From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth America’s Steel Market Sentiment is Strong: Unprecedented Activity in Key Plants

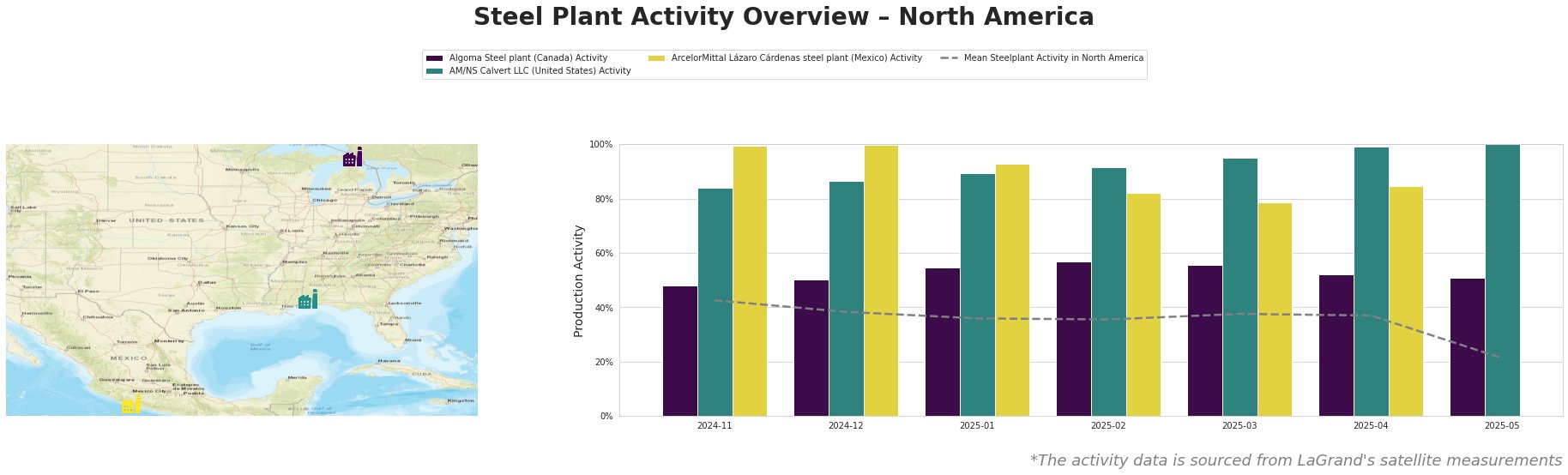

In North America, the steel market sentiment has turned very positive, driven by surging activity across multiple steel plants. Recent articles, notably “Is Lithia Motors, Inc. (LAD) Among the Best Car Stocks To Buy In 2025?“ and “Is Ford Motor Company (F) Among the Best Car Stocks To Buy In 2025?“, indicate an optimistic car sales outlook, projected to increase by 1.7% in 2025, correlating with enhanced steel demand. This positive sentiment is reflected in the satellite-observed activity, particularly at the AM/NS Calvert LLC and ArcelorMittal Lázaro Cárdenas plants.

The data reveals a noteworthy peak at ArcelorMittal Lázaro Cárdenas with an activity level of 100% in December 2024. While the mean activity across the plants fell to 21% by May 2025, AM/NS Calvert LLC maintained a strong presence, achieving 100% activity, recently attributed to the uptick in automotive demand outlined in “Is Ford Motor Company (F) Among the Best Car Stocks To Buy In 2025?”.

The Algoma Steel plant shows solid activity levels but is trending downward, with a peak of 57% in February before stabilizing at 51% in May. The rebounds in automotive sales as highlighted in “Is Lithia Motors, Inc. (LAD) Among the Best Car Stocks To Buy In 2025?” may provide an opportunity to revitalize this plant’s output if market conditions improve.

The AM/NS Calvert LLC, operating with Electric Arc Furnace (EAF) technology, has shown resilience, reaching full capacity thanks to increasing demand from the automotive sector. Currently, it produces finished rolled products primarily for automotive and infrastructure markets. Conversely, while Lázaro Cárdenas achieved a peak in December 2024, its subsequent decline to 85% by April indicates potential volatility amidst shifting market demands.

Procurement actions for steel buyers should target AM/NS Calvert LLC given its stable output and robust demand connections. Furthermore, the recovery potential at Algoma Steel offers a strategic point for sourcing semi-finished products, anticipating an uptick as automotive sales potentially revive through 2025. Conversely, Lázaro Cárdenas’s fluctuations warrant close monitoring, especially concerning its position as a crucial supplier in the semi-finished market.

In summary, stakeholders should capitalize on the current high activity at AM/NS Calvert LLC while remaining agile to adapt to the evolving dynamics projected in the automotive industry, as detailed in the relevant news articles.