From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Upsurge in European Steel Market: Italy’s Production Recovery Stands Out

Italy’s steel production is rebounding positively, highlighted by Italy’s steel production ended 2025 higher, with a strong rebound in December and Italy increased steel production by 3.6% y/y in 2025. This resurgence is reflected in satellite-observed activity data, where Italy’s production rose sharply by 20.5% year-on-year in December 2025, with long products leading the recovery. Conversely, Germany’s steel production is struggling, as detailed in German steel production falls to its lowest level since 2009 and Germany reduced steel production by 8.6% y/y in 2025, indicating a stark contrast in market dynamics.

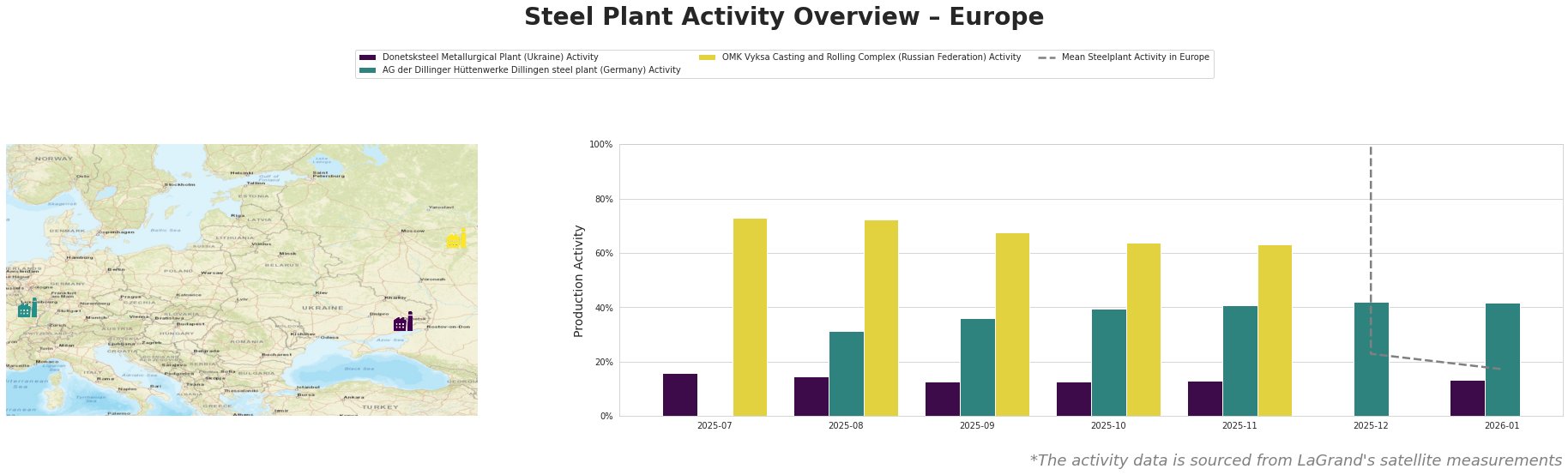

The mean activity level across European plants is predominantly low, particularly at the end of 2025, with an average activity drop to 2.3% in December; notable discrepancies arise. The AG der Dillinger Hüttenwerke maintained an activity level of 42.0% in December, reflecting relative stability amidst the broader decline, potentially linked to stable demand in associated sectors like automotive and energy.

Donetsksteel Metallurgical Plant registered activity levels of 16.0% in July 2025, declining to 13.0%, signaling instability and missing any direct connection to the nail-biter news from Italy, showcasing ongoing regional challenges without recent recovery.

AG der Dillinger Hüttenwerke has seen a 0.2% decrease at year-end, likely tied to domestic demand pressures but standing relatively strong amidst German production lows, with 34.1 million tons as reported.

OMK Vyksa, operating under EAF technology, displayed higher resilience with activity levels around 68.0%, suggesting a specific focus on finished products for critical sectors like infrastructure.

Evaluated Market Implications

The divergence in activity levels and production between Italy and Germany poses potential supply disruptions specifically in Germany, where low production output might restrict availability for local buyers. Analysts and steel buyers should prioritize procurement from Italian suppliers taking advantage of the positive production trends and stability in output levels. Monitoring the instability at Donetsksteel due to geopolitical factors is crucial; this plant may face potential operational interruptions that the market should be prepared for.

Furthermore, establishing long-term supply agreements with firms like AG der Dillinger Hüttenwerke can mitigate risks associated with diminishing German output, ensuring steady access to necessary materials.