From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Asia’s Steel Market: Export Growth and Increased Plant Activity Signal Opportunities

Steel market sentiment in Asia remains positive amid notable developments reported in recent news. “India increased its rolled steel exports by 33% y/y in April-December“ has explicit ties to rising activity at key plants, with satellite observations pointing towards robust operational levels. Furthermore, China’s “increased steel exports by 7.5% y/y in 2025” reflects a sustained demand that appears to bolster regional activity, particularly as export regulations loom.

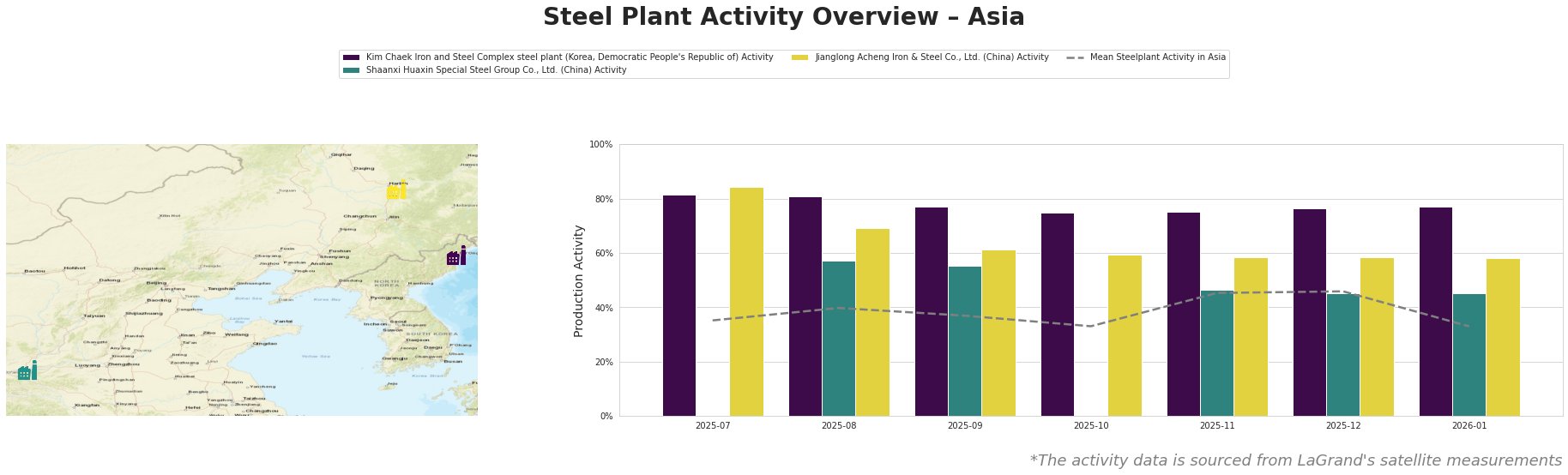

The satellite activity data shows variances among key steel plants over the last several months:

The Kim Chaek Iron and Steel Complex showed peaks in activity, reaching 81% in both July and August 2025. This aligns with the overall increase in steel demand, with India increasing its rolled steel exports by 33% y/y potentially driving regional consumption. However, the plant saw a decline to 75% activity in November, which may reflect broader market adjustments.

Shaanxi Huaxin Special Steel Group, although reporting lower activity trends averaging 47%, still contributes to the specialty steel segment crucial for domestic demand amidst protective measures imposed by India against cheaper imports from China. Notably, this plant’s activity has remained more stable, indicating resilience in specialty steel output even as export dynamics shift.

On the other hand, Jianglong Acheng Iron & Steel Co. displays activity levels consistently around the 58% to 69% mark, maintaining operations which are vital for its automotive and energy sectors. The recent increase in steel exports from China demonstrates a need for more product availability from such producers, particularly as exports rise despite an 11.1% drop in imports showcased in the “China increased steel exports by 7.5% y/y in 2025“ report.

Given the current trends, operations may face potential supply disruptions if Chinese export regulations hinder shipments. Steel buyers should consider securing inventories from plants like the Kim Chaek Iron and Steel Complex and Jianglong Acheng Iron & Steel Co., which are more agile in response to rising demand. Proactively engaging with these producers can capitalize on their relatively higher production levels and product diversity amidst a strengthening export market.