From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market: LPG Push Fuels Coking Coal Demand; ArcelorMittal Tubarão Activity Dip

South America’s steel market shows a positive outlook, influenced by Brazil’s expanding LPG initiatives and evolving fossil fuel transition discussions. The “Brazil boosts payouts for new LPG scheme by 2.6pc” initiative may indirectly affect steel demand, while the broader implications of the “Fossil fuels shift talks to continue outside Cop” and its voluntary initiatives are yet to be fully reflected in steel plant activity. No direct connection between these news items and observed plant activity levels can be definitively established from the provided data.

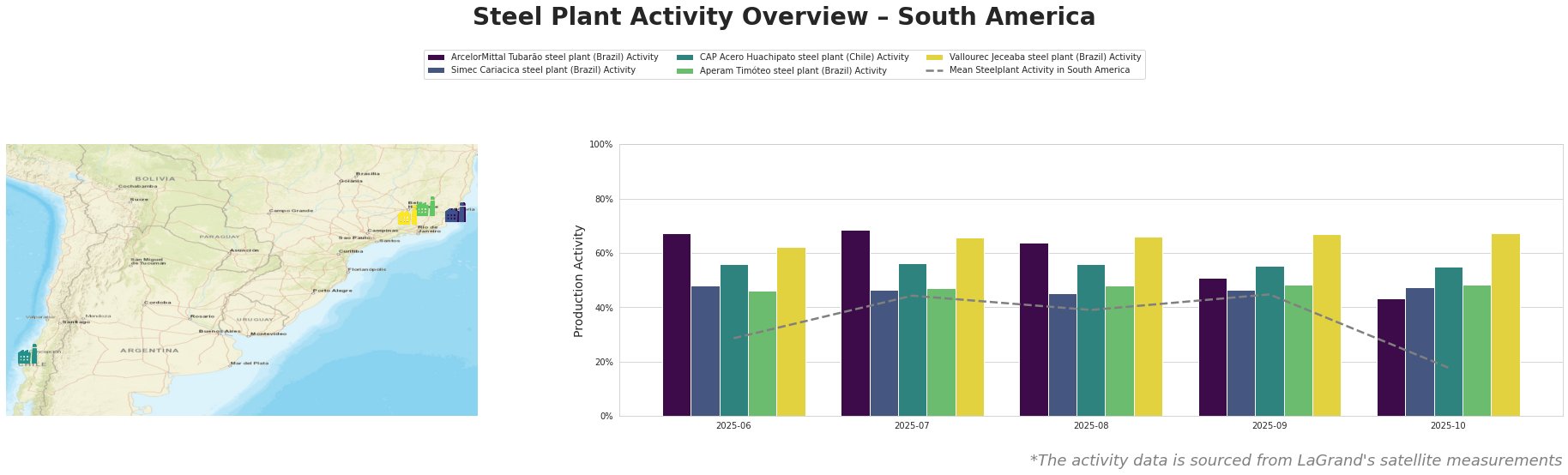

The mean steel plant activity in South America has been volatile, with a high of 45.0% in September 2025 and a low of 18.0% in October 2025. ArcelorMittal Tubarão showed significantly higher activity than the regional average from June to August, peaking at 68.0% in July before declining sharply to 43.0% in October. Simec Cariacica steel plant’s activity has been relatively stable. CAP Acero Huachipato steel plant’s activity remained steady around 55-56%. Aperam Timóteo steel plant exhibited consistent activity. Vallourec Jeceaba steel plant showed high stability, peaking at 67% in September and October.

ArcelorMittal Tubarão, an integrated BF/BOF steel plant in Espírito Santo, Brazil, with a crude steel capacity of 7.5 million tonnes, experienced a significant activity drop from 68.0% in July 2025 to 43.0% in October 2025. This decline does not have an explicitly established connection to the news articles provided.

Simec Cariacica, an EAF-based steel plant in Espírito Santo, Brazil, producing rebar and profiles, has shown relative stability in its activity levels. The “Brazil boosts payouts for new LPG scheme by 2.6pc” news item mentions that Brazil aims to distribute 65 million cylinders by the end of 2026, and since Simec Cariacica produces rebar and profiles used in construction, this could imply a positive effect on demand.

CAP Acero Huachipato, an integrated BF/BOF steel plant in Concepción, Chile, focusing on finished rolled products, has maintained consistent activity. No direct link can be established between its activity and the provided news.

Aperam Timóteo, an integrated BF/BOF/EAF steel plant in Minas Gerais, Brazil, producing stainless and special carbon steels, maintained a steady activity level. No direct link can be established between its activity and the provided news.

Vallourec Jeceaba, an integrated BF/EAF steel plant in Minas Gerais, Brazil, producing seamless steel pipes primarily for the energy sector, exhibited high stability. Considering “Fossil fuels shift talks to continue outside Cop” it cannot be concluded whether the outcome of the COP30 summit will affect the Vallourec Jeceaba activities.

Given the activity decrease at ArcelorMittal Tubarão and the potential for increased demand due to Brazil’s LPG initiative impacting rebar demand (Simec Cariacica), steel buyers should:

- Diversify slab sourcing: ArcelorMittal Tubarão’s production decrease could potentially disrupt slab supply. Secure alternative slab sources to mitigate risks.

- Monitor rebar pricing: The LPG subsidy program could increase demand for rebar. Closely monitor rebar prices and potentially secure contracts to hedge against price increases, particularly from Simec Cariacica.