From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Upsurge in Asian Steel Market Driven by Thyssenkrupp-Jindal Prospects

Thyssenkrupp’s consideration of a phased sale of its steel subsidiary to India’s Jindal Steel International marks a pivotal shift in the Asian steel landscape. Specifically highlighted in the articles “Thyssenkrupp continues talks on the sale of its steel unit TKSE to Jindal Steel“ and “Merz discusses thyssenkrupp sale during India visit: reports“, these negotiations have coincided with observable increases in steel plant activity across the region.

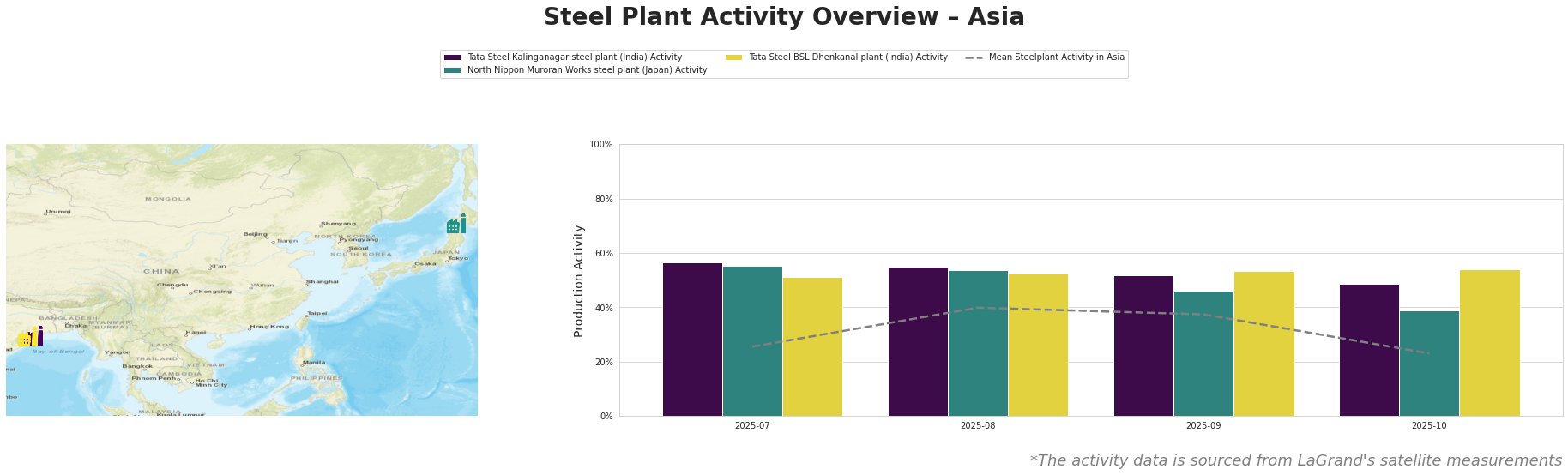

The satellite data indicates a fluctuating but generally positive trend in activity levels among key steel plants. Tata Steel Kalinganagar, consistently a leader at an activity level of 56.0% in July, experienced a slight dip to 49.0% by October. Conversely, Tata Steel BSL Dhenkanal maintained a relatively stable activity around 54.0%, aligning closely with the region’s mean levels. North Nippon Muroran Works’ activity fell from 55.0% to 39.0%, suggesting potential operational challenges that could disrupt supply.

The connection between the news surrounding Thyssenkrupp’s sale and the activity trends at Tata Steel and Nippon Muroran is compelling yet indirect. While the heightened interest from Jindal may indicate future investments leading to improved productivity, the direct impacts on these specific plants remain unclear.

Procurement professionals should closely monitor the ongoing negotiations around Thyssenkrupp’s sale, as the successful transition could stabilize or even enhance supply dynamics across Asia. Considering Tata Steel Kalinganagar’s positional stability within the market, establishing procurement agreements for Q1 2026 with this plant could yield favorable terms before any operational enhancements from the ongoing transactions materialize. Additionally, due to the notable decline in activity at North Nippon Muroran Works, buyers should approach suppliers with a contingency strategy to offset potential supply disruptions stemming from this plant.

In summary, the overall market sentiment remains positive with emerging opportunities for strategic procurement aligned with the evolving landscape following Thyssenkrupp’s ongoing negotiations.