From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Market Outlook for European Steel Sector Driven by Activity Growth

Recent political developments in Germany, especially the announcement titled “Friedrich Merz Set To Become Germany’s Chancellor, Ending Political Stalemate“ on May 6, 2025, signal potential policy shifts impacting economic stability and growth in the steel sector. These changes coincide with satellite data showing increased activity levels in key European steel plants, suggesting an optimistic market sentiment.

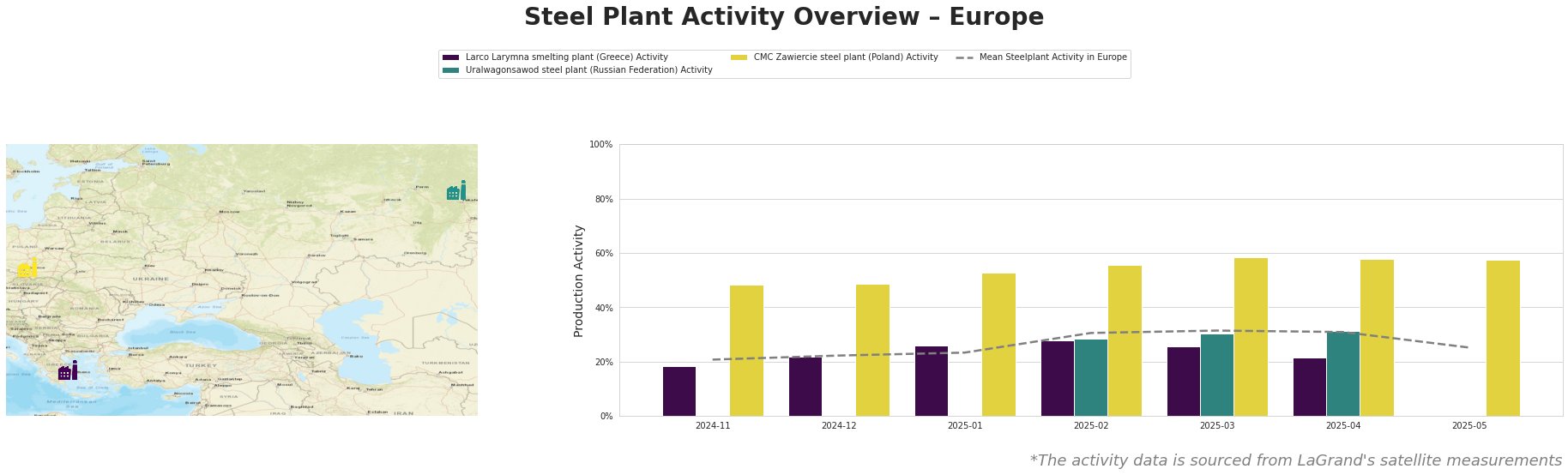

The mean activity level across European steel plants has seen notable peaks, climbing from 21.0% to a high of 31.0% in April 2025. In contrast, the Larco Larymna smelting plant in Greece exhibited a gradual increase to 28.0% before a decline to 22.0%. The CMC Zawiercie steel plant in Poland consistently reported high activity levels, peaking at 58.0%, suggesting a robust operational status. The Uralwagonsawod steel plant in Russia also increased activity to 31.0% in April 2025. These trends do not directly connect to the political changes cited in the news but indicate overall robust production capabilities within the region.

The Larco Larymna plant’s recent fluctuation in activity rebounded to 26.0% in January 2025, possibly in response to regional economic expectations, although specific connections to news articles cannot be established. Meanwhile, the CMC Zawiercie plant has enjoyed strong performance in the automotive and infrastructure sectors, likely benefiting from anticipated government infrastructure spending under Merz’s proposed fiscal policies.

Potential supply disruptions could arise from the political landscape in Germany, as uncertainty might affect energy and raw material pricing. Therefore, steel buyers should consider increasing stock ahead of expected regulatory changes and prepare for possible volatility in the supply chain.

For procurement actions, buyers are recommended to:

– Prioritize sourcing from CMC Zawiercie due to its stable and high production levels, ensuring minimal risk of supply interruptions.

– Monitor Larco Larymna’s production changes closely, given its recent fluctuations, to gauge whether to adjust procurement timelines.

– Understand the implications of Merz’s leadership on upcoming fiscal policies that could affect demand; advance orders could hedge against rising costs or delays due to procurement complexities in light of political transitions.

In conclusion, while no direct correlation between observed plant activities and the political landscape can be firmly established, the overall positive trend in activity suggests a favorable environment for steel procurement in Europe.