends and Activities

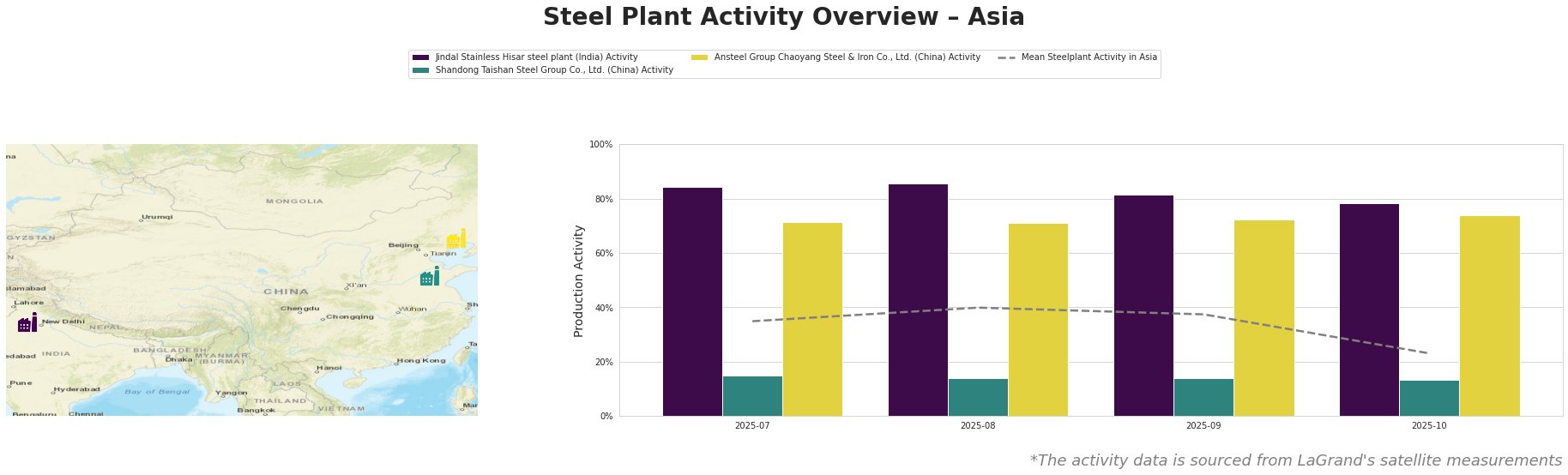

Recent developments in Asia’s steel market indicate a negative sentiment, primarily driven by the impact of US steel tariffs, as articulated in the articles “Viewpoint: US steel tariffs cause scrap supply glut“ and “Viewpoint: US steel tariffs lead to oversupply of scrap“. These tariffs have influenced domestic supply chains and affected the operational capacity of steel plants observed via satellite data, which shows declining activity levels across leading manufacturers, notably Jindal Stainless Hisar, Shandong Taishan, and Ansteel Group.

Jindal Stainless Hisar, with a capacity of 800K tons, primarily produces stainless steel through Electric Arc Furnaces (EAF). Its activity, which peaked at 86% in August, dropped to 78% by October, aligning with the declining demand for stainless steel seen in “Viewpoint: Stainless scrap surplus may weigh on 1Q.” Notably, this drop coincides with a larger trend in Asia, where mean activity fell to 23%, suggesting an overall cooling in market demand.

Shandong Taishan Steel, a major integrated producer with a capacity of 5M tons, also exhibited declining operational metrics, slipping from 15% to a low of 13% over a similar timeframe. This drop in activity correlates with rising operational constraints due to enhanced domestic scrap availability influenced by US tariffs, leading to increased competition and pressure on pricing.

Ansteel Group Chaoyang, with a production capacity of 2.1M tons, saw a modest decline in activity from 71% to 74%. This relative stability within a declining market could indicate internal management strategies to mitigate the effects of international supply shifts, although no explicit links to the US tariff discussion can be drawn directly.

The observed decrease in activities across these key plants signals potential supply disruptions throughout the Asia region, particularly in stainless and finished rolled products. Steel buyers should consider immediate procurement actions by securing inventories in anticipation of further price pressure exacerbated by reduced activities and supply-side constraints as outlined in the news articles. Given the current downward trend in activities and the prevailing news climate, buyers may face escalating costs if these patterns persist. Strategic purchasing now could buffer against future price hikes driven by decreased availability in critical sectors.