From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for European Steel Market Amid Activity Fluctuations and Strategic Halts

Recent developments in Europe reveal a mixed yet optimistic steel market trend, primarily highlighted by the ArcelorMittal halts DRI-EAF projects in the EU and Keine Umstellung: Arcelor Mittal streicht Pläne für grünen Stahl zusammen. These articles detail ArcelorMittal’s decision to stop its decarbonization efforts in Bremen and Eisenhuttenstadt, impacting plant activity levels. The halt arises from unfavorable market conditions, high electricity prices, and insufficient economic viability, urging calls for stronger EU policies to maintain competitive edge.

In contrast, the activity data shows resilient overall trends, particularly in certain plants.

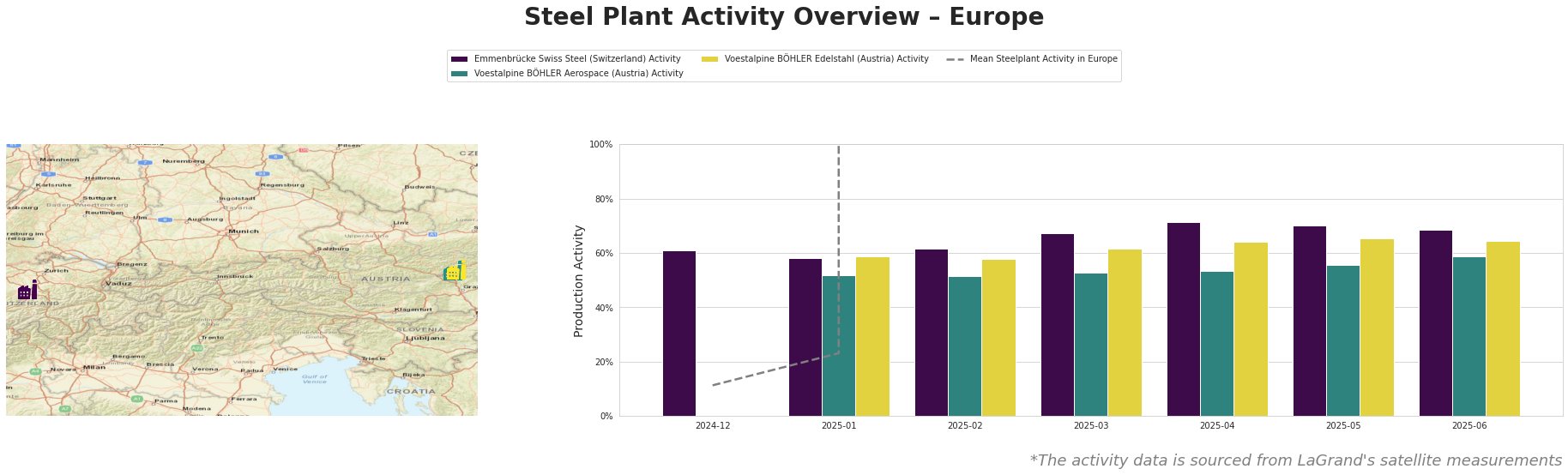

Emmenbrücke Swiss Steel maintained a relatively stable activity level, peaking at 72% in April 2025 before stabilizing around 68% in June. This stability suggests operational resilience despite market disruptions linked to ArcelorMittal’s project cancellations, as highlighted in the news articles.

Voestalpine BÖHLER Aerospace and Voestalpine BÖHLER Edelstahl have both shown activity increases with notable peaks; BÖHLER Edelstahl reached 66% in May 2025. However, fluctuations remain apparent, and despite their higher activity levels, these plants face risks associated with low-cost imports and the repercussions of halted green steel projects.

The immediate implications for the steel market include potential supply disruptions, particularly in regions previously reliant on ArcelorMittal’s decarbonization initiatives, as articulated in the news articles. Given the cancellations and the strategic shift towards electric arc furnaces, procurement professionals should consider diversifying suppliers and securing contracts with plants showing resilient activity, such as Emmenbrücke and Voestalpine, where production capabilities align with the positive sentiment.

In summary, while ArcelorMittal’s halt affects the overall decarbonization landscape, activity metrics from leading plants signal a relatively stable and positive market outlook, justifying strategic procurement actions in anticipation of potential supply interruptions.