From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Steel Demand in Asia Driven by Automotive Sector Growth

Recent analysis indicates a positive market sentiment for the steel industry in Asia, particularly influenced by China’s automotive sector. The article titled Automotive sector to drive steel demand in China in 2026 highlights predictions of robust steel consumption due to a significant boost in car exports, notably in electric vehicles (EVs). This aligns with satellite data revealing fluctuations in activity levels across key steel plants in the region.

In December, emissions in China’s steel industry rose by 4.4% y/y, yet energy consumption decreased by 6.4% year-on-year, indicating a sector adjusting towards better efficiency while maintaining production. This backdrop underscores a mixed output environment recorded in plants such as Tata Steel Kalinganagar, Wulanhot Steel Co., and Dexin Steel Morowali.

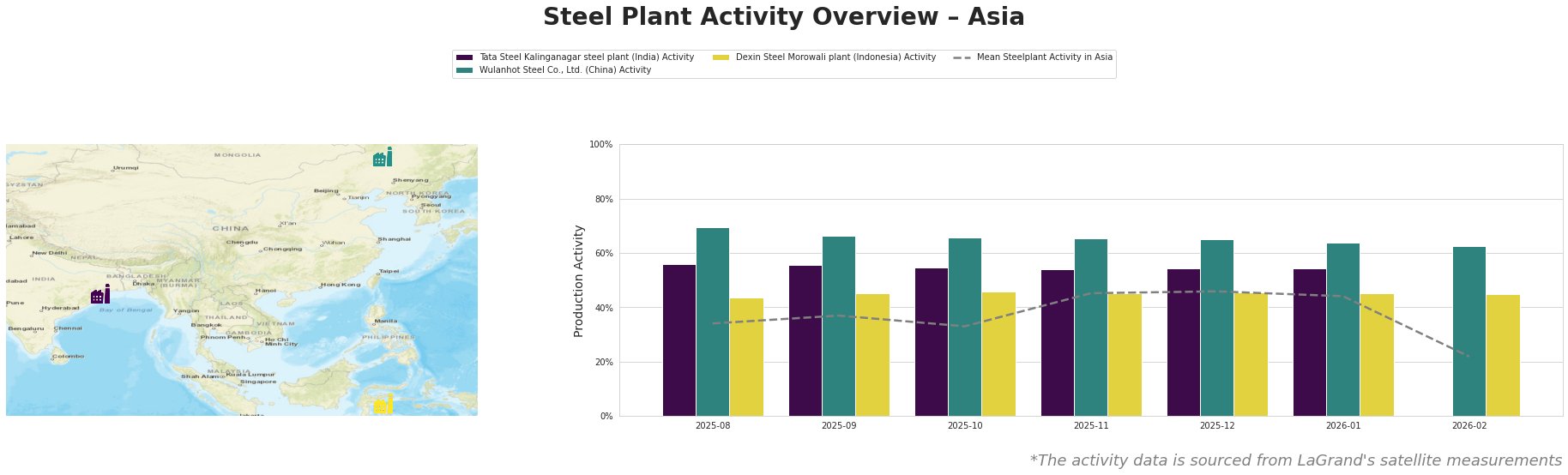

Tata Steel Kalinganagar maintained a relatively stable activity level, peaking at 56.0% activity even as total Asian activity declined to a mean of 22.0% in February 2026. This drop corresponds with no direct news linkage, indicating potential seasonal variations or adjustments in production scheduling.

Wulanhot Steel Co., Ltd. recorded a high of 70.0% in August 2025 but saw a gradual decline to 64.0% by January 2026. Although emissions increased, the overall trend does not seem connected to external news pressures but rather internal operational adjustments.

Dexin Steel Morowali’s activity remains stable, fluctuating between 44.0% and 46.0% throughout late 2025, which might suggest resilience in production capacity amidst broader market fluctuations.

The notable anticipated growth in the automotive sector as detailed in the news article positions steel buyers strategically to consider ramping up procurement ahead of the upward pricing due to increased demand. With the automotive sector expected to grow, particularly in EVs, buyers should prepare for potential supply constraints as demand outpaces supply in the coming years.

To mitigate risks of supply disruptions, it is advisable for procurement professionals to engage with suppliers early, ensuring that contracts cover longer lead times as the automotive sector pivots towards international expansion. The expected increase in steel demand supports not only steel production but also ancillary services tied to automotive manufacturing.

In summary, proactive outreach to suppliers and strategic positioning in anticipation of increased automotive-driven steel demand could lead to favorable procurement terms for steel buyers in Asia.