From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSSAB Green Transformation Drives Swedish Steel Market Optimism Despite Luleå Production Dip

Sweden’s steel market displays overall positive sentiment driven by green transformation investments, even as satellite data indicates fluctuating plant activity. Recent developments center on SSAB’s ambitious projects, as highlighted in “SSAB raises €430 million in financing for Luleå green transformation,” “SSAB raises €430 million in financing for Luleå green transformation,” and “SSAB has raised 430 million euros to finance the Luleå Green Transformation project.” These articles report on the secured funding for the Luleå mini-mill project aimed at significant emissions reductions and production efficiencies. While these projects promise long-term benefits, they do not immediately explain all observed short-term activity fluctuations across various plants; specific dips may relate to facility upgrades or shifts in raw material usage that are not explicitly outlined in the provided news.

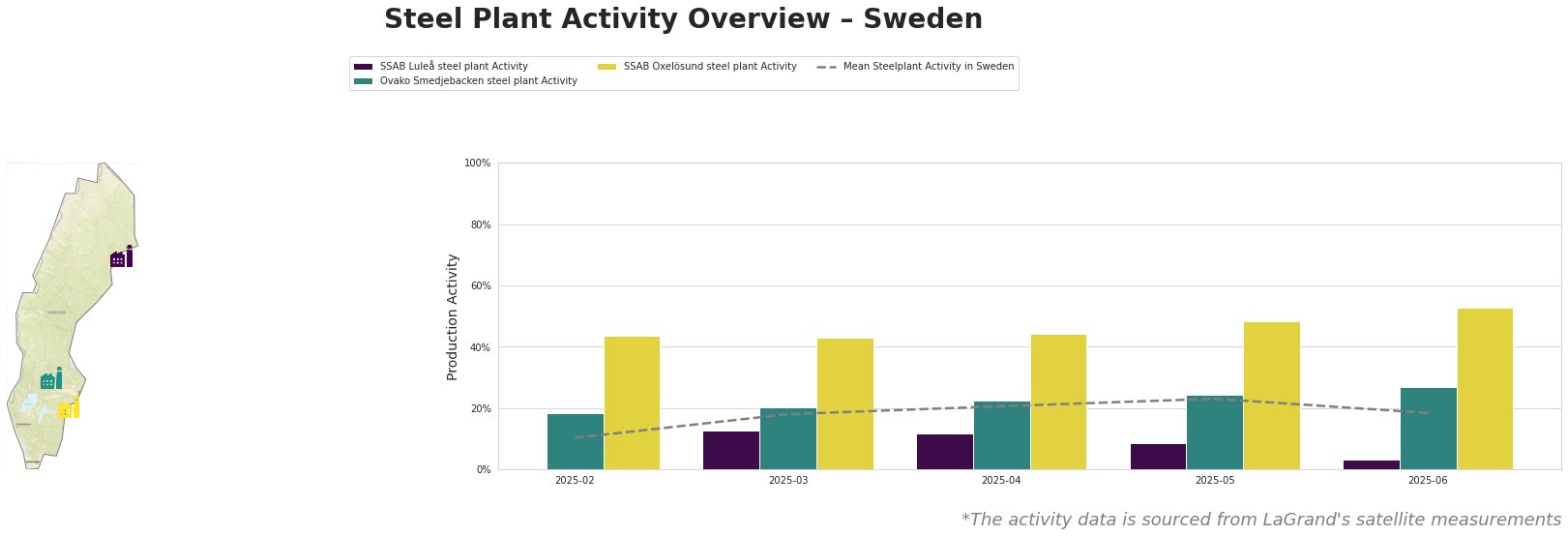

The mean steel plant activity in Sweden increased steadily from February (10%) to May (23%) before dropping to 18% in June. SSAB Luleå’s activity saw a continuous decline over the observed period, culminating in a low of 3% in June. Ovako Smedjebacken’s activity increased steadily, reaching 27% in June. SSAB Oxelösund maintained relatively high activity throughout, peaking at 53% in June.

SSAB Luleå, an integrated BF-BOF plant with a 2.3 million mt crude steel capacity, primarily produces slabs and cast products. The plant’s activity has decreased each month, culminating in a notable drop to 3% in June. This considerable decline may be related to preparations for the transformative upgrades highlighted in the articles “SSAB raises €430 million in financing for Luleå green transformation,” “SSAB raises €430 million in financing for Luleå green transformation,” and “SSAB has raised 430 million euros to finance the Luleå Green Transformation project,” which detail the construction of a new mini-mill, but no direct statement about any shutdown for upgrades appears in the text.

Ovako Smedjebacken, an electric arc furnace (EAF) plant with a 1.01 million mt crude steel capacity, focuses on finished rolled products like high wear resistance, spring, and micro-alloyed steels for the automotive, energy, and tooling sectors. Its activity has consistently increased, reaching 27% in June, outperforming the national mean. No direct connection can be established between this increased activity and the news articles provided.

SSAB Oxelösund, another integrated BF-BOF plant with a 1.5 million mt crude steel capacity, produces specialized products such as Hardox wear plate, Strenx high-strength steel, and Armox protection plate. The plant has maintained high activity levels, peaking at 53% in June, significantly above the national average. No direct connection can be established between this consistent high activity and the news articles provided.

The ongoing investment in SSAB Luleå, aiming to drastically reduce CO₂ emissions and improve production efficiency, signals a potential shift in market dynamics. However, the decreased activity at SSAB Luleå, combined with the overall decline in the mean activity in Sweden during June, suggests possible short-term supply constraints, particularly in crude and semi-finished steel products.

Evaluated Market Implications and Recommended Procurement Actions:

- Potential Supply Disruption: The drop in activity at SSAB Luleå, potentially linked to the transformative project discussed in “SSAB raises €430 million in financing for Luleå green transformation,” “SSAB raises €430 million in financing for Luleå green transformation,” and “SSAB has raised 430 million euros to finance the Luleå Green Transformation project,” could lead to a temporary reduction in the supply of slabs, crude iron, and cast products. The magnitude of this disruption cannot be determined from the provided information.

- Procurement Actions: Steel buyers reliant on SSAB Luleå for slabs or crude iron should:

- Diversify Supply: Proactively explore alternative suppliers for these products in the short term to mitigate potential shortages.

- Monitor Progress: Closely track the progress of the Luleå transformation project, as detailed in the news, to anticipate the timeline for the new plant’s commissioning and the subsequent return to full production. Contact SSAB directly for the most accurate timeline.

- Evaluate Inventory: Assess current inventory levels of SSAB Luleå products and consider increasing safety stocks if feasible to buffer against potential delays.

- Negotiate Contracts: Review existing contracts with SSAB Luleå and, if possible, renegotiate terms to account for potential supply disruptions, including force majeure clauses and alternative sourcing options.

- Assess Impact on Price: Monitor overall steel price movements in Europe and the Nordics, as any supply disruption could result in moderate short-term price increases. Consider locking in prices with suppliers where appropriate.

- Market Analyst Actions: Given the lack of an explicit connection to the news and the observed change at Ovako Smedjebacken, further information is needed on its specific product mix to derive actionable insights.

These actions are predicated on the assumption that the SSAB Luleå decline is connected to its green transformation. Should further information arise indicating alternative factors, these recommendations should be reassessed.