From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market: Plant Activity and Export Insights Reflect Growing Demand

Recent developments in Asia’s steel sector indicate a positive sentiment buoyed by strong export figures and rising production activities. Notably, “China exported over 5 million tons of stainless steel in 2025“ and “China has reduced imports of stainless steel“ highlight a robust export demand, even as overall production experiences a dip.

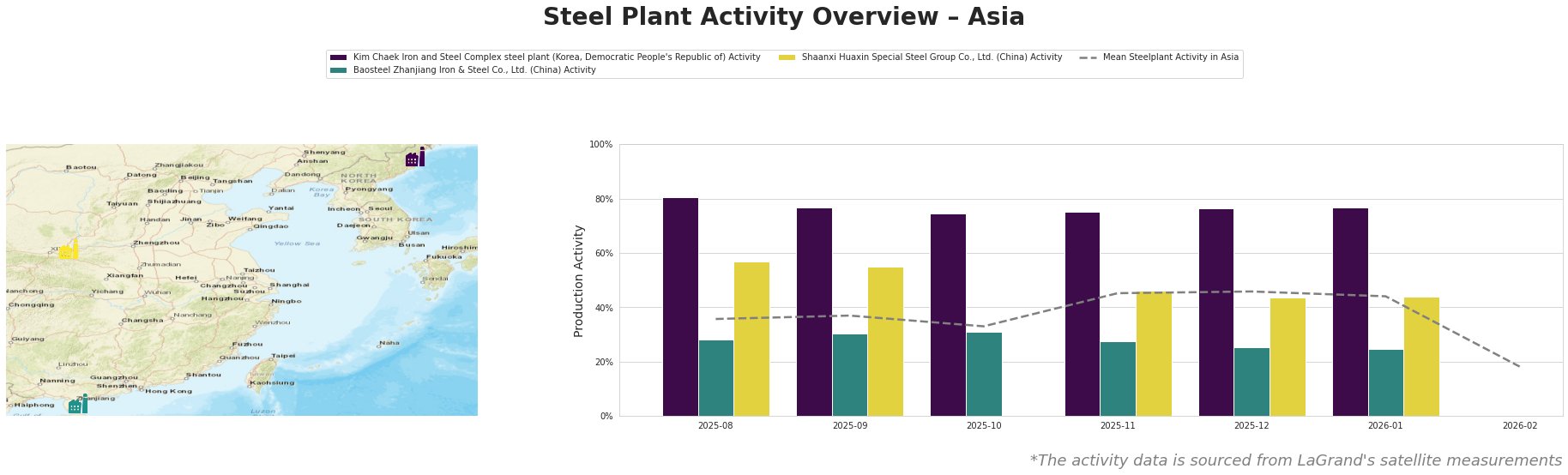

The observed export increase, particularly a December spike to 485,000 tons (19.7% month-on-month rise), correlates with heightened activity at key steel plants. For instance, activity at the Kim Chaek Iron and Steel Complex remained strong, with activity levels peaking at 81% in August 2025, although it declined to 36% by February 2026. In contrast, Baosteel Zhanjiang Iron & Steel Co. showed more stable performance, maintaining an average activity around 76-77% during these months. However, Shaanxi Huaxin Special Steel Group noted a sharper drop, with levels significantly declining to 25% by January 2026.

Kim Chaek Iron and Steel Complex: Despite its significant historical output capacity of 6 million tons, recent activity has decreased to 36%. This drop does not seem directly tied to recent news articles, indicating potential internal operational challenges rather than external market pressures.

Baosteel Zhanjiang Iron & Steel Co. has remained relatively stable, with a production capacity of over 12 million tons. Its activity level holding around 76% suggests consistent operation. This reliability supports export activities as indicated by China’s robust export figures.

Shaanxi Huaxin Special Steel Group, with its focus on electric arc furnace operations, experienced a significant drop with levels at 25%. This significant decline may imply adjustments in production responsiveness to market conditions rather than a clear correlation to export dynamics.

Given these insights, steel buyers should prioritize procurement contracts with established suppliers such as Baosteel Zhanjiang, whose sustained activity levels reflect reliability amidst changing market conditions. Additional attention should be paid to strategic partnerships with producers able to adapt to fluctuating demand, especially during this period of reshaped export dynamics post-real estate adjustments in China. Avoid reliance on the less stable suppliers, marked by significant reductions or operational uncertainties.