From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOptimistic Outlook for Germany’s Steel Sector Driven by Government Developments and Plant Activity

Germany’s steel market sentiment remains positive, particularly fueled by the political landscape’s stability post-coalition agreement discussions, as evidenced by recent satellite data. The approval of the coalition agreements, highlighted in the article “CDU stimmt Koalitionsvertrag zu“, signifies a potential boost in governmental support for industrial sectors, including steel production. Recent activity changes at major steel plants also indicate a responsive adjustment to market demands, linking back to these political developments.

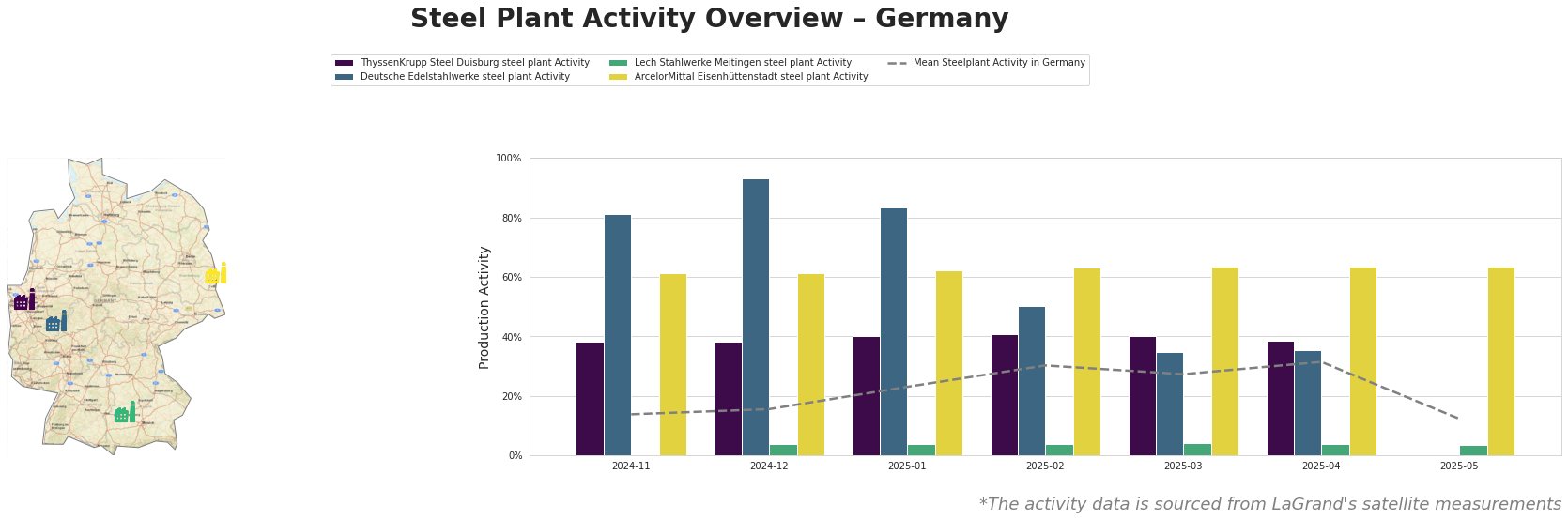

During this period, ThyssenKrupp Steel Duisburg demonstrated stable activity, peaking at 41% in February, while Deutsche Edelstahlwerke reached a remarkable 93% in December. In contrast, Lech Stahlwerke faced an inactivity period at 4% for multiple months, signaling production challenges, potentially responsive to the incoming economic strategies around the coalition agreement. While ArcelorMittal Eisenhüttenstadt maintained its operational levels, fluctuations were less pronounced, suggesting a stable demand.

ThyssenKrupp Steel Duisburg, with a crude steel capacity of 13,000 tons, serves critical sectors, including automotive and infrastructure. The relatively stable output, although dropping to 39% in April, does not exhibit a clear direct correlation to policy changes, indicating resilience in the supply chain.

Deutsche Edelstahlwerke specializes in high-quality steel production using EAF technology. Reaching 93% in December, its performance reflects strong demand trends possibly linked with anticipated new government initiatives to boost industrial productivity.

Conversely, Lech Stahlwerke Meitingen faced operational disruptions, indicated by consistent 4% activity levels. Given the current political developments reflected in “Katherina Reiche: Die Pläne der neuen Wirtschaftsministerin“, further investment in this plant could alleviate production bottlenecks, meaning procurement strategies should take this potential into account.

ArcelorMittal Eisenhüttenstadt’s activity stability resonates positively in a complex landscape, with recent activity remaining consistent above 60%, indicating reliability amidst evolving government policies, although specific impacts from the articles cannot be directly linked.

Given the positive political outlook, steel buyers should consider strategically increasing procurement volumes from Deutsche Edelstahlwerke, while closely monitoring trends at Lech Stahlwerke Meitingen due to its reported inactivity. Further investments driven by government initiatives could bolster production capabilities in the medium term and ensure steady supply levels across all regions.