From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Surge in Asia: Key Insights and Activity Trends (2026)

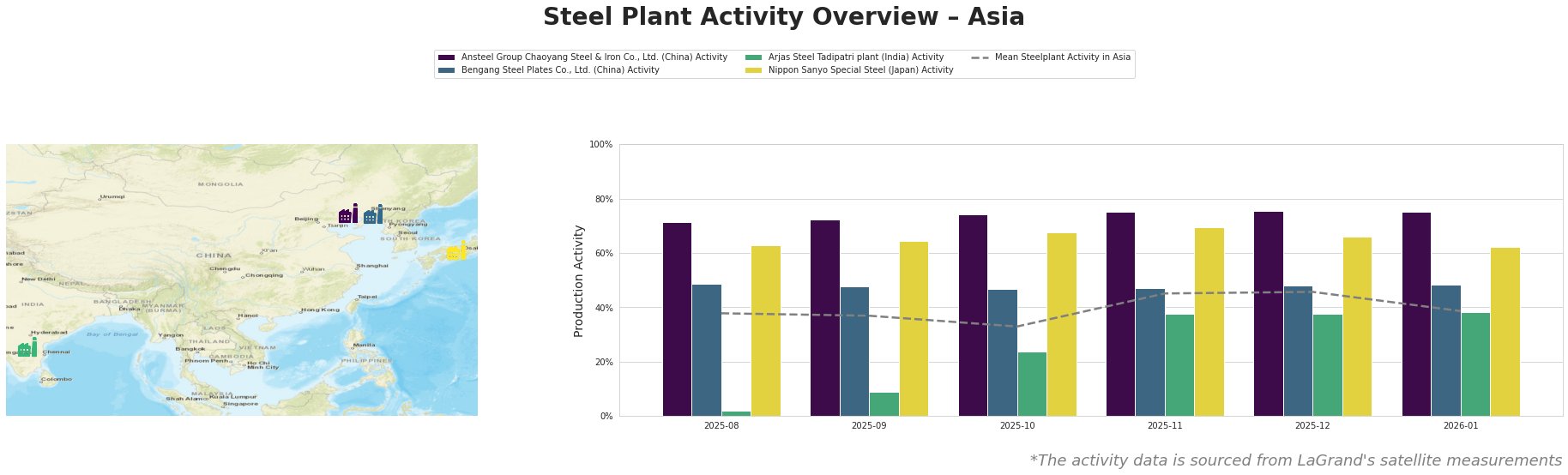

Recent developments in Asia’s steel markets showcase a very positive sentiment fueled by strategic international agreements and robust production activity. The announcement of the India-EU Pact Likely To Expand Trade Rather Than Threaten Domestic Industry: GTRI suggests a favorable trajectory for steel demand, enhancing connectivity and economic collaboration. Moreover, the conclusion of the India, EU To Announce Conclusion Of FTA Negotiations On January 27 indicates an imminent uplift in trade relations that could directly impact steel procurement strategies. As corroborated by satellite observations, steel plant activity mirrors this favorable sentiment.

Ansteel Group Chaoyang Steel & Iron Co., Ltd. in Liaoning shows sustained activity at 75% in January 2026, peaking in December 2025. This aligns with the anticipation of increased trade dynamics following the signed EU agreements, as highlighted by the EU’s New GSP Rules Affect Only 2.7% Exports, Says Commerce Ministry.

Bengang Steel Plates Co., Ltd. also reflects stable activity at 48%, indicating a consistent operational capacity amidst reports of EU tariff adjustments. Arjas Steel Tadipatri plant maintains low activity at 38%, suggesting limited adjustments despite India’s ambitious plans to enhance trade relations.

Conversely, Nippon Sanyo Special Steel sees a decline from earlier peaks, stabilizing at 62% in January; the drop could indicate market volatility potentially influenced by recent policy shifts rather than operations.

The impending India Plans Major Cut In Car Import Tariffs In Trade Deal With EU: Reports further signifies potential shifts in consumer demand that could enhance production needs for automotive-related steel products, driven by the expected influx from European automakers.

In closing, buyers should consider strengthening procurement ties with Ansteel and Bengang, whose activity levels and product readiness will likely align with the increasing market demand resulting from newly forged trade agreements. The Arjas plant’s lower activity may pose risks for timely supply; thus, it’s advisable to monitor developments closely. Additionally, anticipated changes in automotive demand may prompt buyers to secure steel products from Nippon Sanyo, diversifying their supply sources to mitigate potential disruptions linked to market fluctuations.