From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Momentum in North American Steel Market Amid Tariff Tensions

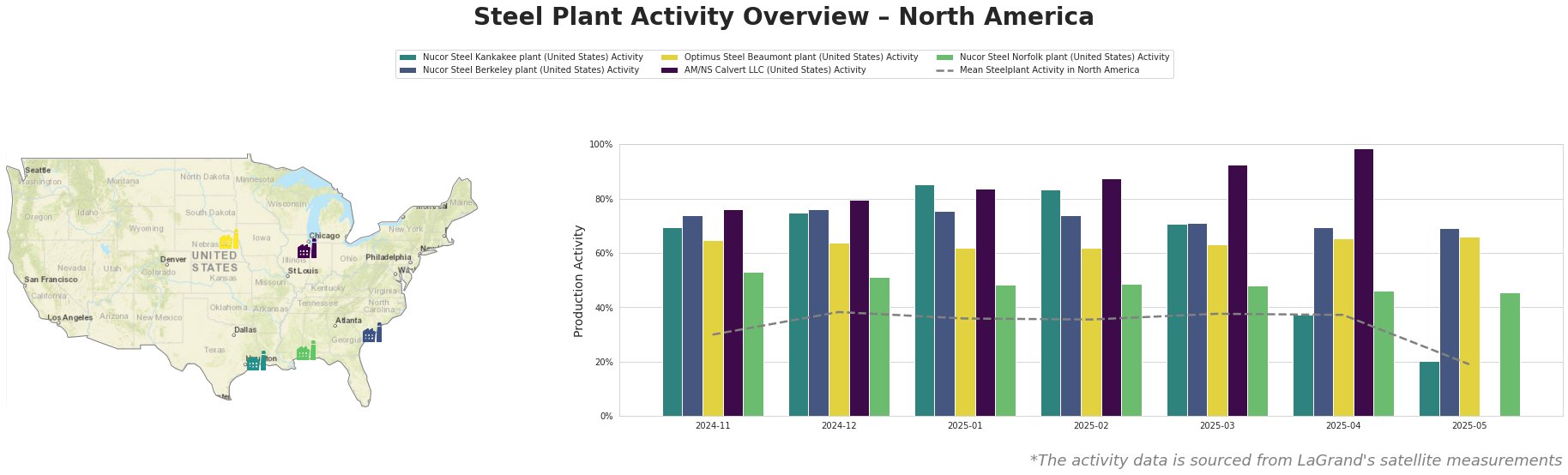

Steel production across North America remains resilient, despite ongoing tariff pressures, as evidenced by recent activity trends. The articles “Trump unlikely to lift tariffs on Canada“ and “Canadian prime minister to Trump: We’re not for sale“ highlight the continuing tariffs impacting Canadian steel imports. Nonetheless, steel plants in the U.S. have shown noteworthy production activity variations, reflecting a robust operational pulse.

The Nucor Steel Kankakee plant started strong in late 2024, peaking at 85% in January 2025 before dropping to 20% in May. This fluctuation may reflect the pressures discussed in “Trump unlikely to lift tariffs on Canada,” positing that tariffs continue to strain relations and operations in North America, particularly affecting the automotive sector, a key market for the plant.

The Nucor Steel Berkeley plant generally maintained stable activity around 70-76%, indicating its resilience against tariff impacts, aligning with stronger production needs. In contrast, the Optimus Steel Beaumont plant slightly dipped to 62% by February, then recovered to 66%, suggesting adaptability to market demands yet indicative of overall stress within the supply chain.

At the AM/NS Calvert plant, activity spiked to 99% in April before it temporarily halted reporting in May. This spike aligns with production shifts to compensate for expected shortages due to ongoing tariff negotiations highlighted in “Kanada und USA ringen um neue Beziehung: Was auf dem Spiel steht.” The Nucor Steel Norfolk plant maintained lower activity levels—peaking at 53% in November 2024 and declining subsequently—implying challenges during the past months, again possibly tied to exacerbated trade tensions.

In summary, while some steel plants exhibit fluctuations in operational activity connected to tariff-related uncertainties, strategic procurement actions for steel buyers should prioritize sourcing from plants like AM/NS Calvert and Nucor Steel Berkeley due to their stable output and ability to navigate current market pressures. Ensure to remain agile in procurement strategies, as ongoing negotiations between U.S. and Canadian leadership could redefine supply landscapes in the near future.