From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSteel Market in Asia: Activity Trends and Supply Insights Amid EU-China EV Trade Agreement

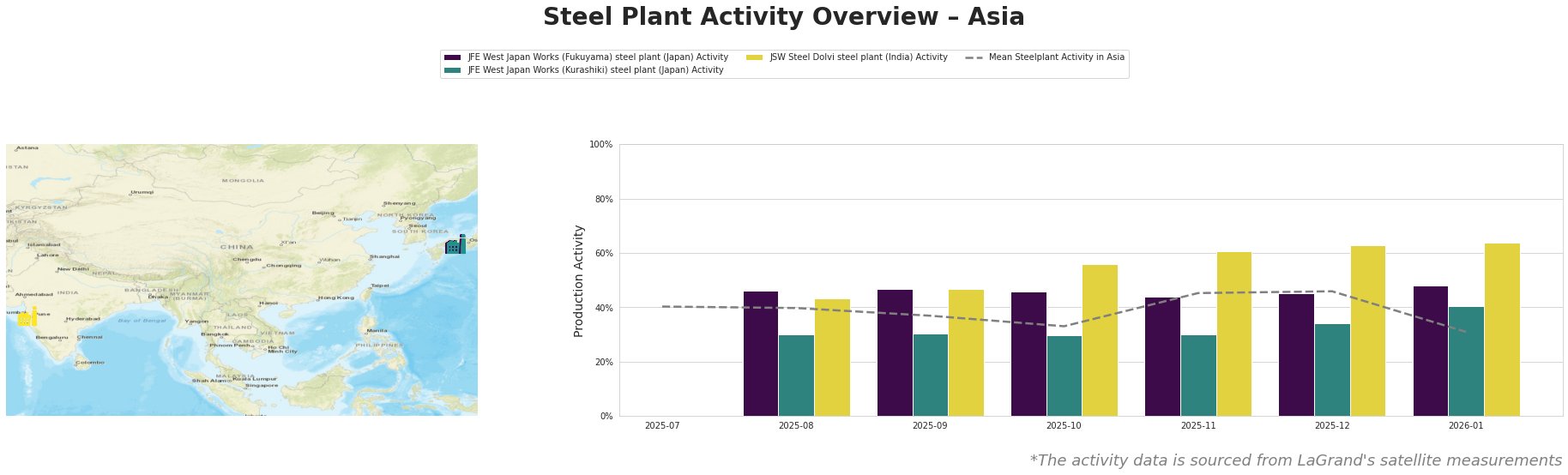

The Asian steel market is currently exhibiting a neutral sentiment as notable shifts in plant activity coincide with recent developments in international trade. In particular, the agreement titled “China and the EU agree on steps to resolve their dispute over EV imports“ on January 12, 2026, reflects an evolving trade landscape that may indirectly impact steel demand, particularly in automotive sectors reliant on steel products. While this trade resolution appears positive for future market stability, recent satellite observations indicate a mixed trend in steel production across key facilities.

The JFE West Japan Works (Fukuyama) steel plant and JSW Steel Dolvi have recently demonstrated noteworthy activity trends. Fukuyama’s production peaked at 48% in January 2026 after previously stabilizing between 40% and 46%. This increase occurred amidst heightened anticipations in automotive steel demand post the EU-China trade agreement, as indicated in “EU guidance sets price undertaking route for Chinese EV imports.”

Conversely, the JSW Steel Dolvi plant experienced a steady growth, escalating to 64% by January 2026, well above the mean of 31%. This rise suggests strengthening demand for its finished products, closely associated with automotive and infrastructure sectors, potentially buoyed by the enhanced trade relations discussed in “India’s European exports highlight Spain, Germany, Belgium and Poland.”

In contrast, the JFE West Japan Works (Kurashiki) plant shows minimal change, with stability around the 30-40% range throughout the observation period. Thus, the direct correlation with the answered articles remains ambiguous, indicating no immediate connections to the observed fluctuations in EU-China trade dynamics.

Implications and Recommendations

Given the current landscape, potential supply disruptions may arise from the variability in activity levels across the observed plants, particularly with plants like Kurashiki lagging behind their counterparts. Steel buyers should consider the following actions:

- Prioritize sourcing from JSW Steel Dolvi and JFE West Japan Works (Fukuyama), which are showing higher activity levels and responsiveness to market changes, hence likely to fulfill demand more reliably.

- Monitor ongoing developments in EU-China trade agreements and associated automotive market dynamics to anticipate shifts in steel demand, especially in sectors heavily reliant on automotive industry growth.

- Evaluate inventory strategies, considering the recent fluctuation patterns, to safeguard against potential supply interruptions, especially from plants showing lower activity figures.

These targeted actions can help procurement professionals optimize supply chains amid evolving market conditions.