From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Trends in Asia’s Steel Market Amid Shifts in Production Activity

In Asia, the steel market showcases a positive sentiment driven by significant changes in China’s production landscape. The news articles titled “China reduced iron ore production by 2.8% y/y in 2025“ and “Global pig iron production in 2025 fell to 1.37 billion tons“ highlight the shifts in activity, correlating with observed reductions in iron ore production and increased imports in December, which align with the satellite data indicating stable steel plant operations in the region.

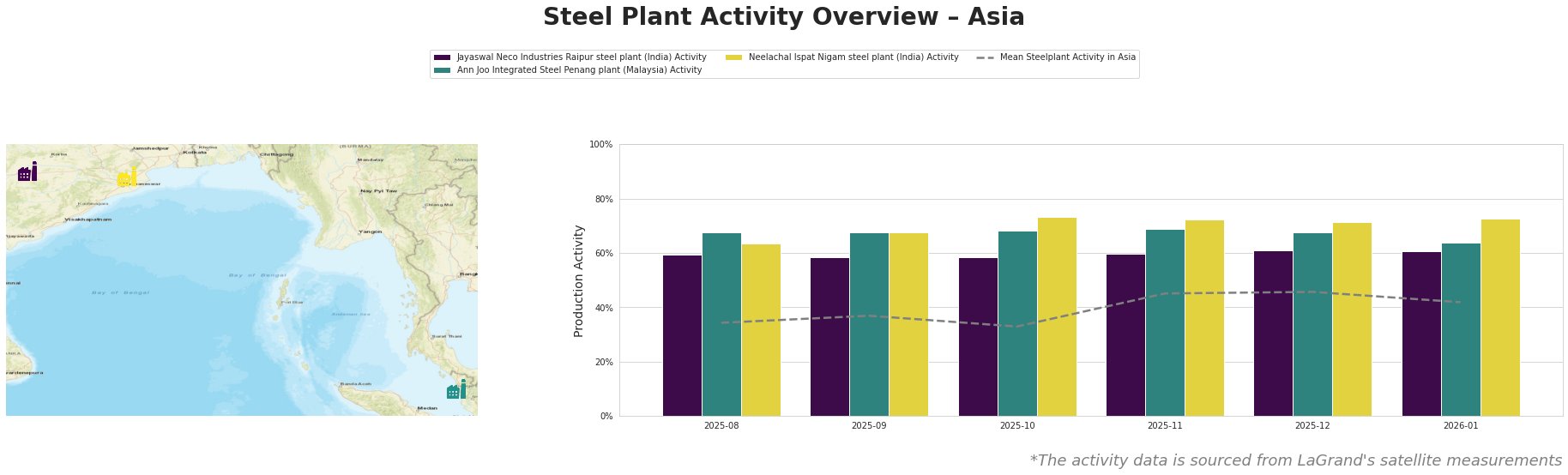

The data reveals that Jayaswal Neco Industries maintained relatively stable activity, fluctuating from 58% to 61%, while Ann Joo Integrated Steel experienced a peak in November (69%) before stabilizing at 68%. Neelachal Ispat Nigam showed a modest increase from 68% to 73% in January. These activity levels are notably higher than the average mean activity, indicating a resilient operational capacity.

Jayaswal Neco Industries, located in Chhattisgarh, focuses on integrating various steelmaking processes, primarily using Blast Furnace (BF) and Direct Reduced Iron (DRI) techniques. The plant’s activity remained steady despite the overall decline in production reported in the “China reduced iron ore production by 2.8% y/y in 2025,” which signals a strong domestic operational profile amid challenging import scenarios.

In Penang, Ann Joo Integrated Steel, leveraging Electric Arc Furnace (EAF) technology, showed resilience with activity consistently around 68% and peaking at 69%. This adaptability is critical as it aligns with increased demand for lower-carbon steel products, countering the decline in Chinese exports, as noted in “Global pig iron production in 2025 fell to 1.37 billion tons.”

Neelachal Ispat Nigam, based in Odisha, observed a rise in activity levels, reaching 73% in January. This increase aligns with the strong domestic demand for higher-value steel products, reflecting an upward trend in procurement activities.

The current environment presents potential supply disruptions due to the reduced iron ore production capacity in China, impacting overall steel supply chains. Steel buyers are advised to proactively secure contracts with the resilient plants mentioned, particularly in India, where operational capacities are robust against fluctuating global market dynamics. Specifically, focusing on sourcing from Neelachal Ispat Nigam and Jayaswal Neco is recommended to mitigate risks associated with potential shortages from China and to capitalize on the local production capabilities.