From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Asian Steel Market Amid Plant Activity Dynamics

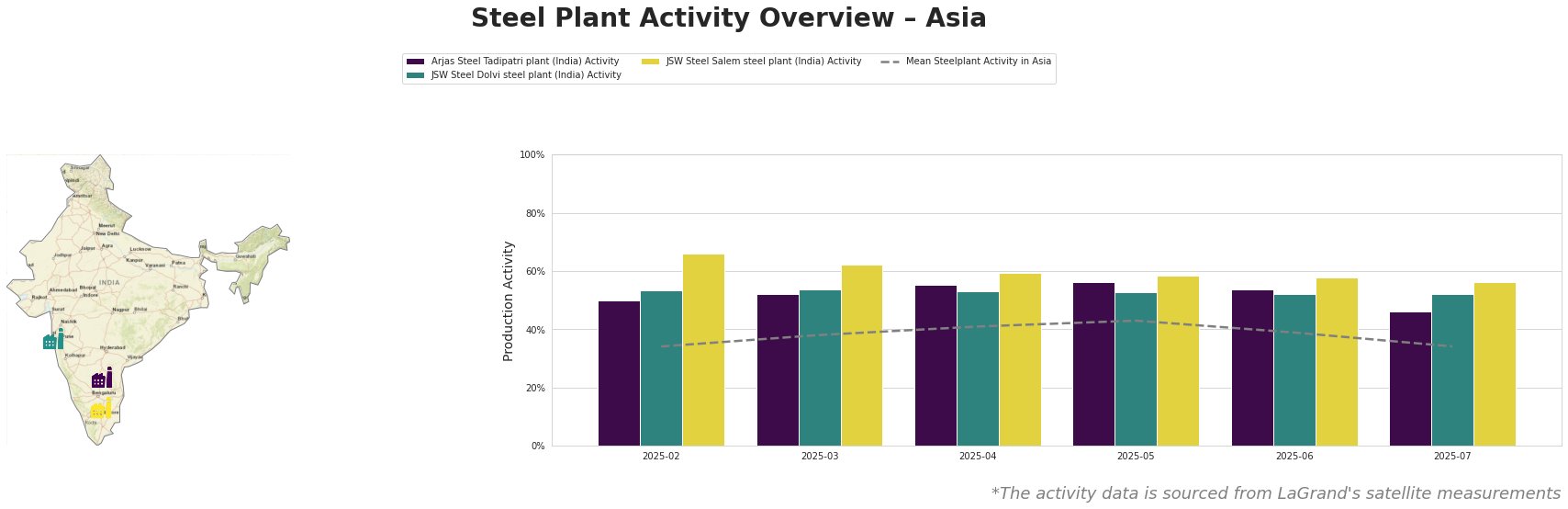

Recent trends in the Asian steel market indicate a positive sentiment, driven by notable developments in plant activity levels. On July 25, Volkswagen’s profit decline, highlighted in the article “Volkswagen: Gewinn von VW bricht im zweiten Quartal ein – Autobauer senkt Prognose,” raises concerns about trade impacts but aligns with stable demand for steel products. Interestingly, satellite-observed data reflects a fluctuation in steel plant activities, with the JSW Steel Dolvi and Salem plants demonstrating adaptability amid market challenges.

The Arjas Steel Tadipatri plant experienced a decline in activity, dropping from 56% in May to 46% in July, which may not directly correlate with the news articles but suggests challenges in operations possibly linked to broader economic uncertainties. Conversely, the JSW Steel Dolvi plant held steady at 52% activity in July, maintaining a resilient production posture. In contrast, the Salem plant has shown robust performance, albeit with a slight decrease to 56%, indicating stability and capacity to adapt to market demands.

The connection between Volkswagen’s profit cut and steel demand is tenuous; however, ongoing restructuring within the automotive sector, as detailed in “Audi cuts forecast over US tariffs and restructuring costs,” signifies a potential slowdown in steel consumption from this segment. With insights into growing electric vehicle sales and the anticipated US-EU trade deal, demand from sectors other than automotive could provide a buffer for steel producers.

For steel buyers, fluctuations in plant activity suggest a short-term window for procurement. Specifically, JSW Steel Dolvi’s stable activity level and Salem’s resilience present procurement opportunities at competitive prices before any possible resurgence in demand, especially with potential supply disruptions stemming from uncertainties surrounding tariffs. Steel buyers might consider securing contracts with JSW Steel to mitigate short-term risk while maintaining flexibility in demand forecasting strategies.