From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOptimistic Growth in North American Steel Production Amidst Tariff Changes

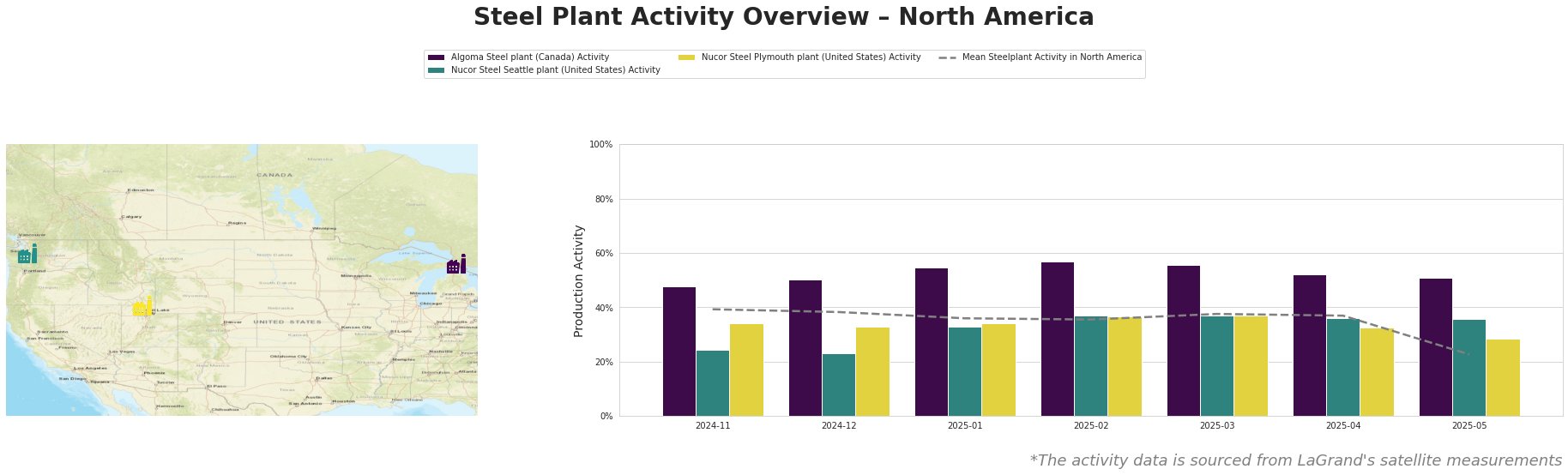

The North American steel market is currently experiencing a Very Positive sentiment, driven largely by recent developments in U.S. tariffs impacting the automotive industry. Notably, in “GM pulls forecast due to tariffs as nervous consumers rush to buy,” it is reported that General Motors has withdrawn its financial guidance due to uncertainties from tariffs, prompting increased consumer vehicle purchases, which in turn is expected to spur demand for steel. Throughout this period, satellite activity data indicates a relative stability and some activity shifts in key steel plants.

The Algoma Steel plant in Ontario shows remarkable activity with peaks at 57% in February and maintaining a robust level of 55% in January. These figures are notable given the reported uncertainty in the automotive sector as referenced in “Trump To Sign Order Granting Some Auto Tariff Relief: White House,” which may have positively influenced steel demand for automotive applications.

Conversely, the Nucor Steel Seattle plant demonstrated volatility, with a significant drop to 23% in December but subsequently improved to a stable 36% in April. The fluctuations align with the cautious market sentiments expressed in “Automakers to get a break on some Trump tariffs — but the outlook for the ‘Big 3’ is still cloudy,” where auto manufacturers brace for tariff adjustments. The Nucor Steel Plymouth plant also experienced a downturn to 28% in May following better performance earlier in the year, indicating potential challenges in securing sustained orders amidst tariff-induced market uncertainties.

There are potential supply disruptions due to varied plant responses to market changes. Specifically, Nucor’s Seattle operation showed capacity challenges, reflecting weaker regional demand, which could lead to sporadic supply availability. As steel buyers, assessing relationships with Algoma or alternative providers might mitigate risks associated with reliance on the more volatile Nucor Seattle plant.

In light of these insights, steel buyers are recommended to:

– Prioritize sourcing from Algoma Steel, given their stronger activity levels and alignment with the robust automotive sector.

– Consider diversifying orders from Nucor Seattle and Plymouth, evaluating current inventory levels against market demand and potential tariff impacts to avoid supply shortages, particularly in the automotive and construction sectors reliant on finished rolled steel products.

These actionable strategies should be closely monitored against ongoing developments in tariff policy and market dynamics in the automotive industry, ensuring timely adjustments in procurement practices.