From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Steel Market Outlook in Asia: Satellite Activity Signals Growth

In Asia, the steel industry is witnessing a favorable market sentiment with elevated activity levels across key plants. Notable reports such as “US tool steel exports up 8.5 percent in August 2025 from July“ and “Viewpoint: US flat steel demand hinges on data centers“ correlate with increased operational metrics observed through satellite monitoring of Asia’s prominent steel facilities. These insights inform us of a robust demand cycle, primarily driven by technological advancements in sectors reliant on steel.

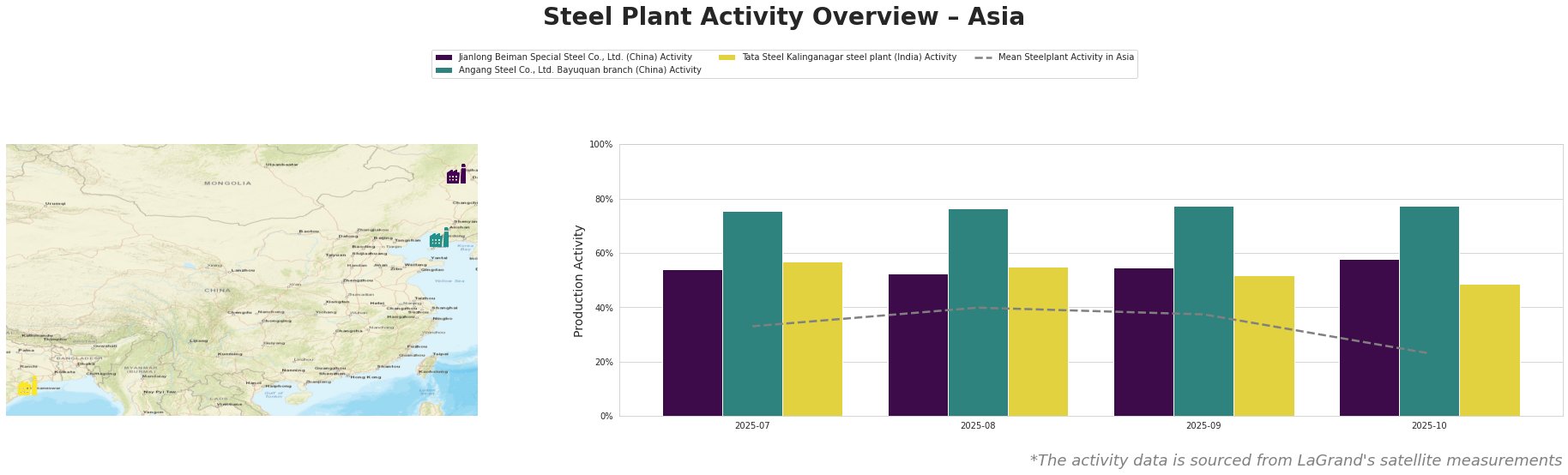

Jianlong Beiman Special Steel Co., Ltd. in Heilongjiang has shown stable activity, peaking at 58.0% in October after a slight rise from 54.0% in July, which aligns with the increased demand for tool steel as noted in the article on US exports. Angang Steel Co., Ltd.’s Bayuquan branch consistently maintained high levels, specifically at 77.0% in September and October, suggesting a strategic alignment with strong market trends. In contrast, Tata Steel’s Kalinganagar facility observed fluctuations, with activity dipping to 49.0% in October, reflecting a temporary adjustment phase.

Jianlong Beiman Special Steel Co., Ltd.

The Jianlong Beiman plant utilizes an integrated blast furnace approach. Recent satellite data shows an increase to 58.0% activity, closely following the boost in US tool steel exports, which highlights a demand for high-quality and specialty steels in Asia’s market.

Angang Steel Co., Ltd. Bayuquan branch

This facility employs a fully integrated process with a capacity of 6,500 tonnes. Remarkably stable at 77.0% activity, the plant reflects consistent output amid the rising flat steel demand, which is underscored by increased construction and manufacturing needs highlighted in recent market narratives.

Tata Steel Kalinganagar steel plant

The Kalinganagar plant, which predominantly services the automotive industry, showed a decrease to 49.0% in October. This decline appears disconnected from current market conditions; thus, further monitoring is recommended.

In conclusion, the current upward trends in steel plant activity across Asia signal resilience and potential growth. Given the strengthened demand for tool and flat steels correlated with US exports and sectoral investments in technology, steel buyers should consider strategically increasing their procurement volumes, especially from plants like Angang and Jianlong, to leverage favorable conditions in the upcoming quarters. Monitoring the activity of Tata Steel will also be crucial as it may indicate shifts in automotive sector dynamics.