From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Cools: BlueScope Activity Diverges Amidst Weak Global Demand

Oceania’s steel market faces a negative outlook. Observed steel plant activity shows mixed signals amidst subdued global demand. Specifically, the downturn in European HRC markets as reported in “Hot-rolled coil prices in Europe fall further amid sluggish demand” has the potential to indirectly impact Oceania, particularly regarding import competition. This article highlights the pressure on domestic prices in Europe due to cheaper imports, a dynamic that could extend to Oceania. However, a direct relationship between these articles and Oceania plant activity cannot be definitively established.

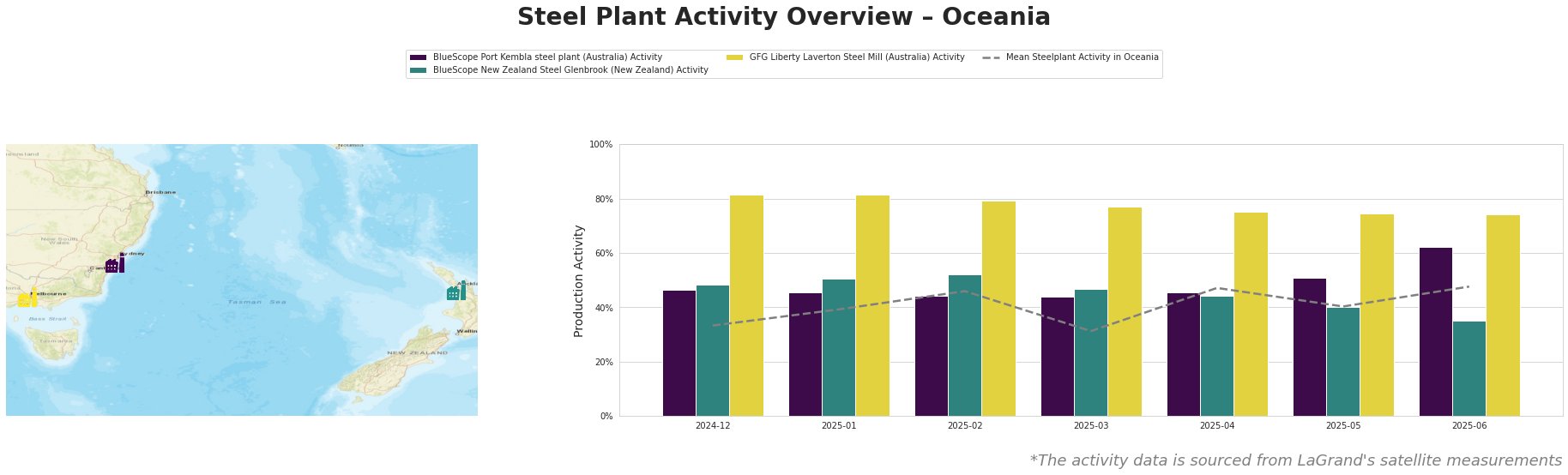

Overall steel plant activity in Oceania shows fluctuations, with a general upward trend from March (31%) to June (48%) of 2025. The GFG Liberty Laverton Steel Mill consistently demonstrates the highest activity levels (82% down to 74%), while the other plants show lower activity.

BlueScope Port Kembla steel plant, an integrated BF-BOF facility in New South Wales, Australia, with a crude steel capacity of 3.2 million tonnes per annum, shows a notable increase in activity. After remaining relatively stable at around 44-47% from December 2024 to April 2025, activity jumped to 51% in May and further to 62% in June. This rise contrasts with the general downward pressure described in “Hot-rolled coil prices in Europe fall further amid sluggish demand“, indicating potential regional factors supporting Port Kembla’s output.

BlueScope New Zealand Steel Glenbrook, an integrated DRI-BOF plant located in South Auckland, New Zealand, with a crude steel capacity of 650,000 tonnes per annum, presents a contrasting picture. After hovering around 47-52% from December 2024 to February 2025, the plant’s activity decreased to 44% in April, increased to 40% in May, and decreased sharply to 35% in June. This decline potentially aligns with the weaker demand sentiment, mirroring the situation described in “Hot-rolled coil prices in Europe fall further amid sluggish demand“. This news discusses weak demand pressuring mills.

GFG Liberty Laverton Steel Mill, an EAF-based plant in Victoria, Australia, with a crude steel capacity of 660,000 tonnes per annum, has maintained relatively high, but decreasing activity levels. It remained at 82% for December 2024 and January 2025, before gradually decreasing to 74% in June. This consistently high activity, albeit slightly declining, contrasts with the overall weaker demand signals, suggesting a focus on specific product segments or regional demand resilience.

Evaluated Market Implications

The divergence in activity between BlueScope Port Kembla and BlueScope New Zealand Steel Glenbrook suggests a split in the Oceania market. While Glenbrook’s decreasing activity could reflect sensitivity to global demand weakness as reflected in the European market (“Hot-rolled coil prices in Europe fall further amid sluggish demand“), Port Kembla’s increased activity suggests potential localized demand or supply chain factors at play. The GFG Liberty Laverton Steel Mill’s decreasing activity level may also indicate a generally softening demand.

Recommended Procurement Actions:

- Steel Buyers: Given the decreased activity at BlueScope New Zealand Steel Glenbrook, carefully evaluate current contract terms and consider diversifying supply sources to mitigate potential disruptions to supply. Negotiate with consideration for possible supply constraints at this facility. Buyers dependent on BlueScope New Zealand Steel Glenbrook should explore alternative sources, particularly given the potential import pressures highlighted in “Hot-rolled coil prices in Europe fall further amid sluggish demand“.

- Market Analysts: Closely monitor the price trends for hot-rolled coil (HRC) in Oceania. Observe the impact of cheaper HRC imports from Europe and Asia. Analyze the causes of divergence between plant activity. Look to identify specific industries in Australia that may be creating localized demand and supporting BlueScope Port Kembla.