From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Report: Positive Growth Amidst Activity Variations

Brazil’s steel industry is exhibiting positive signs of growth with rising exports and robust activity in key production facilities. The article Brazil increased iron ore exports by 10% y/y in June highlights a notable year-on-year increase in iron ore exports, which could bolster steel production capabilities in the region. Conversely, the decline in Colombia’s iron and steel export volume detailed in the article Colombia’s iron and steel export volume down 1.7 percent in Jan-May 2025 reflects regional disparities that may impact overall supply dynamics.

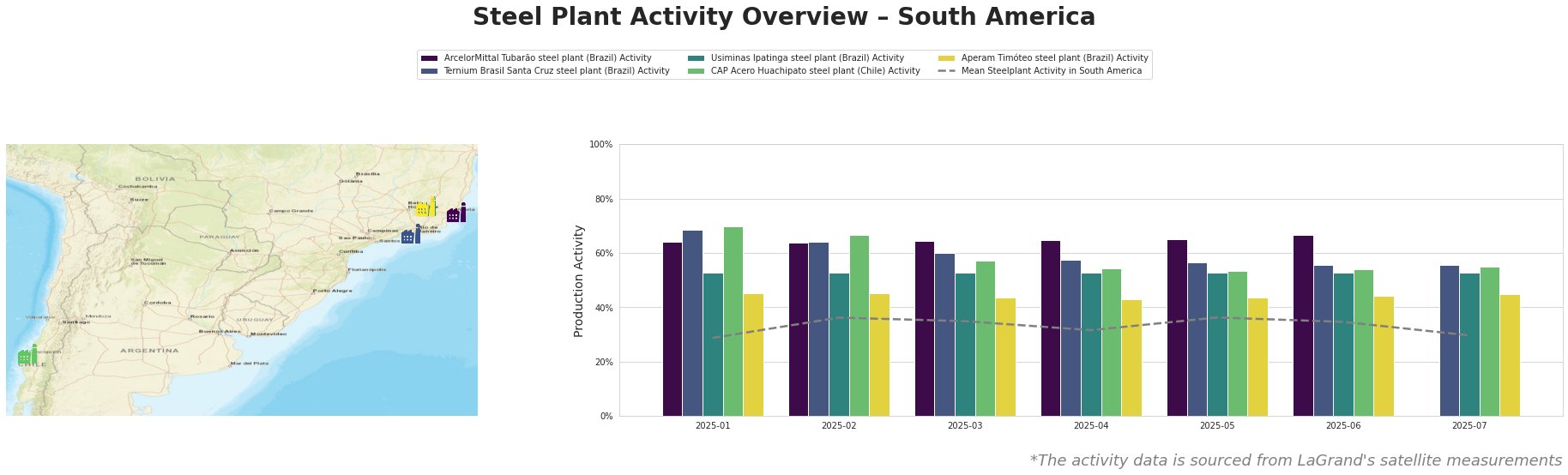

The satellite-observed activity levels from selected steel plants reveal intriguing trends:

ArcelorMittal Tubarão reported a stable activity level at 67.0% in June, aligning with the positive sentiment expressed in Brazil increased iron ore exports by 10% y/y in June. Ternium Brasil has shown more variability, declining to 56.0% in July, although it maintained a similar level in June. Usiminas’ activity has remained consistently low at 53.0%, not directly impacted by any of the cited news articles. CAP Acero Huachipato’s activity remains relatively stable, while Aperam Timóteo’s slight recovery to 45.0% in July reflects improved conditions, although connections to specific external factors are tenuous.

The review of plant capacities and export activities indicates potential supply disruptions may arise from Colombia’s export declines. Steel buyers operating in South America should consider increasing procurement quantities from Brazil’s robust suppliers, particularly ArcelorMittal, to capitalize on the positive export flow and optimize inventory on the back of rising export demands.

In summary, focused procurement from Brazilian producers aligned with export efficiencies is recommended, particularly in light of state-driven production potentials while remaining cautious of Colombian market weaknesses which could challenge overall regional supply stability.